Editor’s Verdict

Overview

Review

Headquarters | Australia |

|---|---|

Regulators | ASIC |

Tier 1 Regulator(s)? | |

Owned by Public Company? | |

Year Established | 1995 |

Execution Type(s) | Market Maker |

Minimum Deposit | 0$ |

Trading Platform(s) | Proprietary platform |

Islamic Account | |

Signals | |

US Persons Accepted? | |

Managed Accounts |

CommSec, also known as Commonwealth Securities, is a full-commissioned online broker. The Commonwealth Bank of Australia (CBA) owns but does not guarantee it. Since its foundation in 1995, it has primarily catered to traders from Australia and New Zealand. Initially, it only offered equity trading in Australian-listed companies but CommSec swiftly expanded to include international equities, CFDs and other derivative products, managed funds and self-managed super fund (SMSF) administration, margin lending, and short-term deposits. In 2008, it transformed into a 100% online broker, and thanks to its massive retail trading client base, CommSec raised capital for several initial public offerings (IPOs). A number of mergers and acquisitions helped CommSec to expand its market share across Australia and New Zealand; these included Colonial First State, TD Waterhouse, AOT, Neville Ward Direct, Auckland Savings Bank (ASB), and IWL.

CommSec is a member of the Australian Securities Exchange Limited (ASX) and Chi-X Australia Pty Ltd. It also acts as a clearing participant of ASX Clear Pty Limited and is a settlement agent of ASX Settlement Pty Limited. CommSec is among the most trusted online brokers in Australia and New Zealand, but clients must accept an elevated cost structure in exchange. The Commonwealth Bank of Australia provides services to investors and traders of CommSec, which carry additional fees.

Regulation and Security

The Australian Securities and Investments Commission (ASIC) does provide regulatory oversight. Inexplicably, CommSec makes no effort to inform clients; the information is not available on the website, and new traders must access the Financial Services Guide (FSG), where CommSec provides limited statements about regulation. The FAQ section also fails to cover regulatory or security questions. CommSec does not provide necessary details about the segregation of client capital from corporate funds, negative balance protection, or other security aspects. Since CommSec only caters to domestic clients, their presentation may suffice. The lack of transparency does not suit one of the leading online brokers in Australia. Not maintaining a dedicated section concerning regulation remains a significant oversight.

CommSec fails to cover regulation on its website transparently; clients can get limited information in the Financial Services Guide (FSG) PDF.

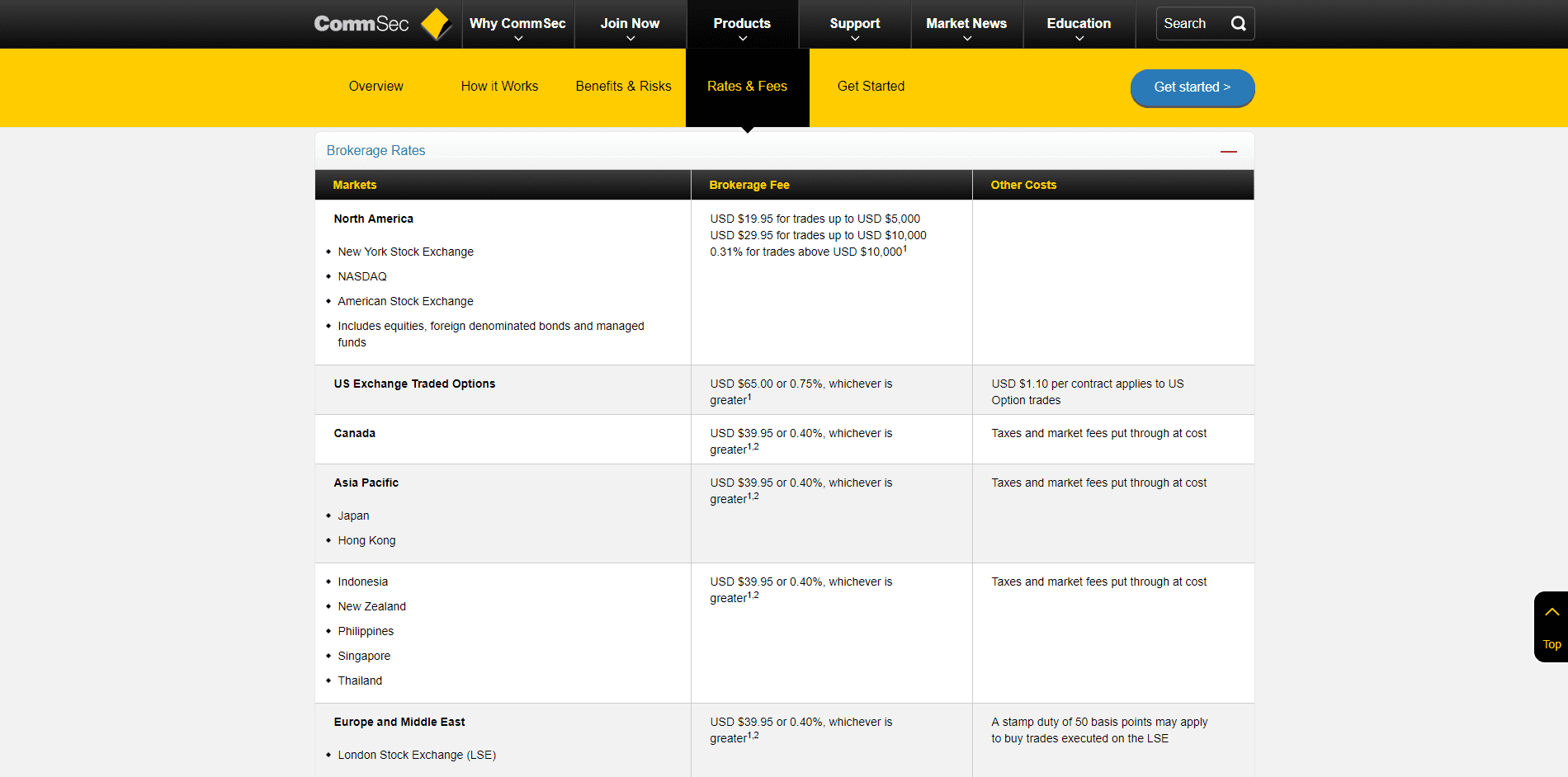

Fees

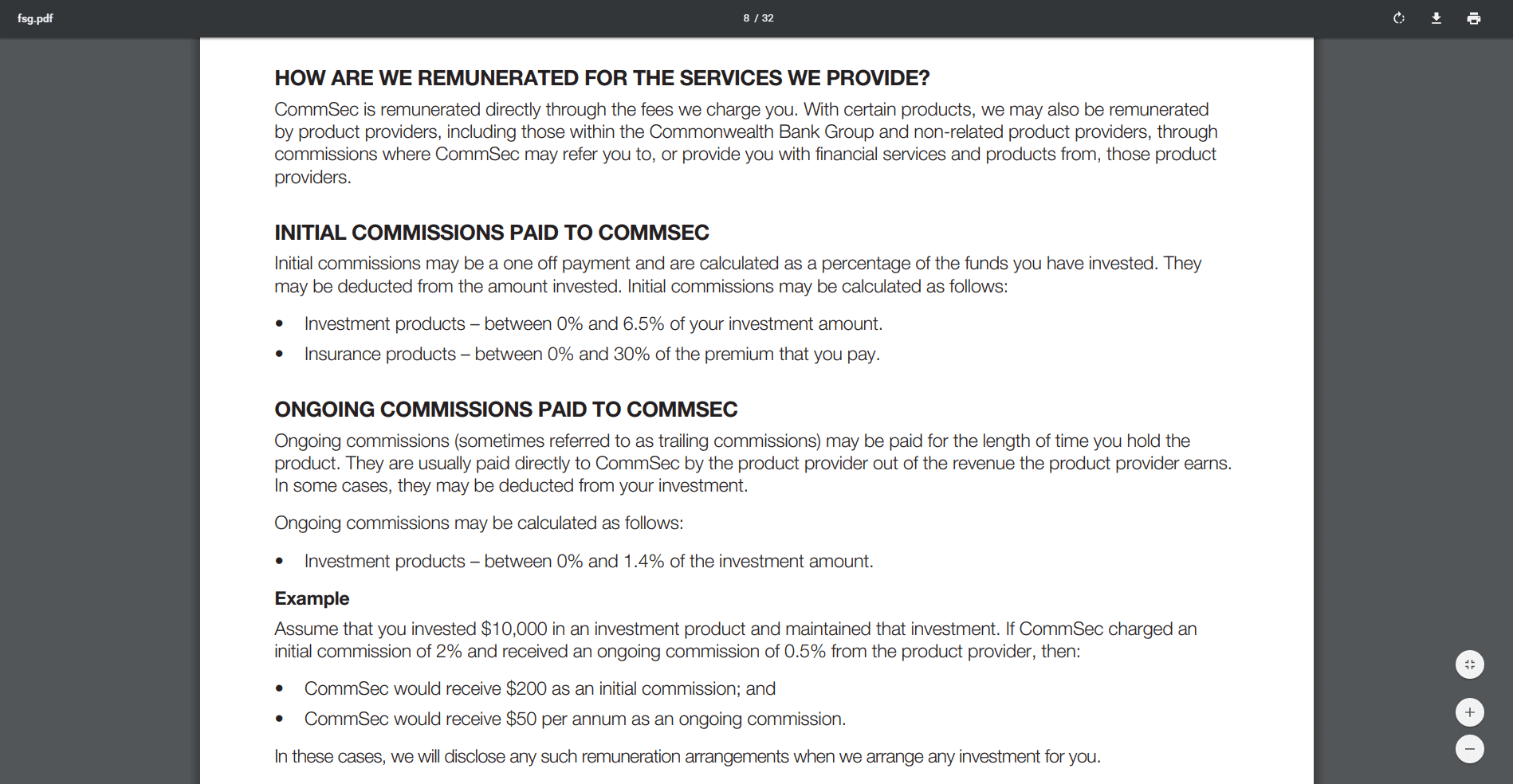

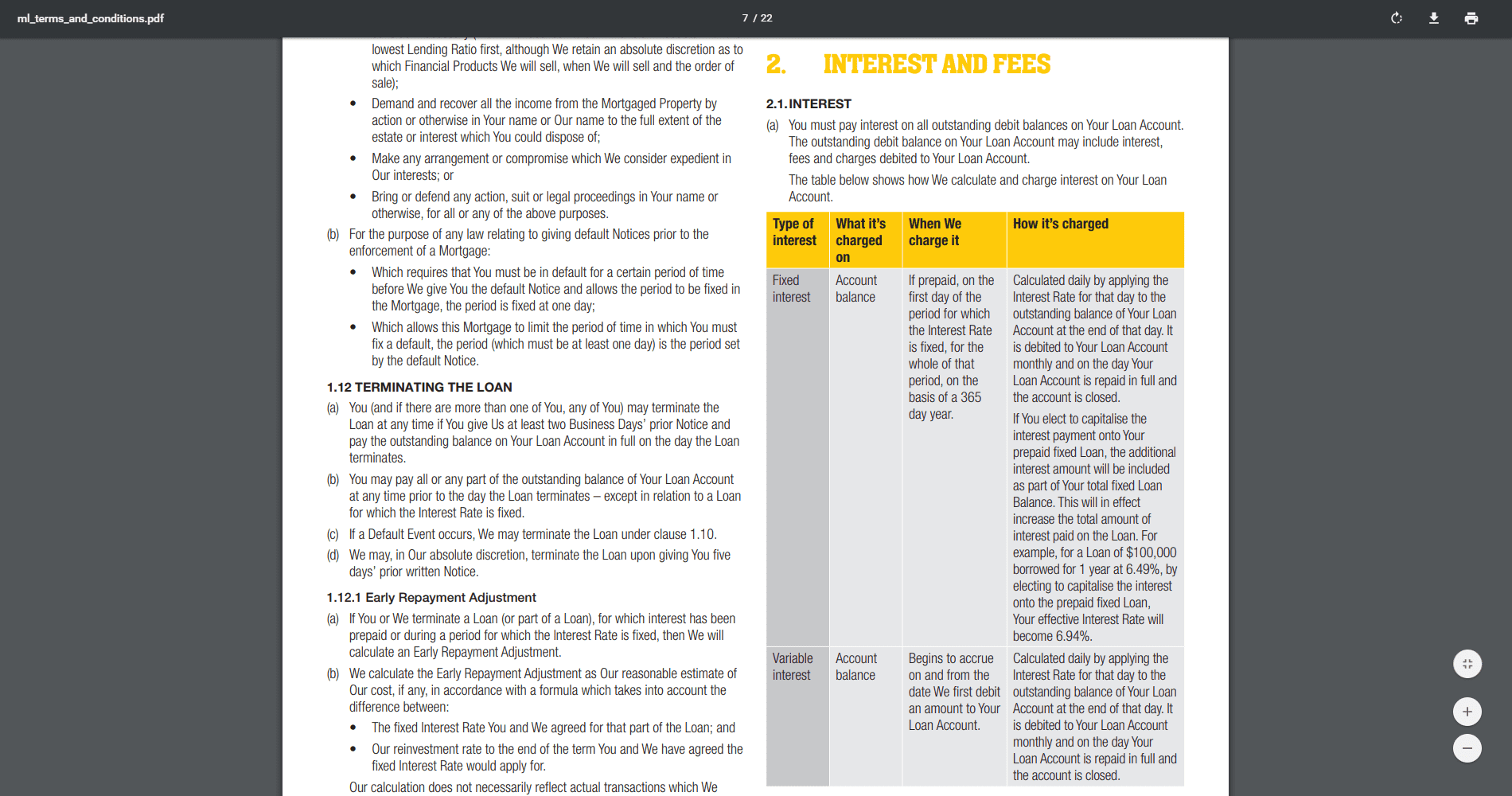

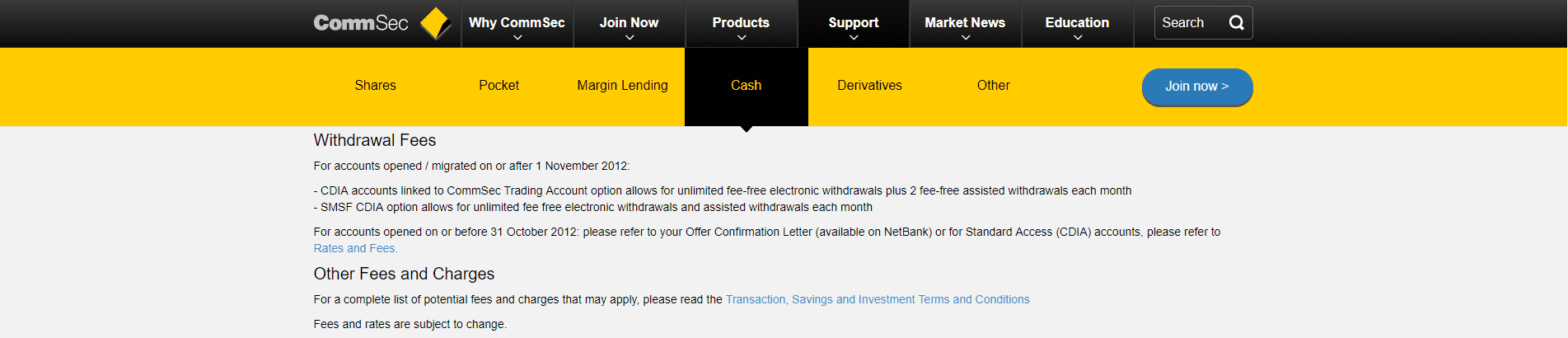

The fee structure is expensive and not suitable for active traders. While many Australian investors and traders trust CommSec because of the corporate ownership of a Big Four Australian Bank (CBA), the cost structure does not justify that trust. A $19.95 fee for trades between $1,001 and $10,000 remains among the highest compared to international competitors. CommSec also provides trading over the phone, for which a minimum commission of $59.95 applies. Depending on the investment product, CommSec may collect ongoing costs. Traders have to pay swap rates on leveraged overnight positions, but the process and fees are not as transparent as other Australian online brokers or international competitors. The fees section lists trading commissions but fails to offer a complete introduction of spreads. A $25 inactivity fee exists. Given the various products CommSec offers as full-commission brokerage and via services by CBA, there are many costs to consider, depending on the individual.

CommSec only lists trading commissions on its fees page. The lack of transparency concerning spreads is disappointing, as clients are not provided with the complete pricing environment.

CommSec may collect ongoing commissions, depending on the product.

Swap rates on leveraged overnight positions apply, the industry standard for leveraged trading accounts, but the costs vary among brokers.

What Can I Trade

CommSec provides clients with Australian equity trading, ETFs, fixed income products, options, warrants, cash accounts, and Forex trading. Through a partnership with the Bank of New York Mellon's subsidiary, Pershing LLC, CommSec grants access to 25 international equity markets. Regrettably, CommSec does not provide a detailed asset list. The lack of transparency continues at this broker, and new clients lack information concerning assets until they open an account. Clients should expect more upfront clarity from one of the leading brokers in Australia.

CommSec only notes the available products without clarity of included assets.

It does list 25 international equity markets with an unacceptable cost structure.

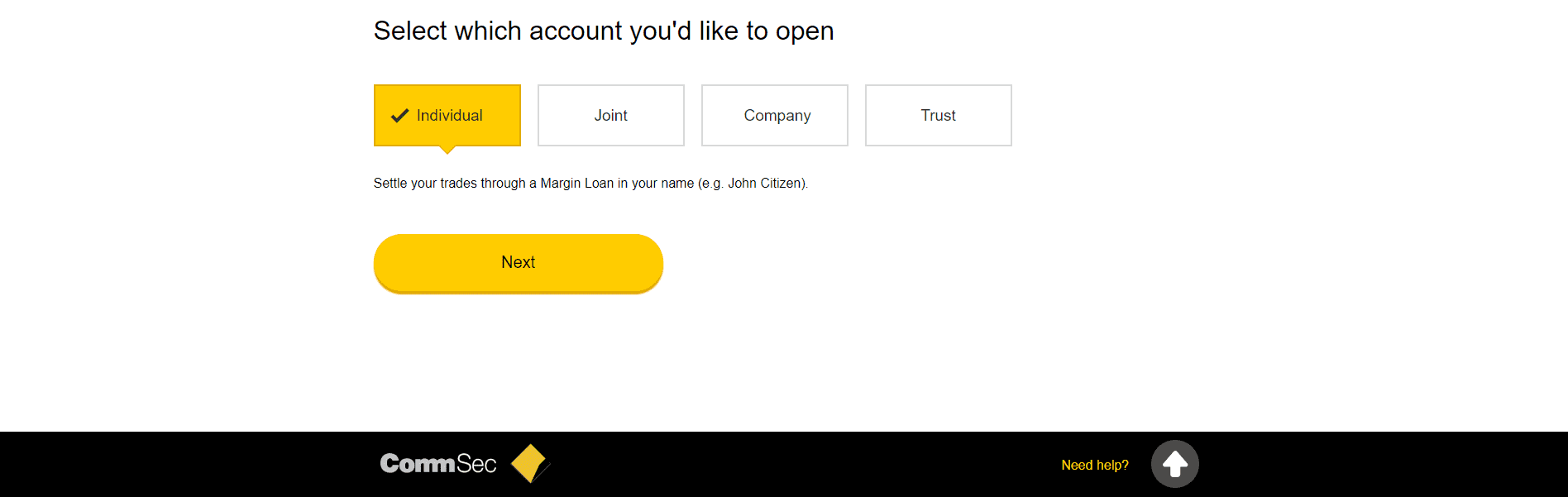

Account Types

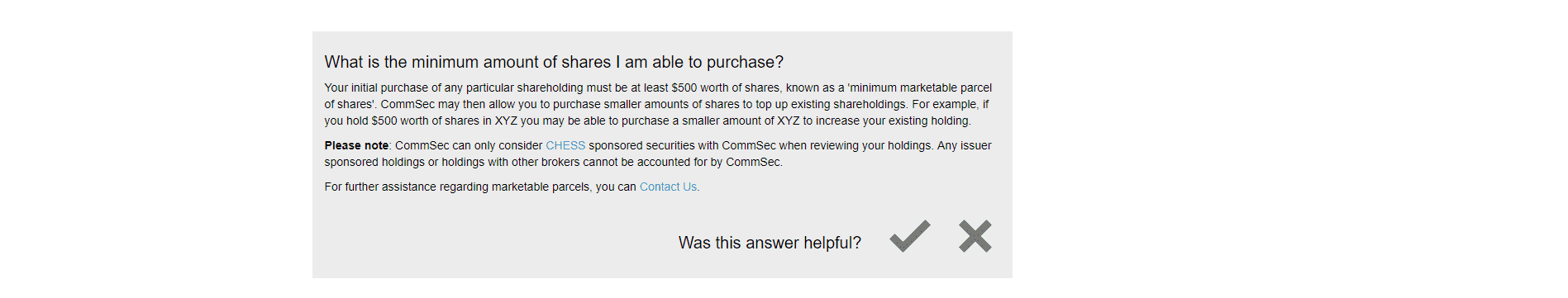

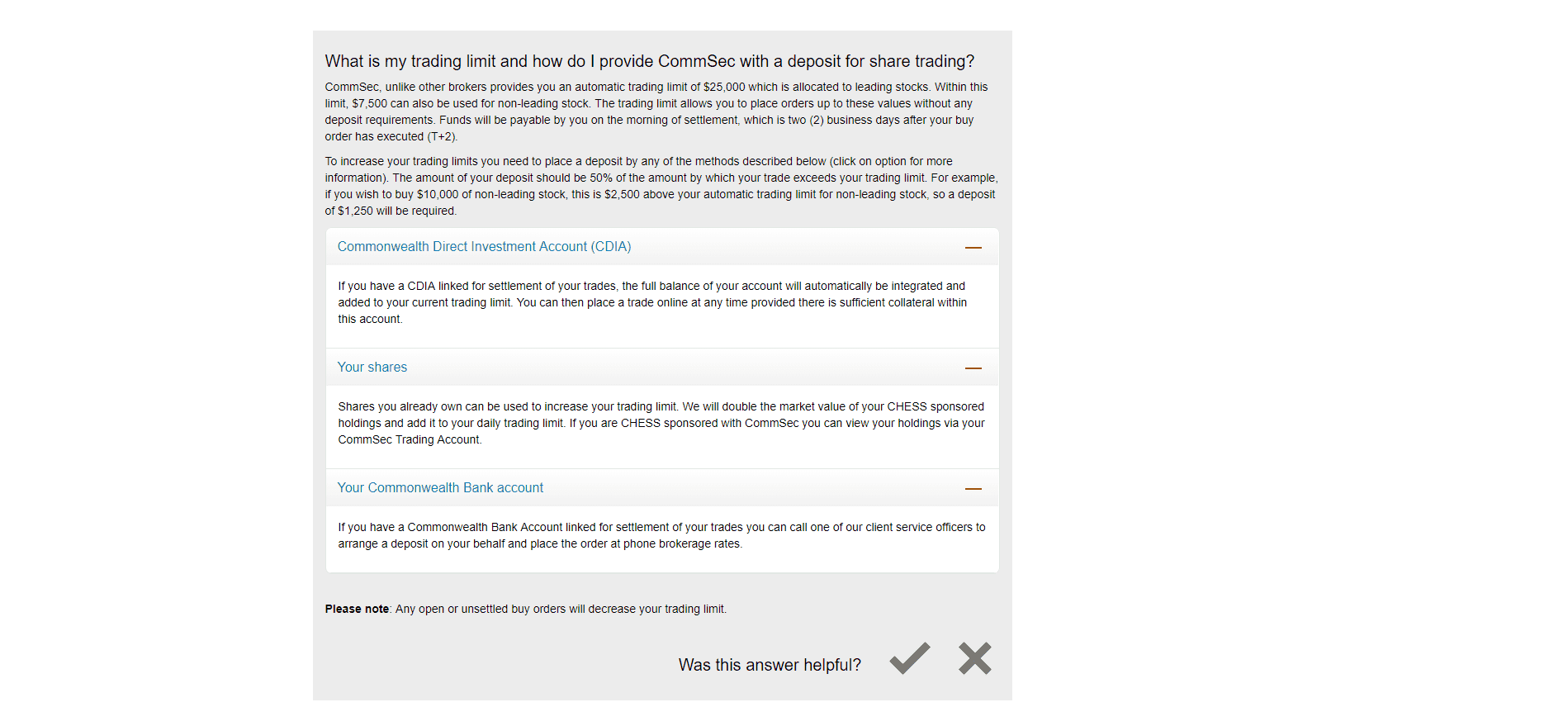

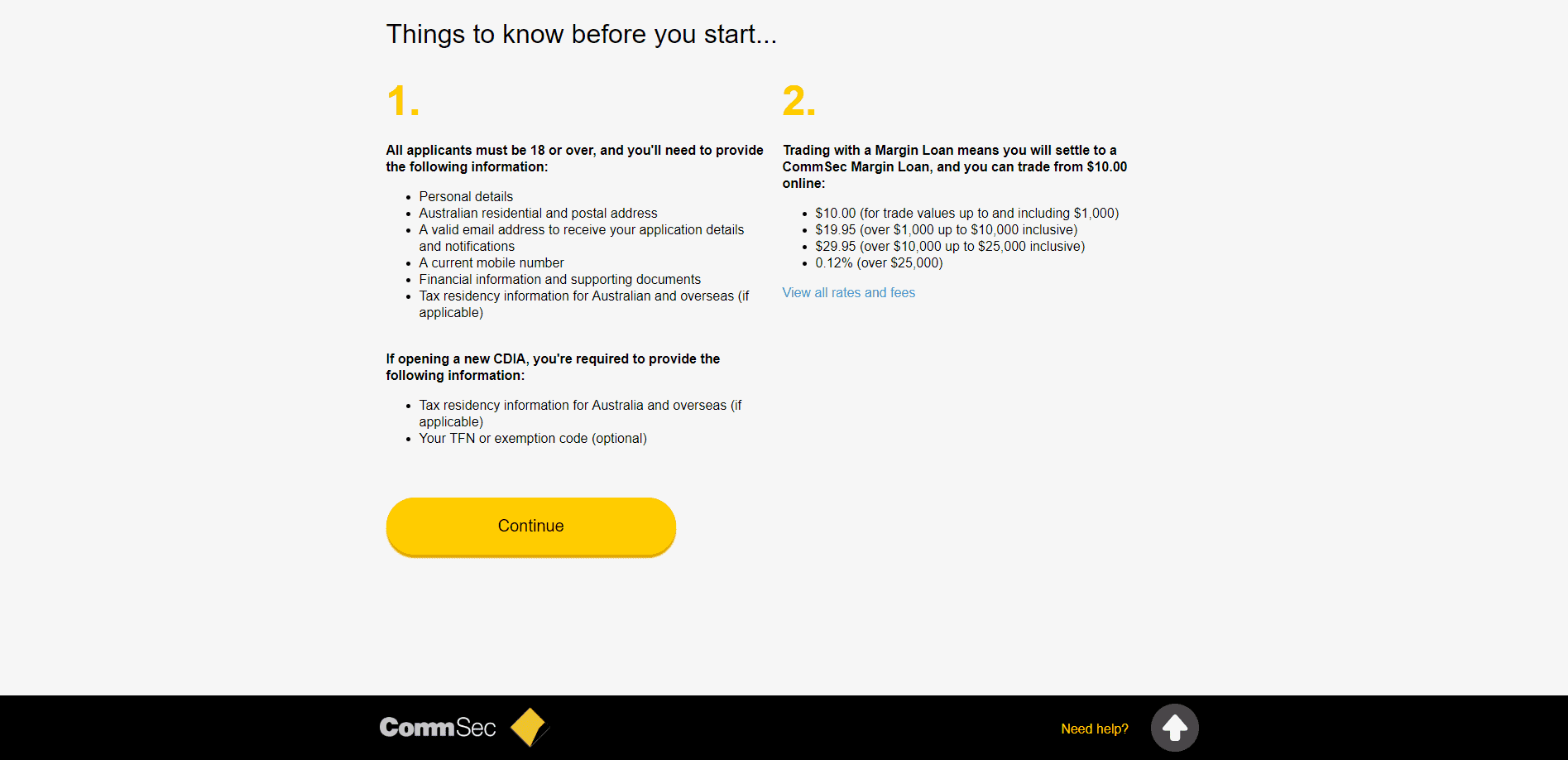

Clients may select between an individual or joint account, a company account, or a trust account. It also provides self-managed super funds (SMSFs), which are superannuation funds for retirement purposes. New traders with smaller deposits will benefit from CommSec Pocket, which offers investments from as little as $50. There is no information regarding a minimum deposit or maximum leverage, but the minimum initial investment is $500. Investors may add smaller amounts as follow-up transactions. Trading limits depend on the assets and account balance, but CommSec offers up to $25,000 deposit-free. Clients must deposit funds on the settlement day, i.e., the transaction day plus two (T+2).

Four standard account types exist at CommSec.

Self-managed super funds (SMSFs) for retirement purposes are equally available.

Small investors can start investing with as little as $50 in the CommSec Pocket account.

The minimum initial investment at CommSec is $500 worth of equity.

CommSec has trading limits in place.

Trading Platforms

CommSec makes no mention of its trading platform and fails to introduce it to potential clients. One screenshot from its brief paragraph of “powerful trading tools” shows only an average chart labeled as advanced charting. It appears to be for manual traders only, without support for automated traders and sophisticated solutions. The absence of detailed information suggests that its trading platform is below average without powerful trading tools. CommSec notes the CommSecIRESS Viewpoint trading platform, which is available only to CommSec One clients. It is an active trader program that requires minimum annualized broker commissions of $3,000, an average margin loan balance of $100,000, or average CHESS holdings of $2.5 million. No further information exists, as CommSec continues with its lack of transparency.

It appears that the CommSec trading platform is below-average, without support for advanced trading solutions.

A CommSec One subscription is required to gain access to the CommSecIRESS Viewpoint trading platform, which is an unacceptable and dated approach to inspire more trading activity.

Unique Features

The lack of transparency in core aspects of the trading environment is a unique feature at CommSec. It simply does not fit with CommSec's leadership position in the Australian brokerage industry. CommSec fails to provide an upfront picture about all trading costs, as it never references spreads. It fails to introduce its trading platform and does not offer enough details about available assets. It has many of the hallmarks of a brick-and-mortar bank rushing to compete in the online brokerage sector without deploying the necessary attention to the information traders require. It masks this shortfall with the trust of its corporate owner and a sufficient marketing budget.

Research and Education

CommSec does provide clients with in-house market commentary, but investors should expect no less from a full-commission brokerage owned by a Big Four bank in Australia. The Markets, the Executive Series, and Podcasts are where CommSec offers market commentary, interviews with executives of companies across the financial sector, and podcasts providing market reviews. CommSec does not generate trading recommendations, but clients may obtain access to CBA research for an additional cost. CommSec One clients may also receive actionable research. While the market commentary is of good quality, it offers investors no recommendation they can act on or consider, which adds to disappointments at CommSec.

CommSec publishes market commentary as videos and PDF documents under The Markets.

Investors can listen to video interviews at the Executive Series.

CommSec Podcasts feature more market commentary and reviews.

New traders have access to a quality educational section at CommSec, divided into four sectors. CommSec Learn provides an excellent starting point and introduces the basics investors need to consider. Each of the five lessons features numerous sub-lessons followed by a quiz. The high-quality content ranks among the best thought-through courses. CommSec Insights explains market-moving events but has a marketing-bias to open an account and trade at CommSec. The Welcome to CommSec category attempts to guide first-time investors through the initial steps and several aspects of the CommSec trading environment. CommSec also has lengthy webinars that enhance the overall educational value at this broker. While CommSec lacks in most categories, it delivers a market-leading educational package. It is accessible to all investors and not just clients, and CommSec deserves credit for making it available.

New investors should consider CommSec Learn as their first step.

CommSec Insights is more of a marketing-related section but offers quality content.

Welcome to CommSec talks new clients through the initial steps.

The CommSec webinars offer excellent value via in-depth explanations of numerous topics and represents one of the best educational features at this broker.

Customer Support

Customer Support Methods |  |

|---|---|

Support Hours | M - F, 8am - 7pm |

Website Languages |  |

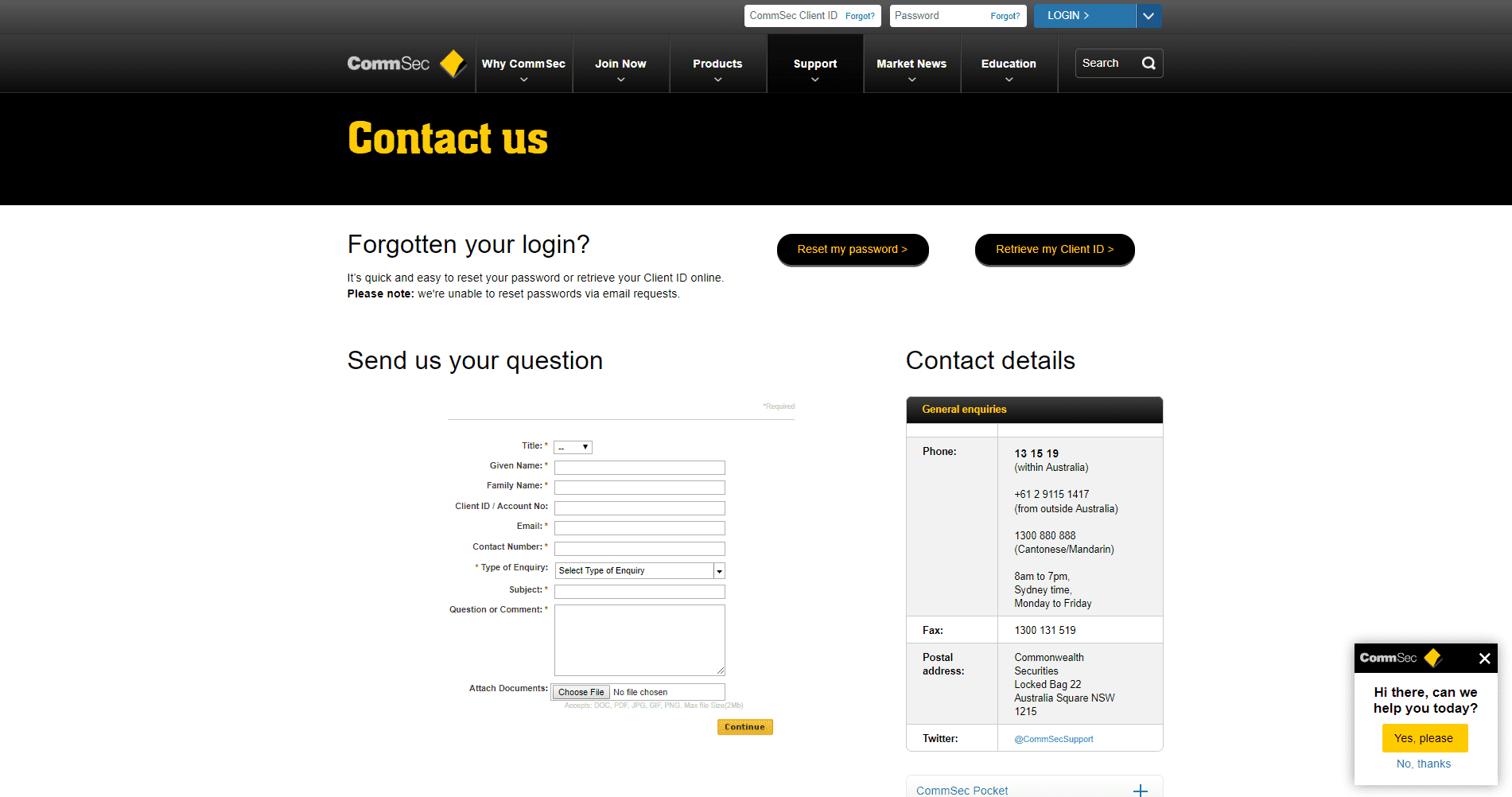

CommSec offers support via phone, webform, Twitter, and live chat. Clients may reach a representative Monday through Friday between 8 am and 7 pm. The FAQ section provides answers to many common questions. The overall customer support is acceptable, as CommSec only caters to Australian and New Zealand customers.

Customer support is available five days a week for Australian and New Zealand clients.

Bonuses and Promotions

CommSec neither offers bonuses to clients nor does it host promotions.

Opening an Account

An online application form handles new accounts, but CommSec only accepts clients from Australia and New Zealand. The multi-step process asks for personal information, following established industry standards during the first step. Account verification in compliance with AML/KYC requirements, as mandated by its regulator, completes the process. Investors can usually pass it by sending a copy of their ID and one proof of residency document.

The account opening procedure for Australian or New Zealand traders is in line with industry standards.

Deposits and Withdrawals

CommSec makes no mention of deposit and withdrawal methods, suggesting that traders may only use bank wires and credit/debit cards. It follows the lack of transparency dominant throughout CommSec. The Rates & Fees section notes unlimited free electronic withdrawals and two assisted ones per month.

CommSec fails to provide clarity as regards deposits and withdrawals.

Trading Platform

MT4 | |

|---|---|

MT5 | |

cTrader | |

Proprietary Platform | |

Automated Trading | |

DOM? | |

Guaranteed Stop Loss | |

Scalping | |

Hedging | |

One-Click Trading | |

OCO Orders | |

Interest on Margin |

Summary

CommSec is an online broker which caters only to Australian and New Zealand investors. It is owned by the Commonwealth Bank of Australia (CBA), one of Australia's Big Four banks. CommSec lacks overall transparency concerning its product and services portfolio. The cost structure remains one of the most expensive ones, and the trading platform is a below-average solution for manual traders. On a positive note, CommSec does maintain one of the best educational sections available to clients and the general public. Unfortunately, it also has one of the most uncompetitive trading environments for active investors. CommSec is a trustworthy broker but, at the same time, a perfect example of a bank-owned broker making an online push with inadequate results, i.e., an overpriced and uncompetitive solution. Most investors will find a friendlier product and service portfolio elsewhere. CommSec is a trusted broker with a broad but undisclosed range of assets from what appears a sub-standard trading platform. It is also one of the most expensive brokers, making it less competitive. Yes, CommSec is one of the best brokers for beginners, CommSec has an easy trading platform including helpful website than can support new traders. CommSec has many fees, which rank among the highest compared to all international online brokers. It makes CommSec one of the least competitive choices for active investors. The minimum initial trade size is $500 worth of equities, but follow on investments can be smaller than that. While CommSec offers access to 25 international equity markets, the cost structure makes it an unacceptable choice.FAQs

How good is CommSec?

Is CommSec good for beginners?

Does CommSec have fees?

What is the minimum trade on CommSec?

Is CommSec good for international trading?