Review

CMC Markets is a well-established and well-regulated UK online brokerage firm, listed on the London Stock Exchange and member of the FTSE SmallCap Index. Services are offered to retail clients as well as institutional clients such as banks, brokers, hedge funds and trading desks. It offers its own proprietary trading platform as well as the MT4 trading platform which shows that it is deeply committed to allow all its traders to take full advantage of its services. CMC Markets is a provider of Tier 1 liquidity and active in the prime brokerage market.

Retail clients can benefit from an educational package created over the past thirty years by this experienced broker. Asset selection is great and allows for a well-diversified cross-asset portfolio with relatively low trading costs. Regardless if you are a new trader, an established trader or an institutional client, CMC Markets offers the full spectrum of services to accommodate all trading needs. Over the past three decades this brokerage has expanded into a world-class operation which continues to grab market share. This CMC Markets review will focus on the services offered to retail traders or “Personal” traders, as they are referred to on the CMC Markets website with an evaluation of its CFD account which is where most traders will manager their portfolios from.

Headquarters | United Kingdom |

|---|---|

Regulators | FCA |

Tier 1 Regulator(s)? | |

Owned by Public Company? | |

Year Established | 1989 |

Execution Type(s) | Market Maker |

Trading Platform(s) | MetaTrader 4, Proprietary platform, Web-based |

Average Trading Cost EUR/USD | 0.6 pips ($6.00) |

Average Trading Cost GBP/USD | 0.9 pips ($9.00) |

Average Trading Cost WTI Crude Oil | $0.03 |

Average Trading Cost Gold | $0.34 |

Average Trading Cost Bitcoin | $75.00 |

Islamic Account | |

Signals | |

US Persons Accepted? | |

Managed Accounts |

Regulation and Security

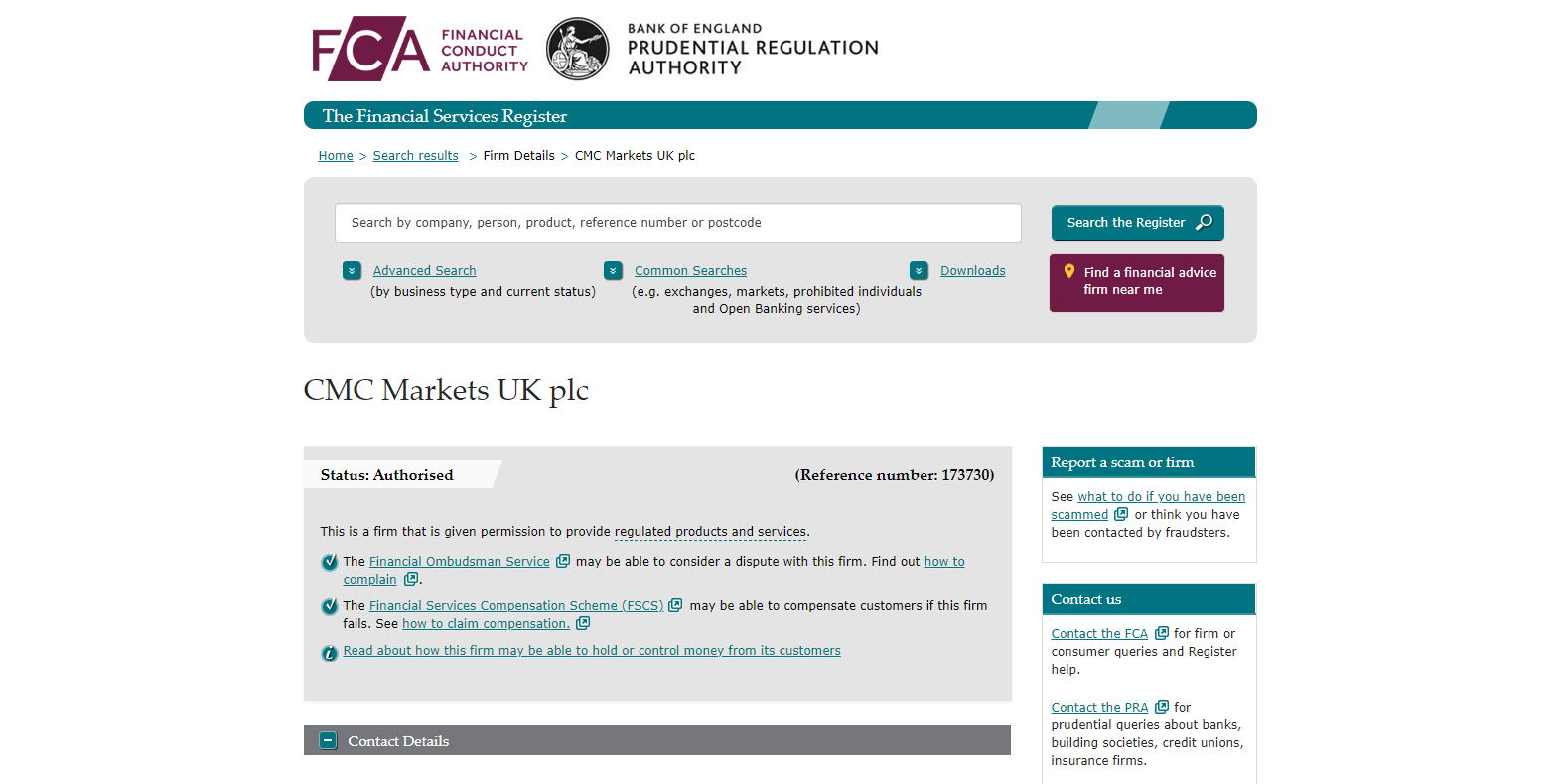

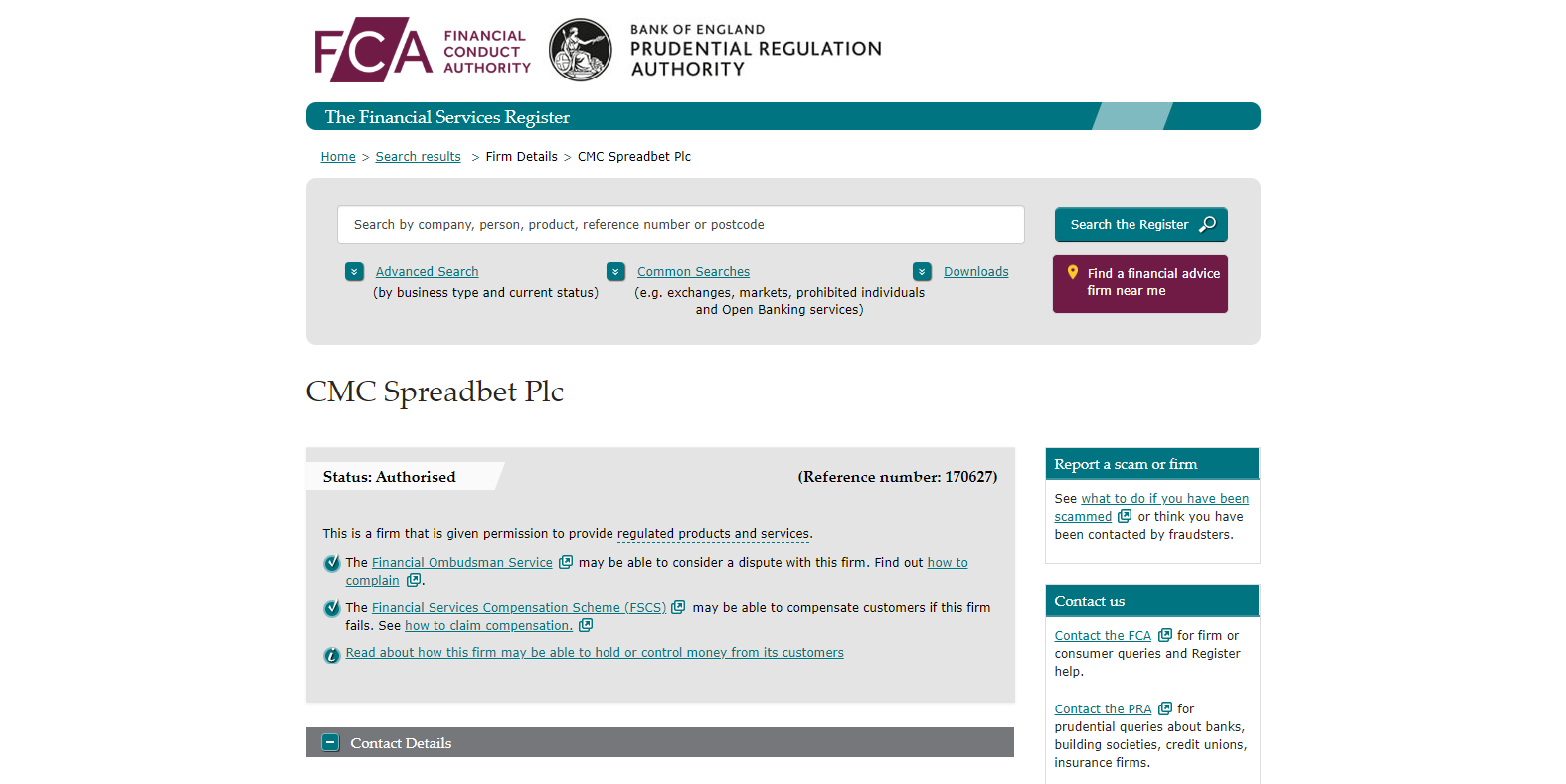

CMC Markets PLC is registered in England and Wales under company number 05145017. It is the owner and operator of CMC Markets UK PLC and CMC Spreadbet PLC which are both authorized and regulated by the Financial Conduct Authority (FCA) in the UK under license number 173730 and 170627 respectively. The FCA is a world class regulator and CMC Markets is in full compliance of regulation.

Client funds remain fully segregated from company funds in account held at Natwest, Barclays and Lloyds in the UK, Ulster Bank in Ireland, Deutsche Bank in Germany and Barclays in France. Being authorized and regulated by the FCA in the UK, client funds are further protected by the Financial Services Compensation Scheme (FSCS) up to £85,000 which offers complete coverage for most, if not all, retail traders. Retail traders who exceed this amount should consider putting some of their funds with other brokers.

Fees

Average Trading Cost EUR/USD | 0.6 pips ($6.00) |

|---|---|

Average Trading Cost GBP/USD | 0.9 pips ($9.00) |

Average Trading Cost WTI Crude Oil | $0.03 |

Average Trading Cost Gold | $0.34 |

Average Trading Cost Bitcoin | $75.00 |

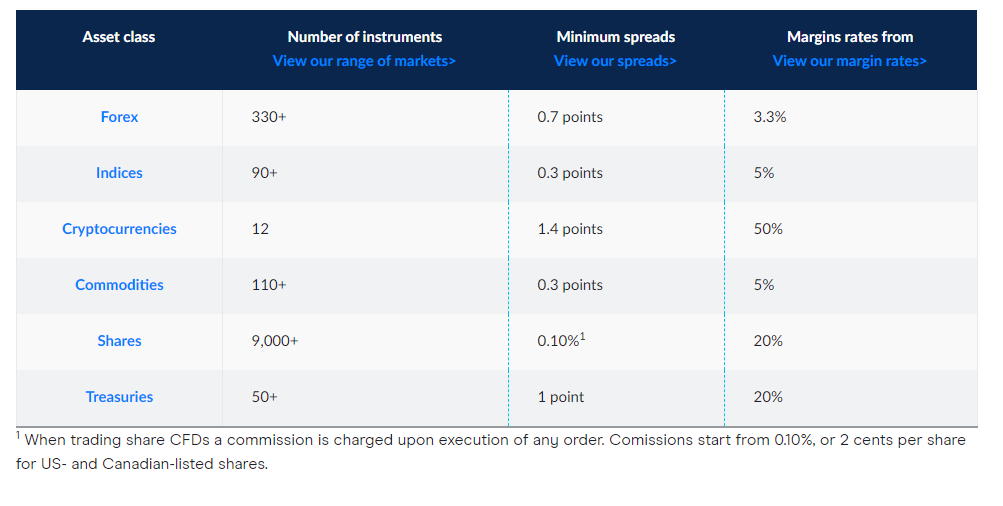

CMC Markets earns their revenue either from spreads, commissions or a combination of both, depending on the asset traded. Spreads on Forex CFD’s start as low as 0.7 pips which represents a competitive spread. Commissions are charged for equity trading and starts from 0.10%. Other trading costs which should be considered is a premium for guaranteed stop-loss orders (GSLOs) which will be refunded if the order won’t be triggered, as well as overnight holding costs, swap rates and a market data fee. An account inactivity fee of £10 per month also applies which is not only unfortunate, but also unnecessary.

CMC Markets is very transparent about all costs involved, and all are listed clearly on the company’s website. As always, traders can access all the costs from inside the trading platform as each deal ticket comes equipped with all the applicable costs.

Market Data Fees

CMC Markets offer the following markets free of additional market data fees:

- Austria

- Canada

- Denmark

- Finland

- France

- Germany

- Ireland

- Italy

- Japan

- Netherlands

- New Zealand

- Norway

- Poland

- Portugal

- Singapore

- Spain

- Sweden

- Switzerland

- UK

- US

Regrettably, a market data fee applies to Australia and Hong Kong. Traders who wish access to live streaming data from those two markets must activate the market data subscription from inside the trading platform. A monthly fee of A$20 applies for Australian markets and HK$120 for Hon-Kong, which excludes value-added tax (VAT). Therefore, the monthly cost can be up to 20% above that, depending on the trader's jurisdiction. After traders activate a subscription, it will automatically renew each month if open positions or pending orders exist. It will do so irrelevant of the account balance, so traders must ensure they maintain sufficient capital and consider the deduction. It will impact the available margin and can lead to an unexpected margin call if traders do not account for it.

The 0.50% currency conversion cost that applies is another cost traders must consider. Since most clients do not have their trading accounts denominated in the Australian Dollar or the Hong Kong Dollar, CMC Markets will convert the monthly market data subscription fee at spot prices plus the 0.50% mark-up. The same applies to any profit or loss from trades placed on Australian and Hong Kong-listed assets. While the charge on an individual basis remains minor, it adds up over time, especially for high-frequency traders.

A trader designated as a private investor by CMC Markets who places two trades within one month will get a rebate in the amount of the market data fee. One classified as a non-private investor must place five trades for a refund but may also face higher market data fees. Since those interested in market data from Australia and Hong Kong generally intend to trade those markets, and CMC offers a refund, the entire process resembles an unnecessary nuance.

CMC Markets Trading Hours

Asset Class | From | To |

|---|---|---|

Currency Pairs | Sunday 21:00 | Friday 22:00 |

Cryptocurrencies | Sunday 00:00 | Friday 22:00 |

Commodities | Sunday 23:00 | Friday 22:00 |

Crude Oil | Sunday 23:00 | Friday 22:00 |

Gold | Sunday 23:00 | Friday 21:59 |

Metals | Sunday 23:00 | Friday 21:59 |

Equity Indices | Sunday 23:00 | Friday 22:00 |

Stocks | Sunday 23:00 | Friday 21:00 |

Bonds | Sunday 23:00 | Friday 22:00 |

ETFs | Monday 14:30 | Friday 21:00 |

Synthetics | Monday 08:00 | Friday 21:00 |

What Can I Trade

CMC Markets offers of 10,000 assets across six classes which include Forex, indices, cryptocurrencies, commodities, shares & ETFs and treasuries. Most traders, retail as well as professional, will find the asset selection very comprehensive and this broker continues to expand its list. All assets can be found listed on their website, but traders will find it a lot easier to navigate the proprietary trading platform in order to find the asset they wish to trade.

A full list of each available asset type is available in several organized, comprehensive lists on the company’s website.

Account Types

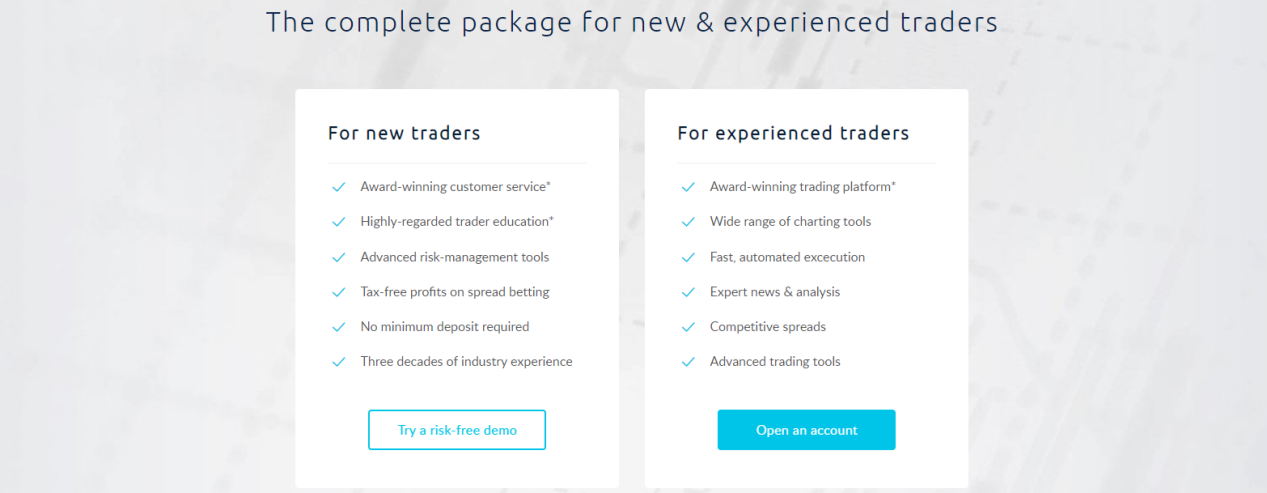

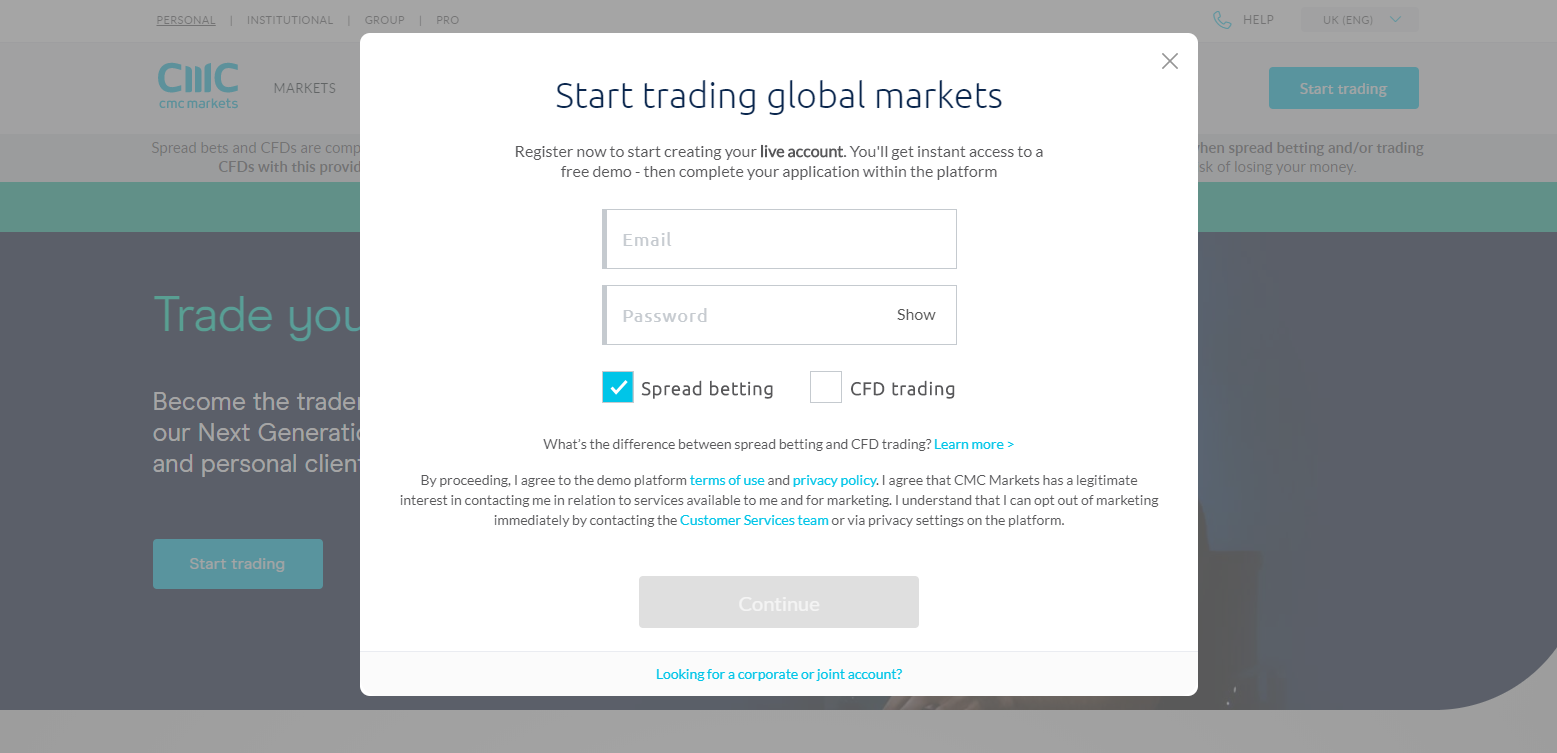

CMC Markets offers four different account types depending on what type of trader a client is and there are no minimum deposits which is great as traders can always opt to deposit as much as they are willing to and not chase account upgrades through higher deposits. All traders are treated equally within each account type which is another great feature in-line with the great trading environment provided by CMC Markets. The four different account types are Spread Betting, CFD Trading, CMC Pro and CMC Corporate.

Spread Betting

This will be a popular choice for UK based traders as it allows for tax-free trading. International traders cannot qualify for a spread betting account, but can look at the CFD Trading Account. Professional clients may also be eligible for cash rebates based on trading volume as CMC Markets paid out £14.1 million in cash rebates to clients during their 2018/2019 financial year. Professional clients wave certain protection granted and in return get more favorable trading conditions; traders need to apply to change their status from retail trader.

CFD Trading

This is the bread-and-and butter business of CMC Markets and most clients will deposit their funds, manage their portfolios and expand their investments from this type of account. CMC Markets offers excellent trading conditions that make it a suitable option for traders at all levels.

CMC Pro

This is where retail traders can apply to get an upgrade to professional client status which grants the same access to assets through the same trading platform, but with better trading conditions which includes higher leverage. Segregation of funds as well as the FSCS protection of up to £85,000 applies, but in order to qualify as a professional clients, assets need to exceed £500,000 and at least one year working experience in the financial industry is required.

CMC Corporate

This is where CMC Markets caters to its institutional clients with a range of services which include grey and white label solutions, API Direct, FX Prime and Prime Derivatives. The 30 years of experience are clearly showing and despite having heavily invested into their proprietary software, they did not neglect support for MT4/MT5 solutions. The attention to detail, deep understanding of market infrastructure and broad inclusion of all types of providers is just the latest proof that this broker truly deserves the countless awards and accolades it has collected.

Trading Platforms

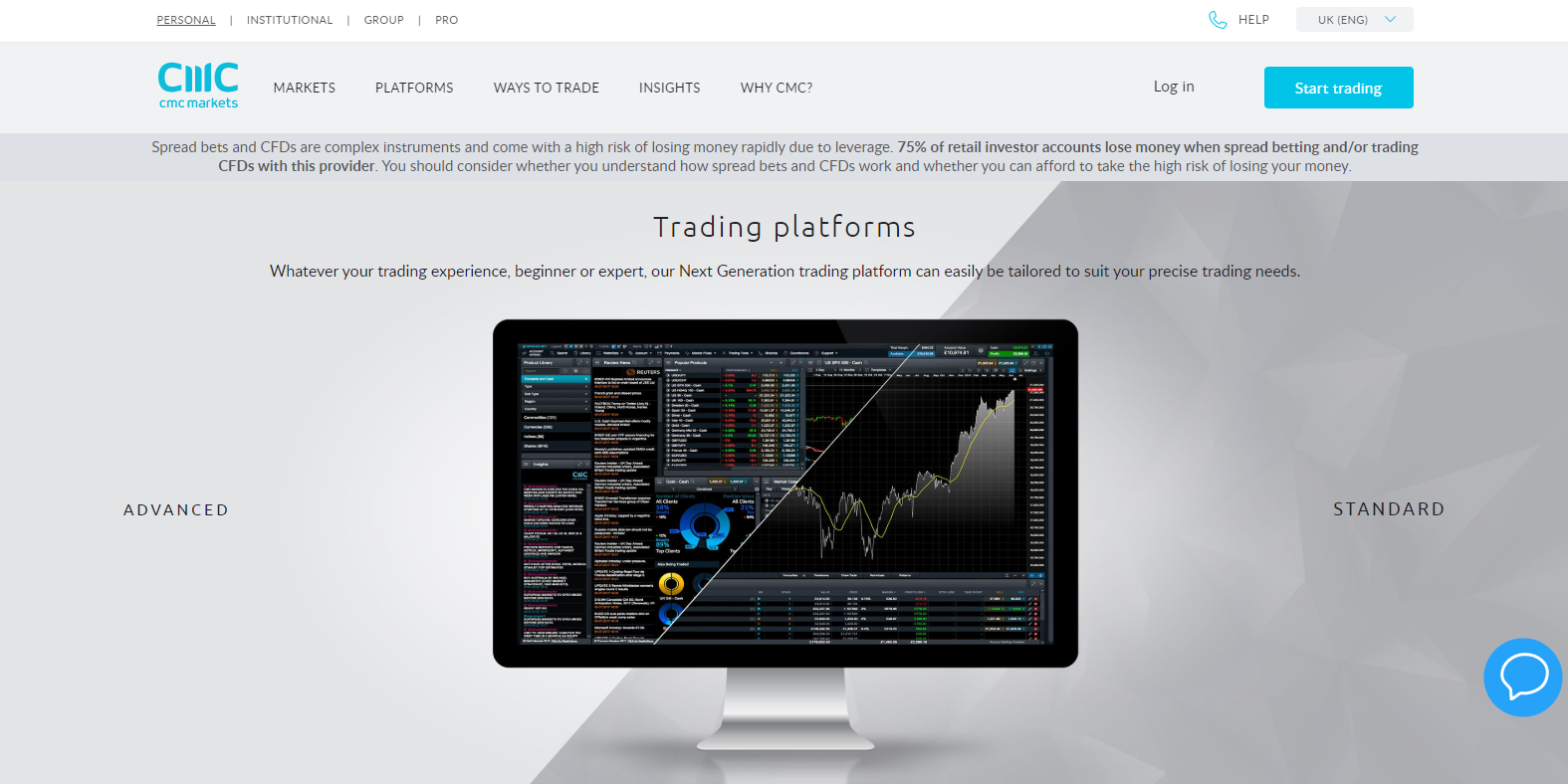

CMC Markets has created its own proprietary trading platform which is packed with unique features, is fully customizable so that you can create the trading terminal which suits you best, allows for fully automated trading solutions, and the overall product is a very competitive and superior trading platform than most traders may be offered, especially in the retail sector. It is available as a web version and comes as a mobile version as well.

Those who are used to the MT4 trading platform and environment or have their own EA’s and other custom trading solutions don’t need to worry as CMC Markets also offers the MT4 trading platform in order to accommodate the millions of dollars’ worth of enhancements which have been developed for the MT4 trading platform, which remains the most popular trading platform for Forex traders. The fact that CMC Markets opted to offer this as a choice and not ignore the largest segment of the financial world ads to the world-class service this broker offers.

Traders who have no custom solution running on MT4 are advised to make the switch to CMC Markets’ own trading platform which offers an overall better trading experience as an unmodified MT4 trading platform; those who have customized their MT4 trading platform may opt to remain loyal to what has worked for them, simply connect to the CMC server and get access to the same great trading conditions for Forex, commodities and indices; CFDs on shares are not available.

CMC Markets Next Generation Trading Platform

CMC Markets offers traders its proprietary Next Generation trading platform, which provides a distinct advantage to CMC broking clients. It suits new traders and professionals alike, as traders can switch between a Standard layout, which caters more to beginner traders, and an Advanced layout, for professional clients. It supports twelve different chart types, including candlestick charts, Kagi, and Renko charts. The industry-leading charting package also provides clients with 115 technical indicators and drawing tools, over 70 chart patterns, and more than 20 years' worth of historical data.

Technical analysts have one of the most comprehensive packages inside the CMC Markets Next Generation Trading Platform. Chart intervals range from one second to one month, ensuring that traders can apply all types of trading strategies. Placing trades directly from the charts enhances the trading experience, and dragging one asset and dropping it into another one allows for swift correlation analysis. The chart pattern analysis tool provides an invaluable assistant for manual traders.

After the CMC Markets Next Generation Trading Platform recognizes a chart pattern, a price projection box estimates where the next move may unfold. Module linking improves the efficiency of analysts, as changing the asset will update all linked modules. The chart forum is where traders can connect, share ideas, and discuss markets. CMC Markets also provides a client sentiment indicator, displaying information about other traders and how they remain positioned. A series of fundamental new sources provide market commentary and insights, including Morningstar quantitative equity research reports. The CMC Markets Next Generation Trading Platform additionally supports advanced order types like price ladders or boundary orders. Traders may use trades with unrealized profits to enter new positions without forcing the closure of them. Therefore, clients can take advantage of other opportunities while extending existing ones. CMC broking via the proprietary trading platform at CMC Markets ensures traders operate with a competitive edge.

Unique Features

The proprietary trading platform developed by CMC Markets is the most unique feature this broker offers, but within its platform is another gem in the form of its charting package which was ranked highest in a 2019 Investment Trends survey. This package comes loaded with over 115 technical indicators, over 70 chart patterns and 12 different chart types and creates a powerful technical analysis tool for traders. Another great feature inside the trading platform is CMC Markets Price Projection Tool which can automatically scan for chart formations as well as candlestick patterns and calculate the projected price.

Traders who prefer a social trading environment can take advantage of the Chart Forum which connects them to like-minded traders and allows traders access to CMC Market analysts with easy to share and copy analysis across the trading platform. Rounding up a great trading platform experience are live news provided by Reuters and quantitative equity research reports by Morningstar. The CMC Markets trading platform is the gateway to a very well organized and developed infrastructure which allows traders access to everything they need in order to trade successfully.

CMC Mobile Apps

CMC Markets provides clients with three mobile apps for the iPhone, one for iPad, and one for Android devices. Since Apple rolled out larger screens, demand for trading apps, especially from millennial traders, continues to increase. The CMC Markets iPhone features intelligent watchlists that synchronize with the CMC Markets Next Generation Trading Platform and offer traders streaming data and performance measures to check their portfolios on the move. Other features include enhanced product search and a customizable home screen. Unlike the webtrader, the iPhone app only supports 35 technical indicators. Users of Apple products will appreciate the swipe login feature, but the screen size remains the most notable disadvantage.

A more suitable alternative for committed traders to the CMC Markets Next Generation Trading Platform is the Apple iPad trading platform. While many new retail traders prefer their mobile phones, they are not suited for analyses and trading purposes. The iPad version features 38 technical indicators, trading from multiple chart types, and traders may scan up to four different charts simultaneously. It also supports the swipe login feature, intelligent watchlists, and advanced order tickets, among other trading and analysis features. The most significant advantage of the iPad over iPhone trading apps is that the former allows traders to conduct an analysis, which can be shared. The latter is only suitable to monitor existing positions.

The Android trading app fulfills the same functionality as the Apple iPhone one. CMC Markets singles out guaranteed stop-loss orders in the introduction, missing from the introduction to Apple products. Trading from Android devices remains popular in emerging and frontier markets, where many new traders who cannot afford multiple devices opt for a high-performance mobile device. While it does not address the screen size, it is how more new clients trade globally. Live streaming prices at the CMC Markets Android trading platform receive updates every five seconds, similar to its Apple counterparts, making all mobile apps unsuitable for scalping and high-frequency traders.

Research and Education

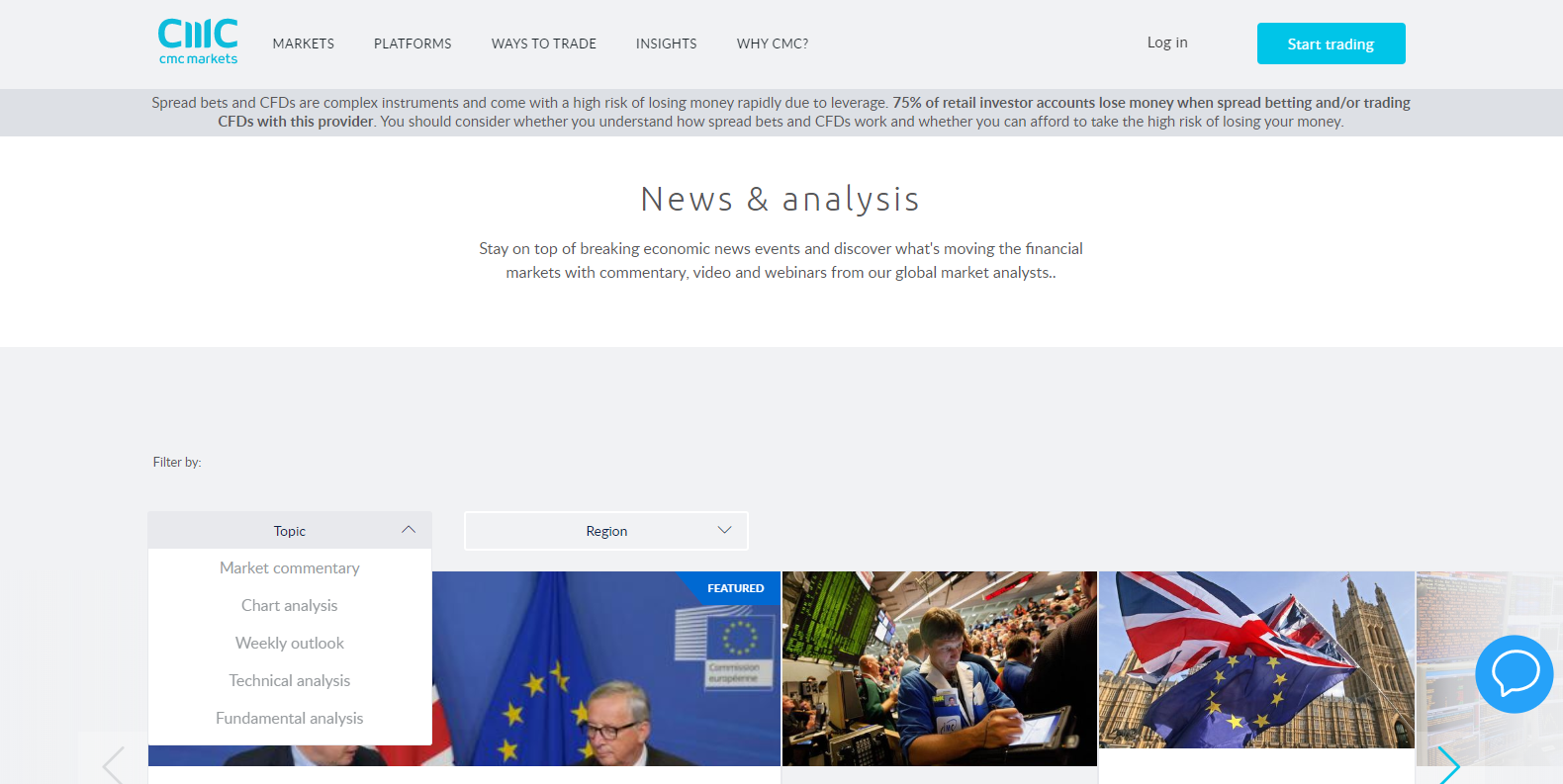

When it comes to research and education, CMC Markets deployed the same attention to detail as it did with its excellent trading platform. A dedicated team of analysts offers coverage across asset-classes, the results are well presented and well organized to that traders can quickly located what they are looking for. The research and analysis is further broken down into market commentary, chart analysis, weekly outlook, technical analysis and fundamental analysis. It can be filtered by asset class as well as region.

The education section is filled with webinars and events hosted by CMC Markets experts and there is an abundance on educational articles which clearly shows the effort placed on education by this broker. The eight main categories of the educational section are as follows: Learn spread betting, Learn to Trade CFDs, Learn Forex trading, Technical indicators, Fundamental analysis, Webinars & events, Platform guides and Trading guides. A comprehensive glossary rounds up the very well thought through educational package of CMC Markets.

Research

Excellent market coverage which makes for a good read, is well organized and adds value to overall service offered by CMC Markets.

Education

New traders will find the educational material very beneficial as it will allow them create a strong foundation from where they can grow. A great effort went into the published educational material and the webinars as well as in-person seminars polish the overall section.

Customer Support

Customer Support Methods |   |

|---|---|

Support Hours | 24/5 |

Website Languages |   |

Customer support is available 24/5 and can be accessed through the FAQ section, live chat, via phone and through e-mail. CMC Markets states that 98% of calls are answered in less than 20 seconds, though we did not test this feature during our CMC Markets review. That being said, CMC Markets was voted the “Best Phone & Email Customer Service” in 2019 by Investment Trends UK Leverage Trading Report.

Bonuses and Promotions

While there were no special promotions or deposit bonuses at the time of this CMC Markets review, professional traders can qualify for cash rebates based on trading volume which is a great incentive.

This is standard operating procedure for prime brokerages which don’t seek to attract clients through monetary incentives, but through services offered which create a superior trading environment as well as experience; CMC Markets has delivered in this regard.

Opening an Account

Opening an account with CMC Markets is quick and easy with an online application which is the norm in today’s global financial sector. This will give traders quick access to the back-office of their live trading account, but additional documentation is required in order to satisfy AML/KYC requirements as mandated by regulators. These documents may be difficult to submit, but they guarantee the safety of every depositing trader.

Deposits and Withdrawals

When it comes to deposits and withdrawals, the only options offered by CMC Markets are credit/debit cards and bank wires. This remains the only weak point in the operational structure of CMC Markets and while it is not an impediment to most traders, it would be nice to have other options available. As with all regulated brokers, the withdrawal method needs to be the same as the funding method and accounts in the same name. Since options are limited to the bread-and-butter, old school methods, there is not a great deal of information provided. CMC Markets doesn’t charge for deposits or withdrawals, but third-party bank charges apply.

Trading Platform

MT4 | |

|---|---|

MT5 | |

cTrader | |

Proprietary Platform | |

Automated Trading | |

DOM? | |

Guaranteed Stop Loss | |

Scalping | |

Hedging | |

One-Click Trading | |

OCO Orders | |

Interest on Margin |

Summary

CMC Markets is a UK-based prime brokerage which offers an exceptional service to all type of clients and covers the entire spectrum of financial markets. Its proprietary trading platform offers a fantastic gateway and market access and the platform offers many bonuses that go above the standard broker offering. These include, but are not limited to, a charting package, price prediction tools with automated chart recognition features, and more. Regulation, security and transparency is what CMC Markets is built on and this LSE listed broker delivers on all its promises. No false hype or marketing, but an honest approach which led to the creation of a superior brokerage.

New traders can benefit from an extensive educational program which allows them to grow as traders, in addition to practice trading using CMC Markets demo account first before they attempt to grow their accounts. A research team offers market coverage and analysis across asset classes and regions and traders have access to over 10,000 different assets. Spreads are tight, commissions acceptable and execution is flawless; this combination creates a trading environment every trader should consider.

Established traders who are used to the MT4 trading platform and have their own range of custom created tools, indicators and automated trading solutions don’t need to worry as CMC Markets offers the MT4 trading platform alongside its own, next generation trading platform. Corporate clients who depend on the MT4 infrastructure will get a bridge in order to connect their solutions to CMC Markets and benefit from the full range of services.

CMC Markets is a prime brokerage and rightfully so. The personalized products and services cater to clients from all segments of finance, attention to detail exits throughout CMC Markets and all awards as well as accolades collected over the past three decades are well deserved. CMC Markets is a first-class broker which should be part of any well diversified approach to asset management, across asset-classes and geographical regions. CMC Markets is headquartered in London, UK. CMC Markets earns money through spreads and commissions charged on over 10,000 assets. It also charges an additional 0.0027% on swap rates for overnight Forex trades. CMC Markets offers bank transfers, credit and debit card payments. The minimum trading size depends on the asset traded and a complete list can be viewed directly on the broker’s website. CMC Markets does issue margin calls, but detailed information was not available on the website. Traders should contact support, but a drop below a 100% equity ratio is likely to trigger a call. CMC Markets PLC is registered in England and Wales under company number 05145017. It is the owner and operator of CMC Markets UK PLC and CMC Spreadbet PLC which are both authorized and regulated by the Financial Conduct Authority (FCA) in the UK under license number 173730 and 170627 respectively. The maximum leverage is dependent on the trader classification, retail or professional, as well as the trades asset. More details need to be obtained from support. CMC Markets has an online application form which is standard operating procedure. Yes, CMC Markets offers the MT4 trading platform on top of its own proprietary trading platform.FAQs

Where is CMC Markets based?

How does CMC Markets make money?

How can I deposit into an CMC Markets account?

What is the minimum lot size at CMC Markets?

When does a margin call take place at CMC Markets?

Is CMC Markets regulated?

What is the maximum leverage offered by CMC Markets?

How do I open an account with CMC Markets?

Does CMC Markets offer the MetaTrader Trading Platform?