BDSwiss Editor’s Verdict

BDSwiss has 1.7M+ registered trading accounts from 180+ countries, offering traders MT4/MT5 with services from Trading Central and Autochartist. Beginners receive quality education and research. BDSwiss remains an excellent broker for active traders and scalpers due to its median execution speed below 0.08 seconds, with 77.8% of orders experiencing zero to positive slippage. My BDSwiss review evaluated trading conditions to determine how BDSwiss ensures its traders have a competitive edge. Is BDSwiss the best broker for your trading requirements?

Overview

BDSwiss maintains an excellent trading infrastructure that is ideal for demanding strategies.

Headquarters | Seychelles |

|---|---|

Regulators | FSA, FSC Mauritius, FSCA, MWALI International Services Authority |

Tier 1 Regulator(s)? | |

Owned by Public Company? | |

Year Established | 2012 |

Execution Type(s) | Market Maker |

Minimum Deposit | $10 |

Negative Balance Protection | |

Trading Platform(s) | MetaTrader 4, MetaTrader 5, Proprietary platform |

Average Trading Cost EUR/USD | 1.2 pips ($12.00) |

Average Trading Cost GBP/USD | 1.6 pips ($16.00) |

Average Trading Cost WTI Crude Oil | $0.14 |

Average Trading Cost Gold | $0.18 |

Average Trading Cost Bitcoin | $24.57 |

Retail Loss Rate | Undisclosed |

Minimum Raw Spreads | 0.0 pips |

Minimum Standard Spreads | 1.0 pips |

Minimum Commission for Forex | $6.00 |

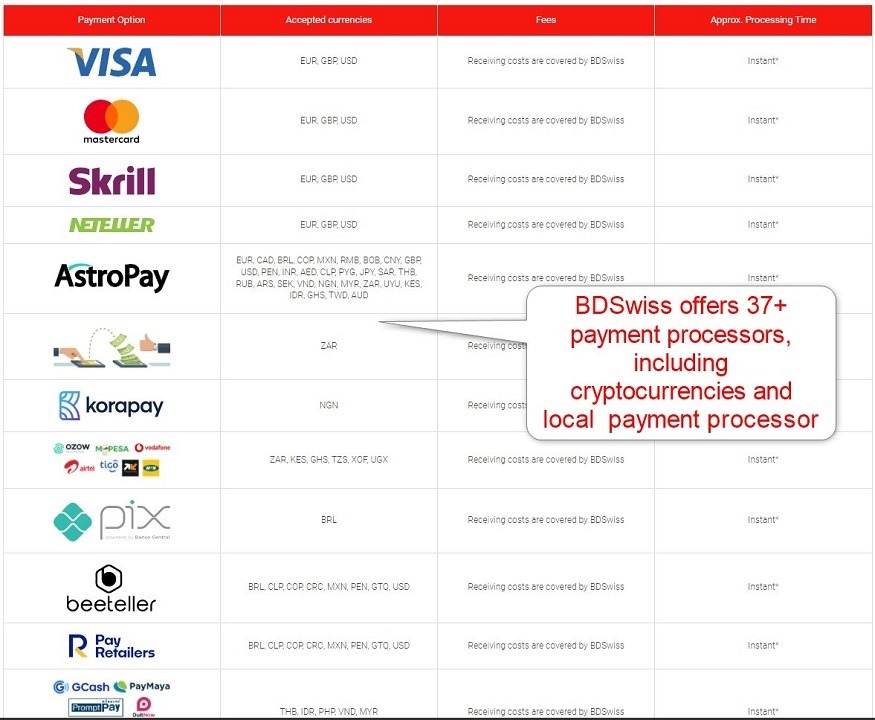

Funding Methods | 37+ |

Islamic Account | |

Signals | |

US Persons Accepted? | |

Managed Accounts |

BDSwiss Five Core Takeaways:

- Trading Central and Autochartist for MT4/MT5

- Median execution speed of below 0.08 seconds

- 77.8% of orders experiencing zero to positive slippage

- 37+ payment processors

- Quality research and education for beginners

Regulation and Security

Trading with a regulated broker will limit the potential for fraud and malpractice. I always recommend traders check for regulation and verify it with the regulator by double-checking the provided license with their database. BDSwiss has four regulated subsidiaries with clean records.

Country of the Regulator | Mauritius, Malawi, Seychelles, South Africa |

|---|---|

Name of the Regulator | FSA, FSC Mauritius, FSCA, MWALI International Services Authority |

Regulatory License Number | C116016172, SD047, 49479, T2023244 |

Regulatory Tier | 4, 4, 2, 5 |

Is BDSwiss Legit and Safe?

My BDSwiss review found no verifiable misconduct or malpractice by this broker, operational since 2012. Therefore, I recommend BDSwiss as a legitimate and safe broker.

BDSwiss regulation and security components:

- Regulated by the Seychelles FSA, the Mauritius FSC, the South African FSCA, and the Moheli Island (Union of Comoros) MISA.

- Founded in 2012

- Segregation of client deposits from corporate funds.

- Negative balance protection

What would I like BDSwiss to add?

BDSwiss could bolster client protection with a Hong Kong-based Financial Commission, offering third-party audits and a €20,000 compensation fund per claim. BDSwiss could also consider a third-party insurance package.

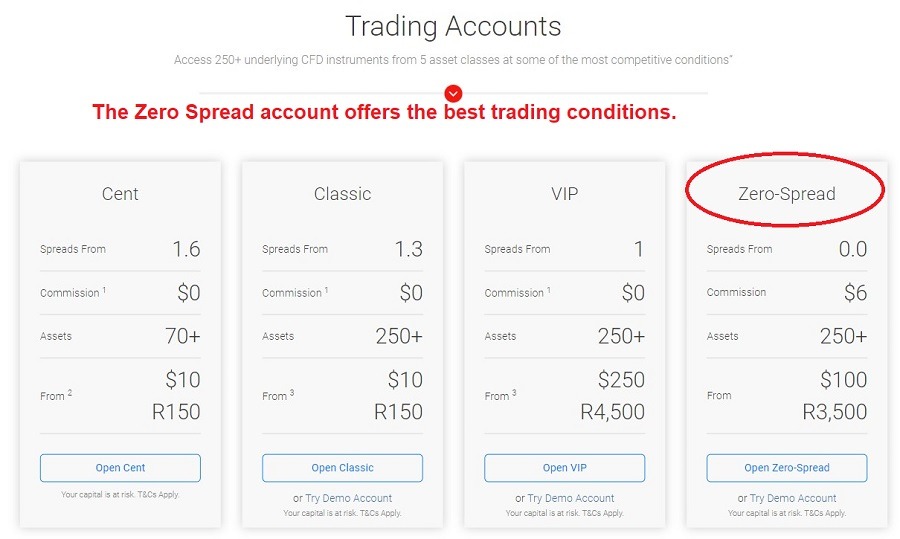

Fees

I rank trading costs among the most defining aspects when evaluating a broker, as they directly impact profitability. BDSwiss offers traders three commission-free pricing options and one very competitively priced commission-based alternative. I recommend traders choose the latter, given the low minimum deposit requirement of $100.

BDSwiss does not levy internal deposit or withdrawal fees, except a $10 fee for bank wire withdrawals less than $100, but traders may incur third-party processing costs, including blockchain fees for cryptocurrency transactions or currency conversion fees.

Traders will pay currency conversion fees if their deposit currency does not match the account base currency. The same applies to trading an asset denominated in a currency other than the account base currency, but BDSwiss states that it does not levy internal markups on currency conversions.

A $30, or a currency equivalent, monthly inactivity fee applies after 90 days of dormancy. While this is a relatively short period, active traders will never face this cost.

Average Trading Cost EUR/USD | 1.2 pips ($12.00) |

|---|---|

Average Trading Cost GBP/USD | 1.6 pips ($16.00) |

Average Trading Cost WTI Crude Oil | $0.14 |

Average Trading Cost Gold | $0.18 |

Average Trading Cost Bitcoin | $24.57 |

Minimum Raw Spreads | 0.0 pips |

Minimum Standard Spreads | 1.0 pips |

Minimum Commission for Forex | $6.00 |

Deposit Fee | |

Withdrawal Fee | |

Inactivity Fee | true |

The minimum trading costs for the EUR/USD at BDSwiss are:

Minimum Spread | Commission per Round Lot | Cost per 1.0 Standard Lot |

|---|---|---|

1.6 pips (Cent) | $0.00 | $16.00 |

1.3 pips (Classic) | $0.00 | $13.00 |

1.0 pips (VIP) | $0.00 | $10.00 |

0.0 pips (Zero Spread) | $6.00 | $6.00 |

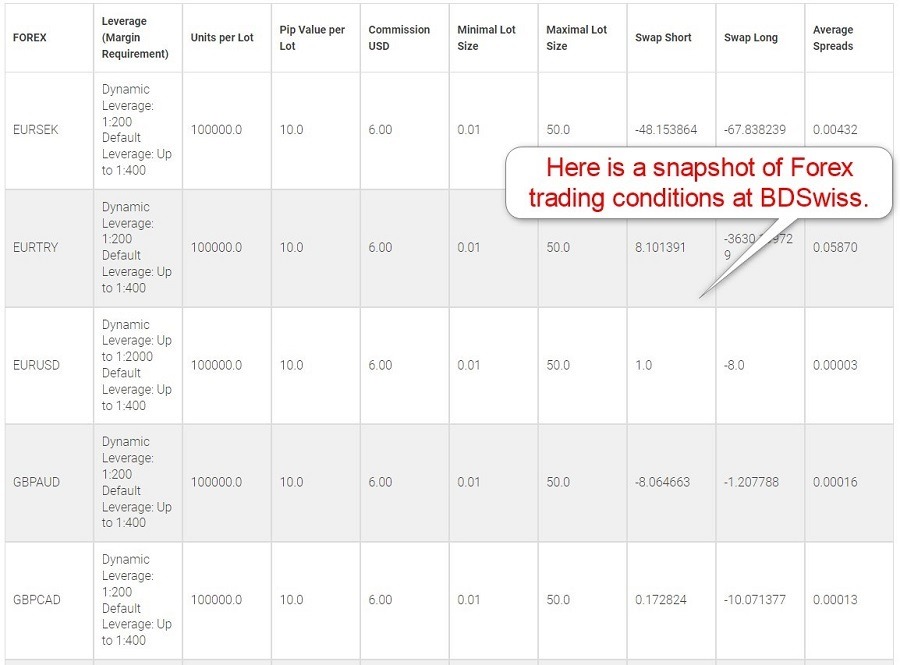

Here is a snapshot of BDSwiss trading fees:

The most ignored trading costs are swap rates on leveraged overnight positions. Depending on the trading strategy, it may become the most significant fee per trade. I always recommend that traders check them before evaluating the total trading costs.

MT4/MT5 traders can access swap rates from their platform by following these steps:

- Right-click the desired symbol in the Market Watch window and select Specification.

- Scroll down until you see Swap Long and Swap Short.

Below is a list of trading cost examples for buying and selling the EUR/USD, holding the trade for one night and seven nights in the commission based BDSwiss Zero Spread account.

Taking a 1.0 standard lot buy/sell position in the EUR/USD, at the average spread and holding it for one night in the BDSwiss Zero Spread account will cost the following:

Average Spread | Commission per Round Lot | Swap Long | Swap Short | Total TradingCosts |

|---|---|---|---|---|

0.00003 pips | $6.00 | $8.00 | X | -$14.30 |

0.00003 pips | $6.00 | X | -$1.00 | -$5.30 |

Taking a 1.0 standard lot buy/sell position in the EUR/USD, at the average spread and holding it for seven nights in the BDSwiss Zero Spread account will cost the following:

Average Spread | Commission per Round Lot | Swap Long | Swap Short | Total TradingCosts |

|---|---|---|---|---|

0.00003 pips | $6.00 | $56.00 | X | -$62.30 |

0.00003 pips | $6.00 | X | -$7.00 | $0.70 |

BDSwiss Trading Hours

Asset Class | From | To |

|---|---|---|

Currency Pairs | Monday 00:00 | Friday 24:00 |

Cryptocurrencies | Monday 00:00 | Friday 24:00 |

Commodities | Monday 01:00 | Friday 24:00 |

Crude Oil | Monday 01:00 | Friday 23:45 |

Gold | Monday 01:00 | Friday 23:45 |

Metals | Monday 01:00 | Friday 23:45 |

Equity Indices | Monday 01:05 | Friday 23:45 |

Stocks | Monday 10:00 | Friday 23:00 |

Range of Assets

BDSwiss provides traders with a balanced CFD asset selection covering five sectors focused on the most liquid trading instruments. The range of assets makes BDSwiss ideal for traders requiring fewer but liquid assets, like scalpers. Equity traders get CFDs on blue-chip equities listed in the US, the UK, France, Germany, Netherlands, Spain, and Switzerland.

During my BDSwiss review, I noted that ETFs are available on the MT5 platform but not on the MT4 platform, but I like the overall asset selection, which should suffice for most traders.

BDSwiss offers the following assets:

- 53 currency pairs

- 26 cryptocurrencies

- 6 commodities

- 10 indices

- 128 equity CFDs

Currency Pairs | |

|---|---|

Cryptocurrencies | |

Commodities | |

Crude Oil | |

Gold | |

Metals | |

Equity Indices | |

Stocks | |

Stocks (non-CFDs) | |

Bonds | |

ETFs | |

Options | |

Futures | |

Synthetics |

BDSwiss Leverage

Maximum Retail Leverage | 1:2000 |

|---|---|

Maximum Pro Leverage | 1:2000 |

What should traders know about BDSwiss leverage?

- BDSwiss offers dynamic leverage*, which decreases with trading volume, resulting in an excellent mix of competitiveness and risk management.

- Maximum retail Forex leverage is 1:2000.

- Index and commodity traders get 1:200.

- Cryptocurrency and equity traders can trade with leverage of 1:5.

- Not all assets within a sector qualify for the dynamic leverage.

- Negative balance protection ensures traders cannot lose more than their deposit.

- Traders must always use appropriate risk management with leveraged trading to avoid magnified trading losses.

*Dynamic leverage is only available to certain clients depending on their location.

Account Types

Traders can choose between three commission-free accounts, Cent (minimum deposit= $10), Classic (minimum deposit= $10), VIP (minimum deposit= $250), Zero-Spread (minimum deposit= $100), and one very competitively priced commission-based alternative, Zero Spread. Islamic and corporate accounts are equally available.

BDSwiss Demo Account

BDSwiss offers a demo account. This is useful for getting used to the broker and the platform and having some educational value. However, it is important to remember that demo trading cannot replicate the psychological conditions of risking real money.

What stands out about the BDSwiss demo account?

- BDSwiss offers a choice of MT4/MT5 demo accounts.

- Traders can choose their leverage and demo deposit balance up to $1,000,000.

- Demo accounts expire after 30 consecutive days of inactivity.

- Traders can only open one demo account per account type but can reset or change leverage and balance without limits.

Trading Platforms

BDSwiss offers MT4/MT5 and upgrades them with services by Trading Central and Autochartist. Traders can choose powerful desktop clients, lightweight web-based alternatives, and popular mobile apps. MT4/MT5 support algorithmic trading and have embedded copy trading services. Traders can upgrade MT4 via 25,000+ custom indicators, templates, and EAs, while MT5 features 10,000+. I recommend the desktop client to all traders, as they offer all the functions. Copy traders can use mobile apps, which provide everything they need to follow other traders.

BDSwiss also developed an in-house web-based trading platform ideal for manual traders with a superior user interface and performance to the MT4/MT5 alternatives. BDSwiss also offers their proprietary BDSwiss mobile app for those that prefer trading on their mobile devices.

Some of the core features of the BDSwiss WebTrader are:

- Synchronized to the MT4 desktop client.

- Intuitive order window

- Available in 20+ languages

- User-friendly interface

- Exclusive Trends Analysis Tool

- Comprehensive charting package

- Cross Browser Compatibility

- Ultra-fast order execution

- Real-time quotes

- Interactive charts

- 24/7 Cryptocurrency pairs trading

MT4 | |

|---|---|

MT5 | |

MT4/MT5 Add-Ons | |

cTrader | |

Proprietary Platform | |

Automated Trading | |

Social/Copy Trading | |

DOM? | |

Guaranteed Stop Loss | |

Scalping | |

Hedging | |

One-Click Trading | |

OCO Orders | |

Interest on Margin |

Unique Features

During my BDSwiss review, the execution statistics stood out. BDSwiss has a median execution speed of 75.8 milliseconds, executes 96.5% of all trades in under 2.0 seconds, and has zero-to-positive slippage on 77.8% of orders without requotes. It confirms deep liquidity and no interference with orders, making it an excellent Forex broker.

Research and Education

Besides trading signals from Trading Central and Autochartist, BDSwiss offers research and actionable trading recommendations by a 9-member team. It also maintains a Telegram channel for trading alerts. Traders get a daily video covering market events and a weekly outlook, preparing traders for the week ahead. I rate the BDSwiss research offering among the leading industry-wide, ensuring clients without a trading strategy receive plenty of trading ideas, recommendations, and alerts.

What about education at BDSwiss?

BDSwiss brings its research excellence to educating beginners. I like that an e-book is offered which focuses on trading psychology. Traders also get 18 educational videos, and I recommend the live webinars. BDSwiss is a hands-on broker that engages with potential clients at numerous seminars each year, where it introduces Forex trading basics.

My conclusion:

- BDSwiss provides a quality foundation for beginners to start their education.

- I recommend beginners seek in-depth education from third parties after taking advantage of the BDSwiss content, focusing on trading psychology and the relationship between leverage and risk management.

- Avoid paid-for courses and mentors.

Customer Support

Customer Support Methods |   |

|---|---|

Support Hours | 24/5 |

Website Languages |              |

Multilingual BDSwiss customer support is available 24/5, but BDSwiss explains its products and services well, limiting or eliminating the need for customer support. I had no reason to contact customer support during my BDSwiss review. Before contacting customer support via live chat, I recommend traders browse the FAQ section.

Bonuses and Promotions

BDSwiss offers bonuses to clients residing in certain locations. BDSwiss maintains a high-paying affiliate program with 20,000+ partners.

Awards

BDSwiss has won numerous industry awards. The three most recent ones include the 2023 Best Forex Research and Education Provider award by UF Awards, the 2023 Best IB/Affiliate Program APAC award by UF Awards, and the 2023 Fastest Growing Multi-Asset Broker award by Gazet International Magazine.

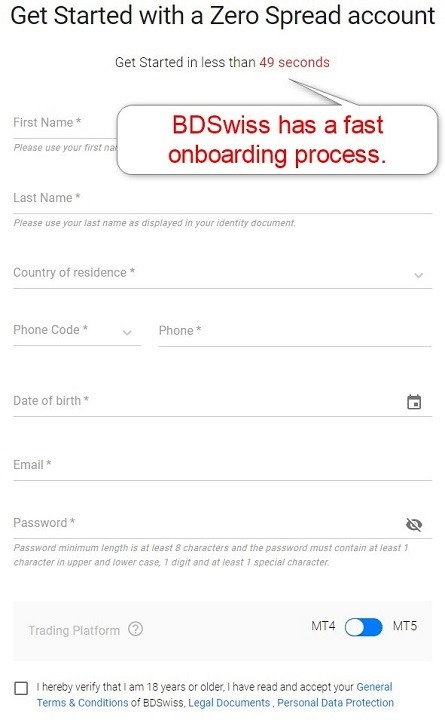

Opening an Account

The BDSwiss account application asks for a first and last name, country of residence, phone number, date of birth, e-mail, and desired password. Clicking “Submit” completes the registration.

What should traders know about the BDSwiss account opening process?

- BDSwiss complies with global AML/KYC requirements.

- Account verification is mandatory.

- Most traders pass verification by uploading a copy of a government-issued ID and one proof of residency document.

- BDSwiss may ask for additional information on a case-by-case basis.

Minimum Deposit

The BDSwiss minimum deposit requirement is $10 for the Cent (minimum deposit= $10), Classic (minimum deposit= $10), VIP (minimum deposit= $250), Zero-Spread (minimum deposit= $100).

Payment Methods

Withdrawal options |       |

|---|---|

Deposit options |       |

BDSwiss accepts bank wires, credit/debit cards, Skrill, Neteller, AstroPay, korapay, OZOW, M-Pesa, Vodafone, Airtel, tigo, PIX, beeteller, Pay Retailers, GCash, Pay Maya, Prompt Pay, cryptocurrencies (BTC, BCH, ETH, PAX, TUSD, USDT, USDC, LTC, XRP, DASH, ZCASH, and ADA), and other localized payment methods in Africa and Asia.

Accepted Countries

BDSwiss accepts traders from most countries but singles out residents of the Democratic Republic of Congo, Eritrea, Iran, Japan, Democratic People’s Republic of Korea, Libyan Arab Jamahiriya, Mauritius, Myanmar, North Korea, Seychelles, Somalia, Sudan, Syrian Arab Republic, the US (and US persons), the UK and the EU. Citizens from Cyprus and the US cannot open an account irrelevant to their geographic location.

Deposits and Withdrawals

The secure BDSwiss dashboard and mobile app handle financial transactions for verified clients.

What are the key takeaways from the deposit and withdrawal process at BDSwiss?

- BDSwiss does not levy internal deposit or withdrawal fees, except for a $10 bank wire withdrawal fee on withdrawals under $100.

- The minimum deposit requirement is $10.

- Deposit processing times are instant to near-instant, except for bank wires, and credit/debit cards, which can take up to five business days.

- The minimum withdrawal amount depends on the withdrawal method. For bank wires, the minimum is $60.

- Cryptocurrency transactions incur a blockchain fee.

- A currency conversion fee applies if the deposit currency mismatches the account base currency.

- BDSwiss processes withdrawal requests within 24 hours.

- A withdrawal hierarchy exists for credit/debit cards, Skrill, and Neteller transactions.

- It can take up to ten business days for bank wires to arrive, but most payment processors have instant to near-instant processing once BDSwiss approves a withdrawal.

- Traders may face third-party payment processing charges.

- The availability of payment processors depends on the geographic location of traders.

- The name on the payment processor and BDSwiss trading account must match in compliance with AML regulations.

Is BDSwiss a good broker?

I like the trading environment at BDSwiss in the commission-based trading account for its low trading fees, fast order executions, lack of requotes, and deep liquidity. BDSwiss upgrades MT4/MT5 with Trading Central and Autochartist, offers VPS hosting for low-latency 24/5 Forex trading, and maintains a mix of highly liquid assets. The research and education sections rank among the most comprehensive in the industry. Therefore, I rate BDSwiss as a competitive Forex broker, and I can highly recommend it to active traders.

FAQs

How reliable is BDSwiss?

BDSwiss ranks among the most reliable brokers with excellent order execution. It complies with four regulators and has 10+ years of operational history.

Is BDSwiss a broker?

BDSwiss is a multi-asset broker with 1.7M+ accounts from 180+ countries, a $84B+ monthly trading turnover, 20,000+ partners, and numerous industry awards.

How long does it take to withdraw money from BDSwiss?

BDSwiss processes withdrawal requests within 24 hours.