Editor’s Verdict

Overview

Review

Headquarters | Montenegro |

|---|---|

Year Established | 2005 |

Execution Type(s) | Market Maker |

Minimum Deposit | $1 |

Trading Platform(s) | MetaTrader 4, Proprietary platform, Web-based |

Islamic Account | |

Signals | |

US Persons Accepted? | |

Managed Accounts |

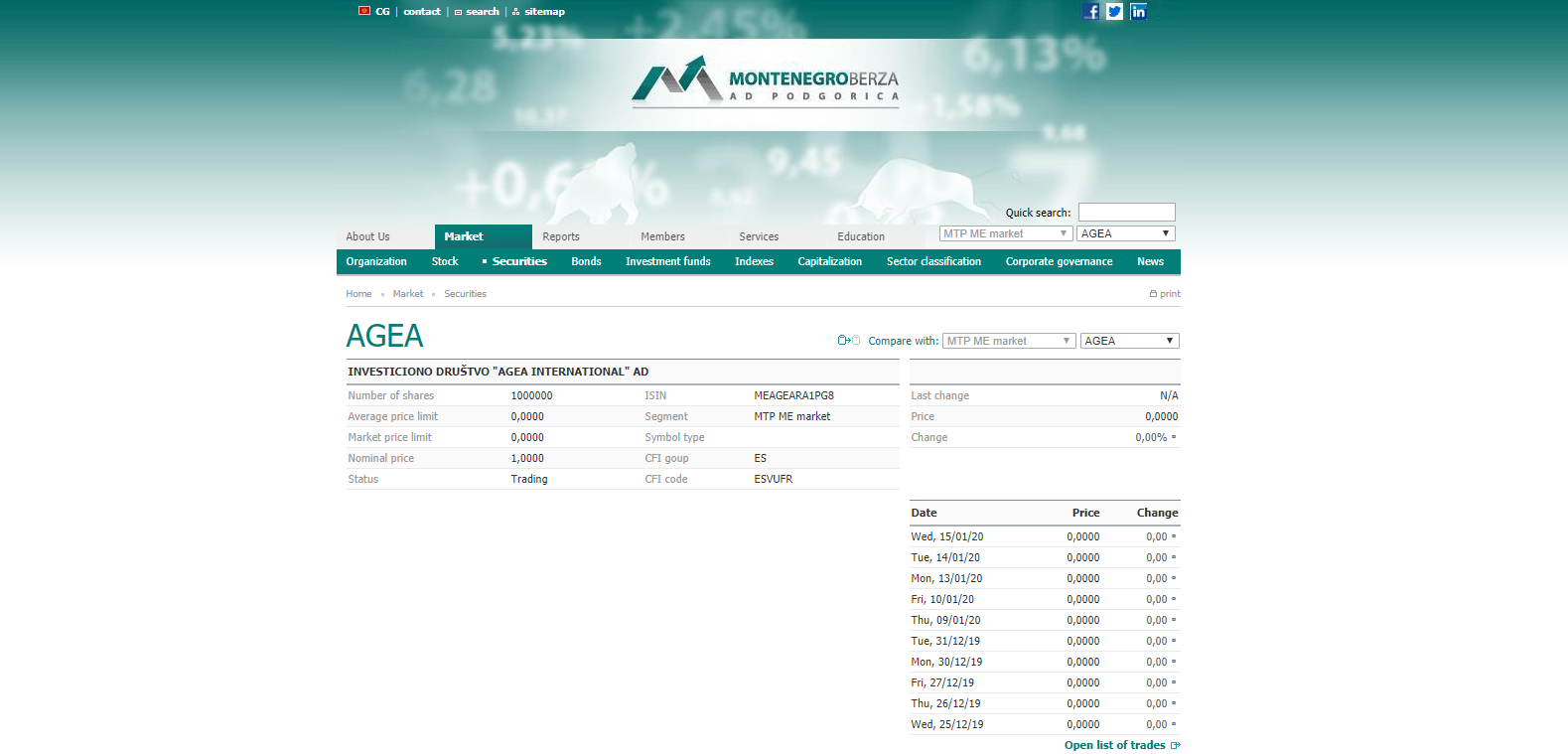

AGEA is a Montenegro-based Forex broker that was founded in March 2019 by industry veterans that had have been operating since 2005. The company is publicly listed on the Montenegro Stock Exchange.

Regulation and Security

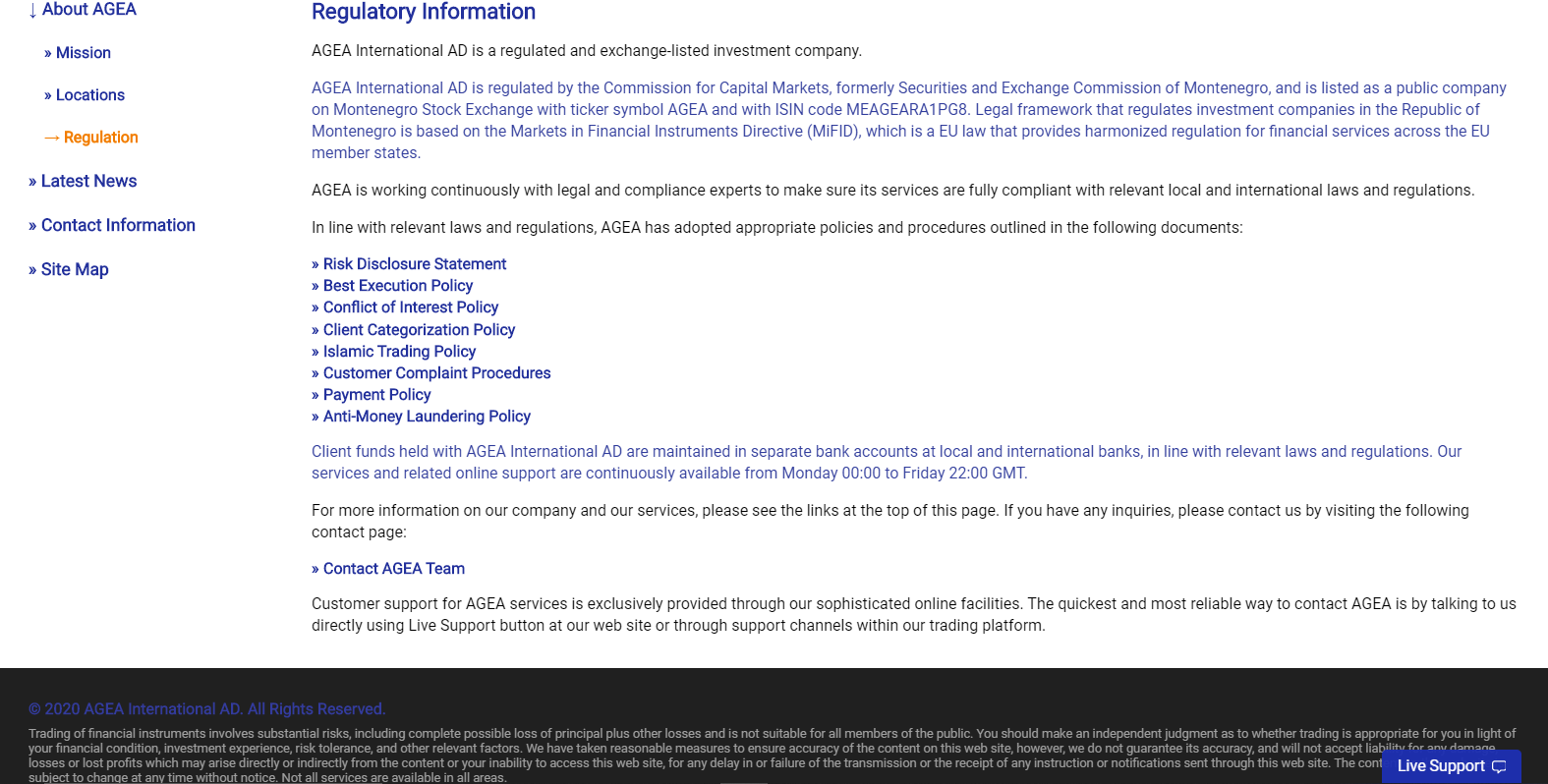

AGEA International AD, the owner of AGEA, is regulated by the Montenegrin Commission for Capital Markets. This regulator is the successor to the Securities and Exchange Commission of Montenegro. The legal framework that regulates investment companies in the Republic of Montenegro is based on the Financial Instruments Directive 2014/65/EU or MiFID II. It is significant to point out that Montenegro is not a member country of the EU and, while the regulatory framework may be modeled on the harmonized EU rules, enforcement is solely at the discretion of Montenegro Securities and Exchange Commission. As far as this we could see during this AGEA review, the company remains compliant with all regulatory requirements. Client deposits remain segregated from company funds, as stipulated by regulatory requirements.

AGEA is listed on the Montenegrin Commission for Capital Markets website.

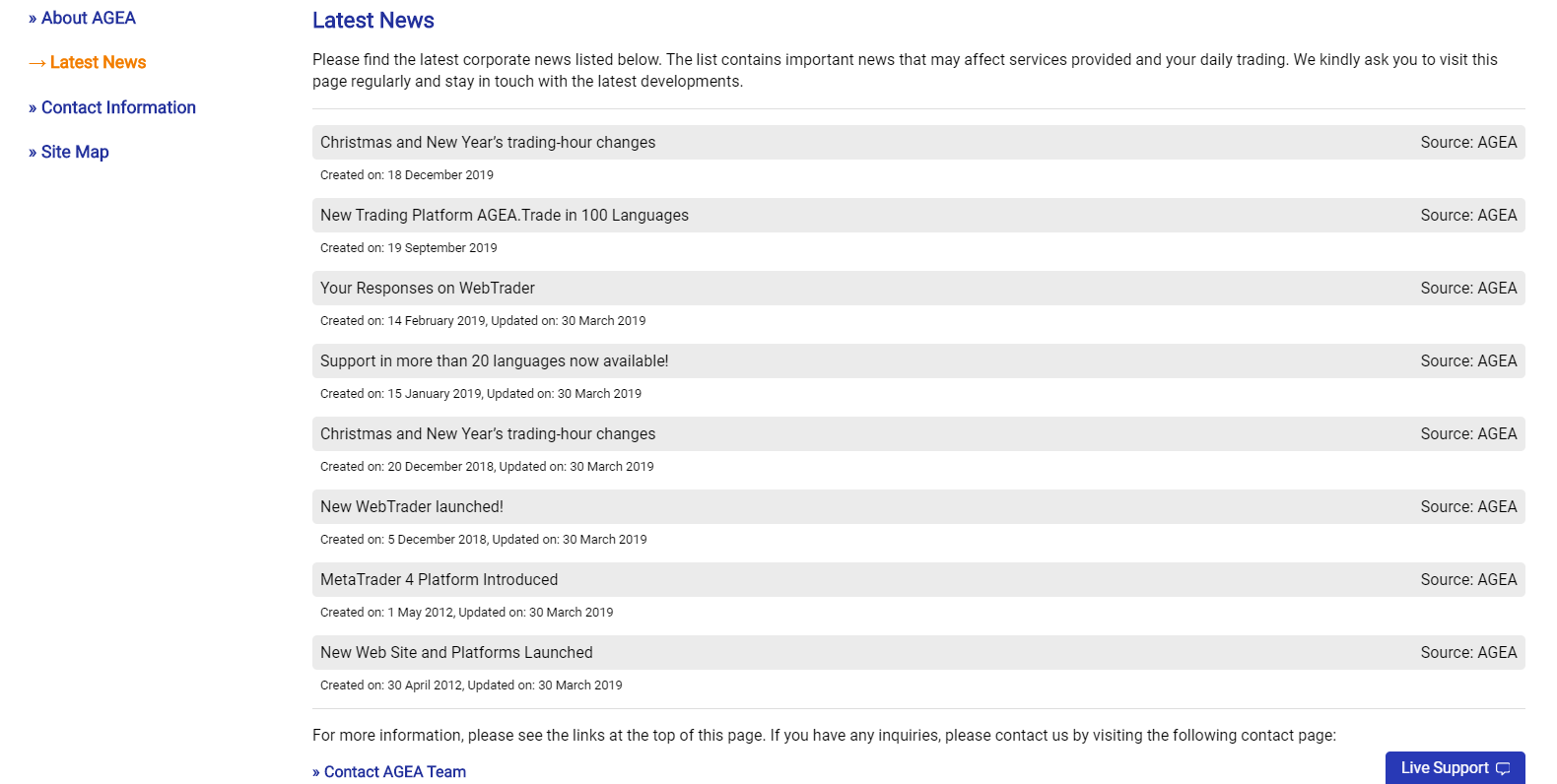

AGEA International AD was established in 2005, but it was not until April 2012 that it ventured into the brokerage industry. This was followed by limited activity until March 2019.

The AGEA website features a regulatory requirements section, where relevant documents are published.

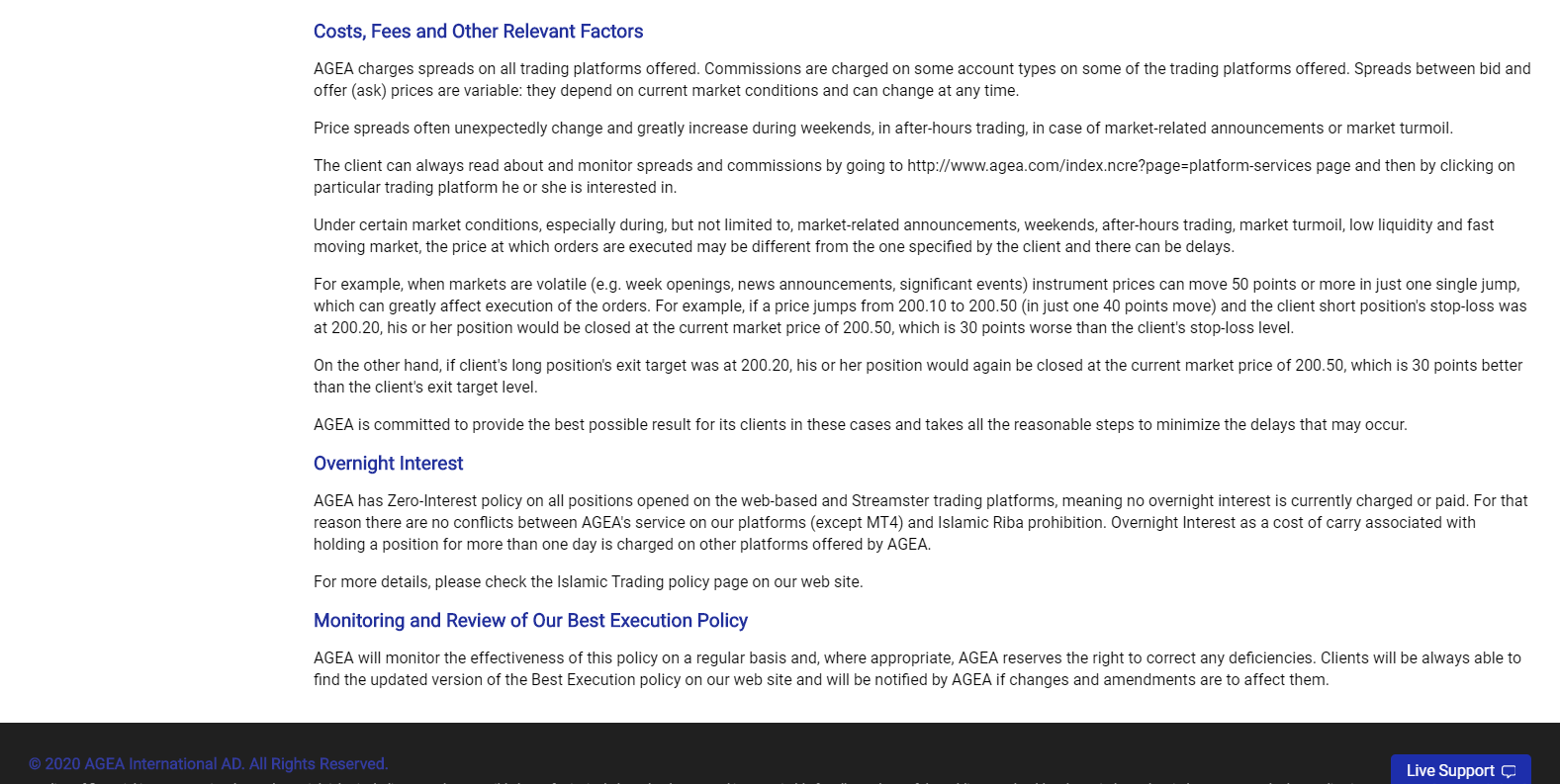

Fees

Unfortunately, we found during our AGEA review that this broker is extremely vague about its trading fees. Spreads are charged on all assets and represent the primary source of trading fees. Commissions are mentioned as applicable in select account types and trading platforms, without elaboration. The EUR/USD is listed with a 1.2 pips spread, which is slightly high for a market maker. Overnight swap rates only apply in the MT4 trading platform. The other two platforms are marketed as free of interest charges, a rather unusual offer. An inactivity fee of $20 per year is also levied after twelve months of account dormancy. This inactivity fee is substantially lower than that charged by most other brokers.

A look at AGEA’s pricing structure:

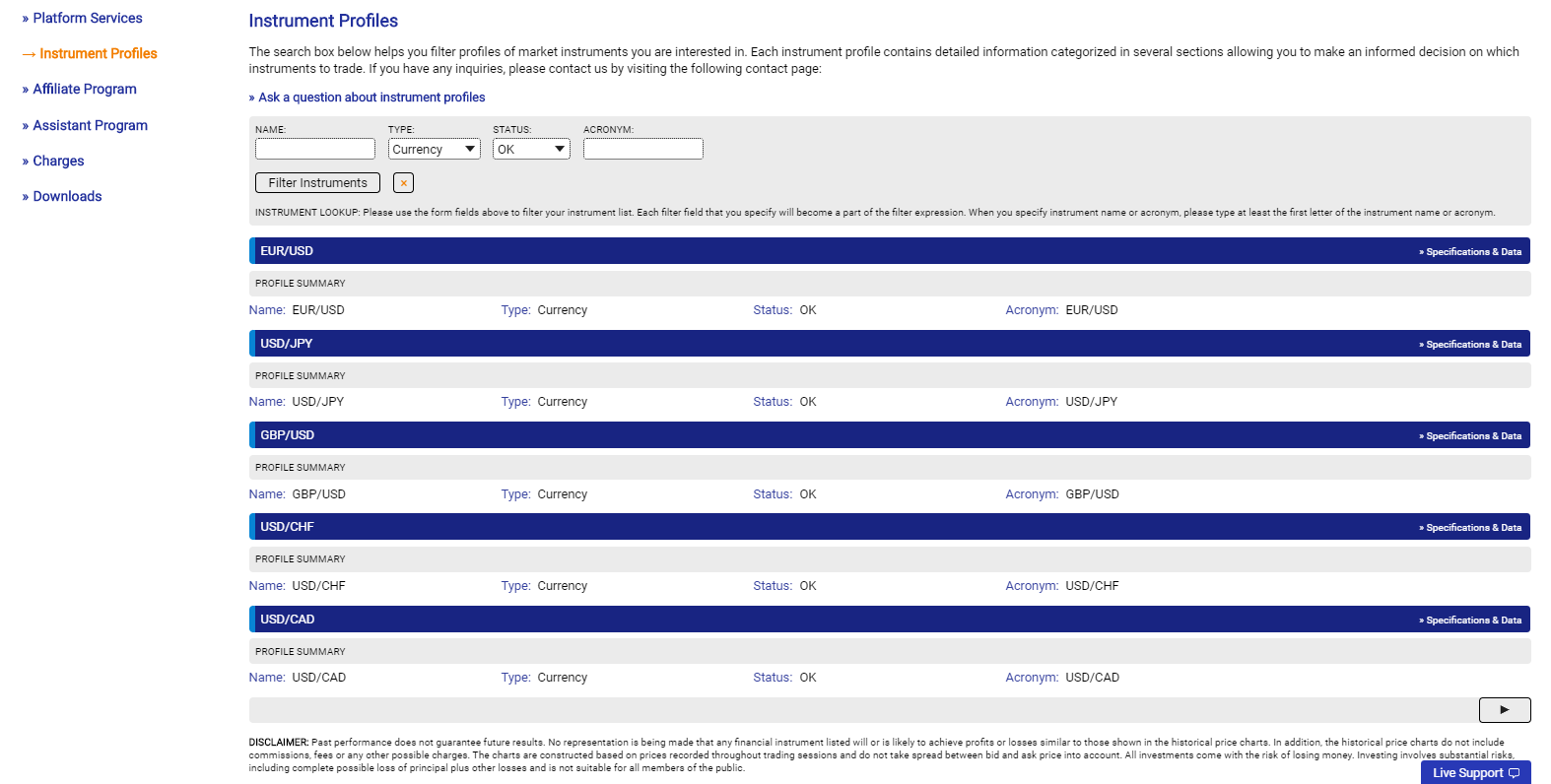

What Can I Trade

AGEA provides traders with only a limited asset selection, as is common with newer brokers. 17 currency pairs are presented on its proprietary webtrader, together with two commodities, and six indices. In comparison, the MT4 trading platform offers 45 currency pairs. The “Instrument Profiles” section notes an additional eight ETFs, but the dual-listing of certain assets creates a bit of confusion; traders will need to sort through the data to identify which assets are provided on which platform. Traders who take a few moments to review the offerings should be able to find ample tradable assets to get started or supplement their other trades.

AGEA instrument profiles:

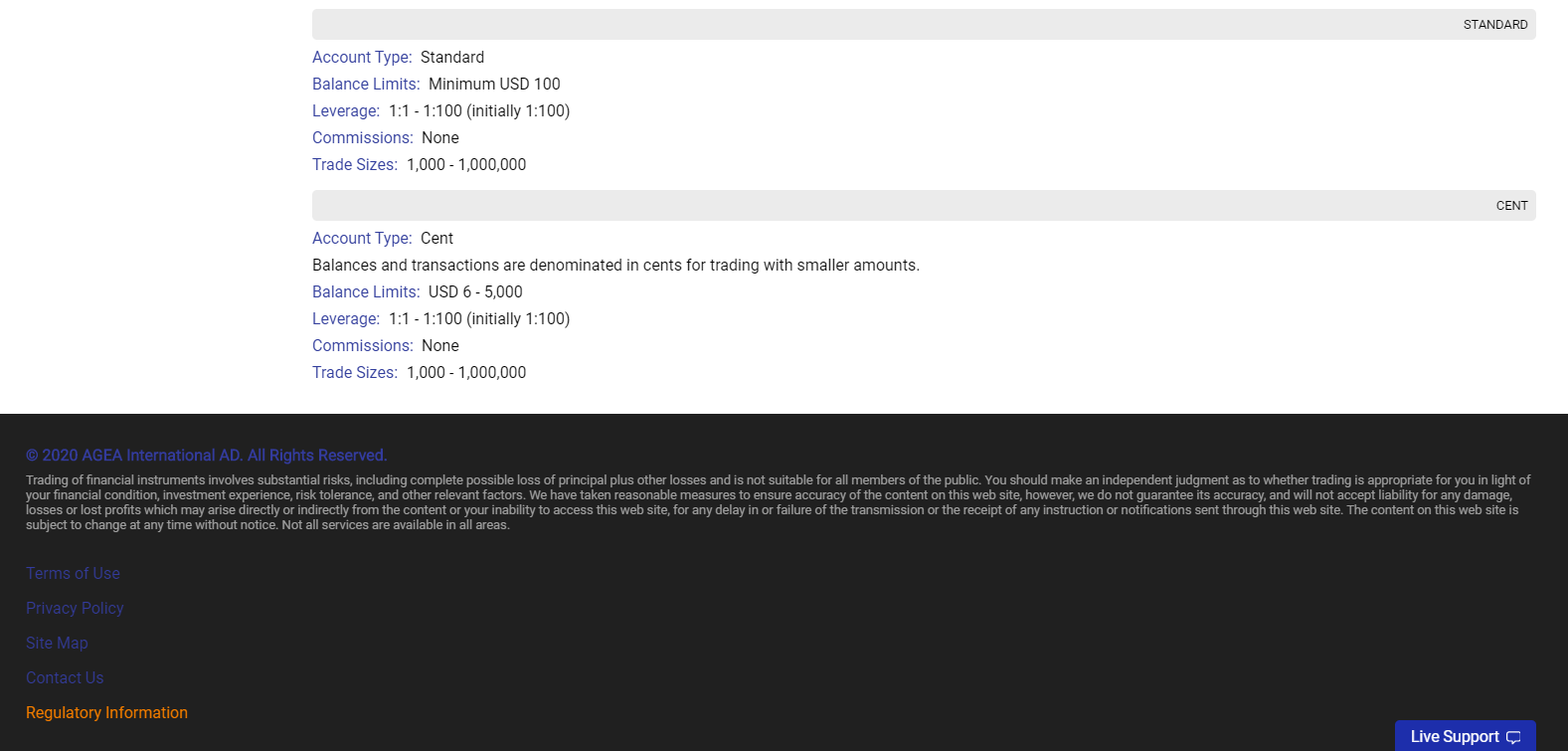

Account Types

Traders may choose between a Cent Account and a Standard Account. The account features of the Cent and Standard accounts are primarily the same, with the sole difference being the minimum deposit. Traders may open a Cent Account for as little as $6, up to a maximum of $5,000. A $100 deposit is required for the Standard Account, which is where most traders are likely to manage their accounts. New traders may want to consider “practicing” in the Cent Account, which uses actual cash, instead of in the AGEA demo account which uses virtual currency. Islamic accounts are available on request.

The maximum leverage is capped at 1:100, the most substantial benefit of trading with AGEA as compared to EU-regulated brokers. The minimum transaction size is 0.01 lots, with a maximum of 10.0 lots.

A glimpse of the Standard Account offering:

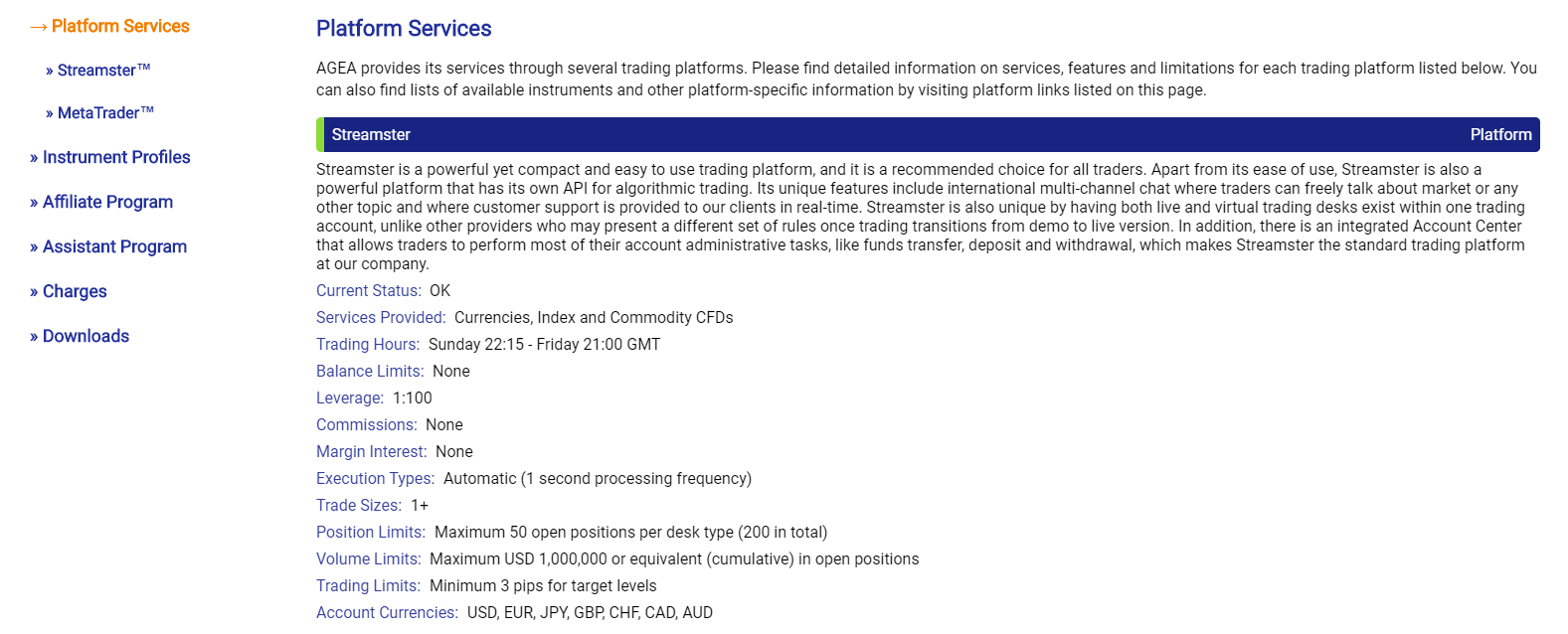

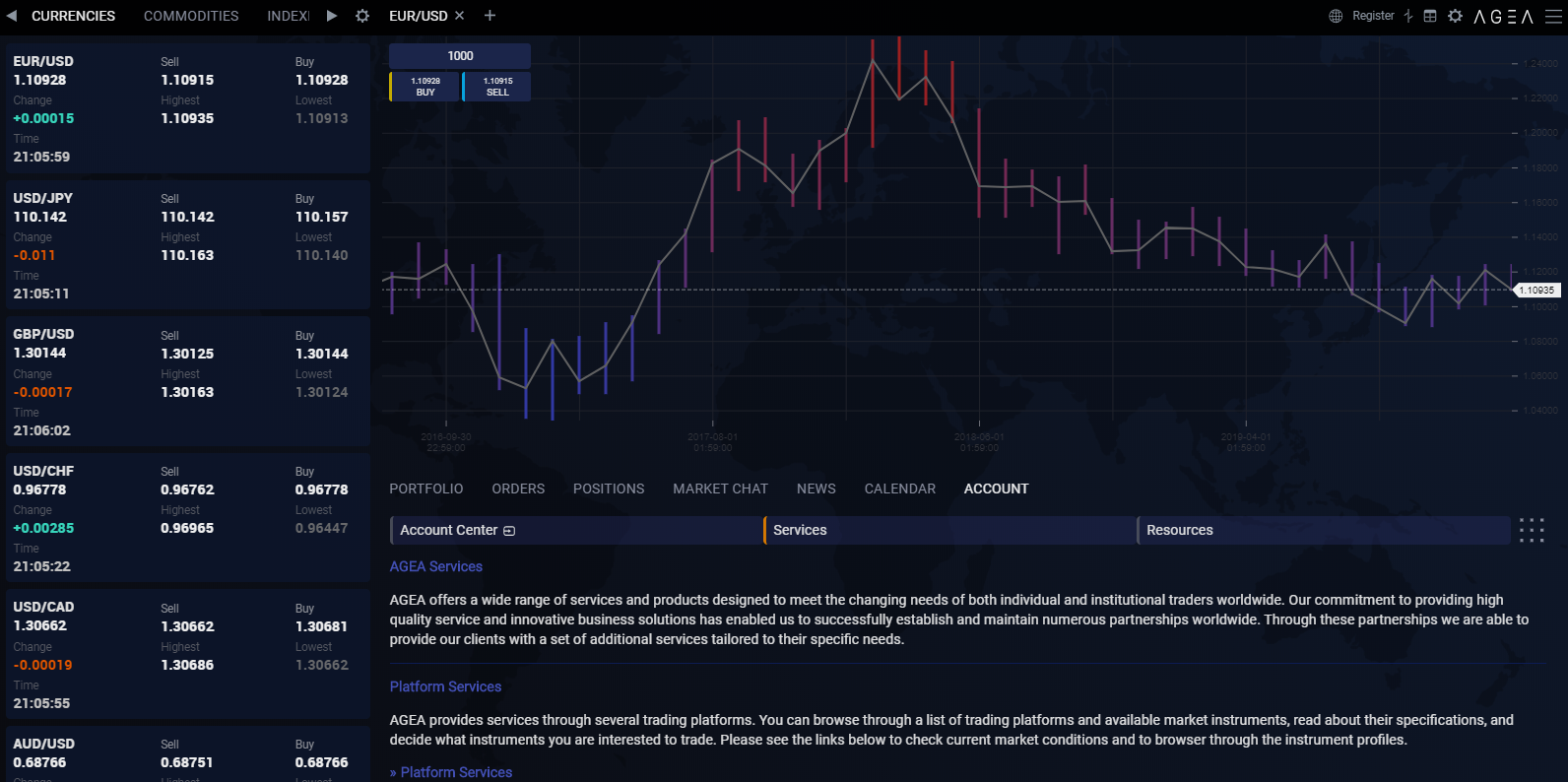

Trading Platforms

The AGEA website mentions both its proprietary Streamster and AGEA.Trade platforms, but the difference between the two is unclear. Offering a proprietary trading platform can represent a tremendous asset for a broker, but AGEA fails to capitalize on it. The presentation is poor, and traders have no clear indication of the platform's various features. Streamster is the primary trading platform at AGEA, but with limited asset selection; it supports automated trading via an API, is equipped with a charting package, and features chart trading. No screenshots or detailed description is available. AGEA.Trade appears to have the same features, but no further information is provided.

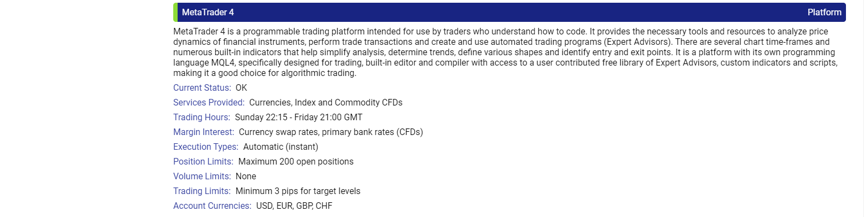

The MT4 trading platform is supported, but AGEA only provides the basic version, without any of the required third-party plugins which are required to unlock its full potential. This basic MT4 offering is not uncommon. This broker presents its Streamster platform as the primary choice, but it seems that only MT4 users can access AGEA’s full list of assets.

Streamster is marketed as the primary trading platform at AGEA but features a limited asset selection.

AGEA.Trade is a webtrader which seems to be an identical trading platform as Streamster. Unfortunately, we couldn’t quite tell the difference during this AGEA review.

Traders have access to the MT4 trading platform, but without requisite third-party plugins.

Unique Features

AGEA’s most unique feature is its proprietary platform(s), which is a nice thing for brokers to offer, presumably to add value to the market. We hope that the broker will continue to develop its offerings and to expand its asset offering.

Research and Education

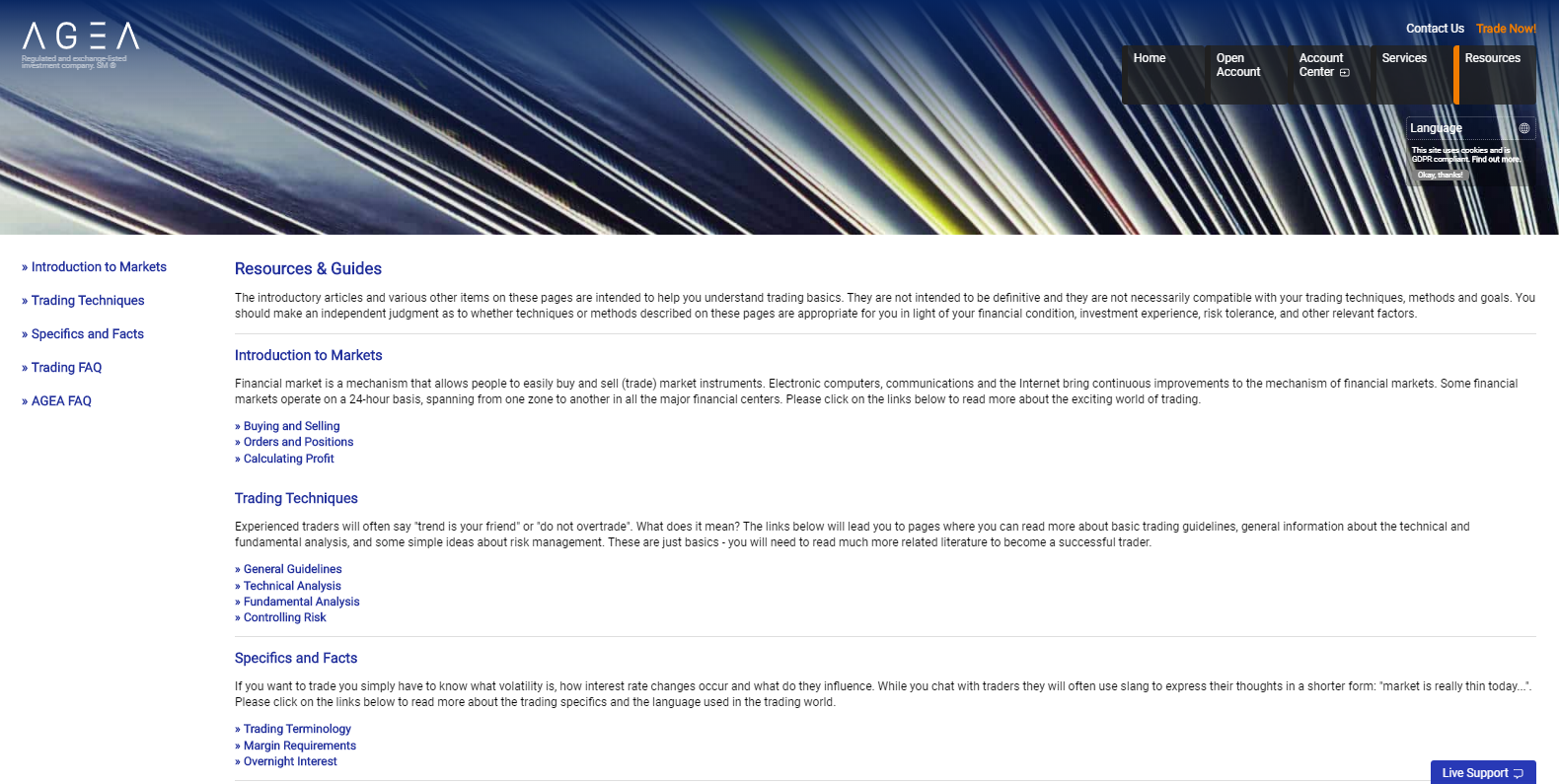

There is little available at AGEA by way of education or research, which again, is not uncommon for new brokers, but would be more than welcome. A basic news feed is available for traders, but it redirects trader to a third-party service.

New traders will find a short introduction to Forex trading in the Resources section of the website

Customer Support

Customer Support Methods |   |

|---|---|

Support Hours | 24/5 |

Website Languages |                        |

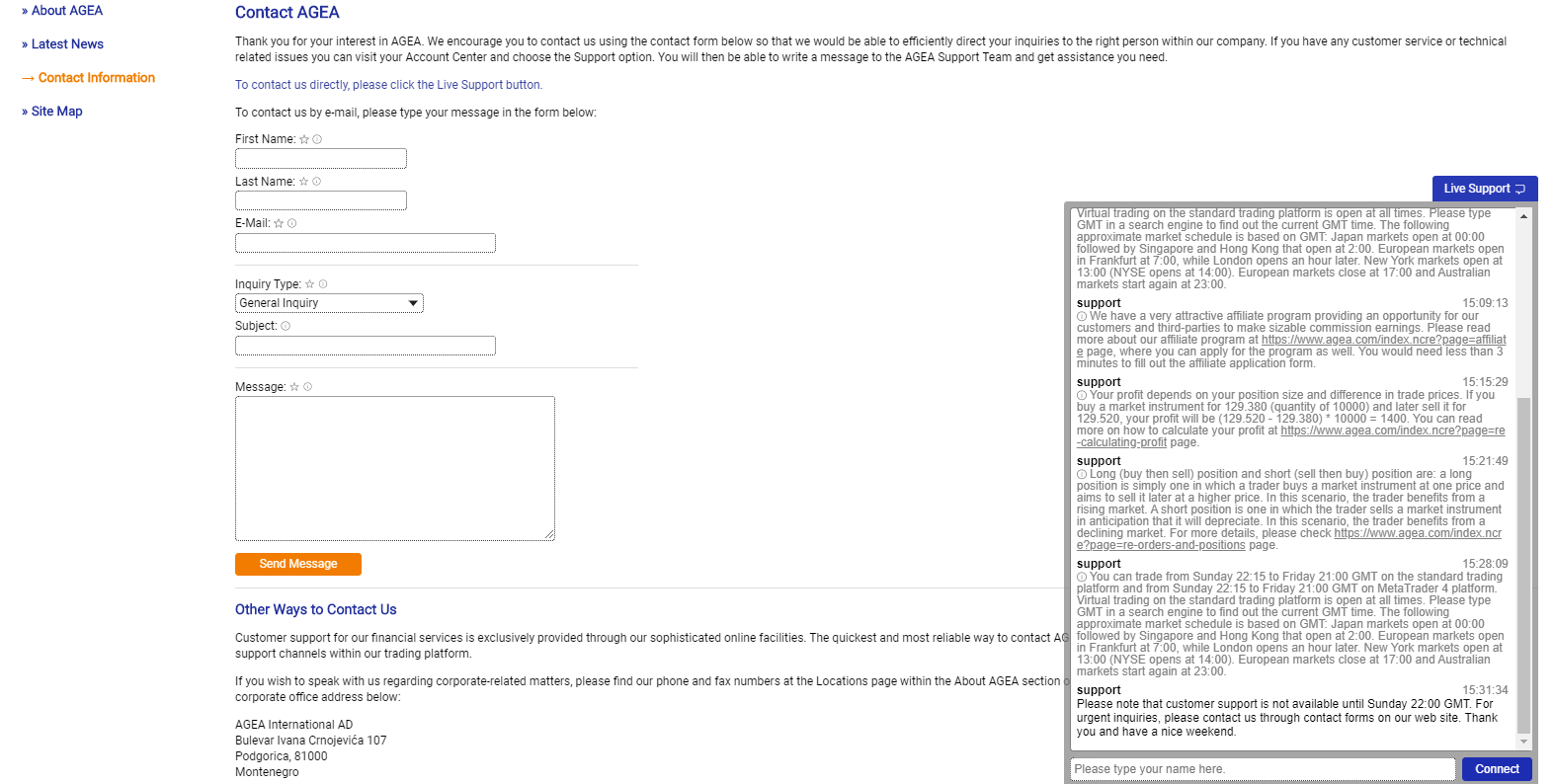

Customer support is available 24/5, and the most convenient means of engaging with the customer support team is through the live chat feature. The chat function which is inside its proprietary trading platform is similar to squawk boxes used by established brokerages for inter-trader communications. Traders may also use the webform to contact support, while a limited FAQ section addresses the most basic questions. AGEA claims to offer support service in over 100 languages, which is most likely achieved through online translators. An Assistant Program is noted, where monetary compensation is provided for AGEA affiliates and individuals who are current AGEA clients; the Assistant Program is intended to render assistance to other traders. This social approach to customer service further explains the supported languages.

Bonuses and Promotions

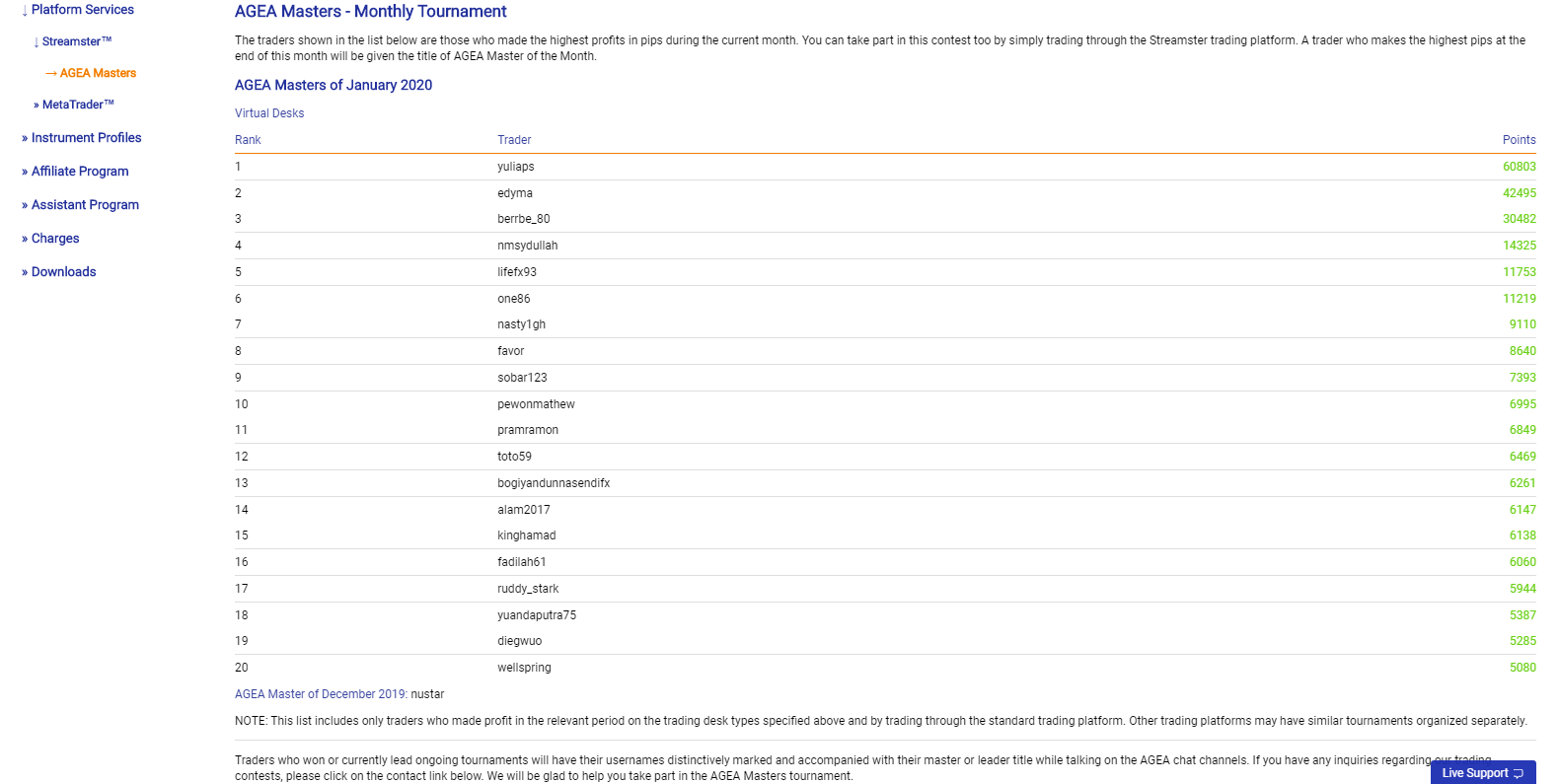

AGEA provides a $5 bonus to all verified accounts, applicable to its Streamster and AGEA.Trade platforms. This is an unusual and welcome offering. AGEA also hosts an AGEA Masters monthly tournament on its Streamster platform.

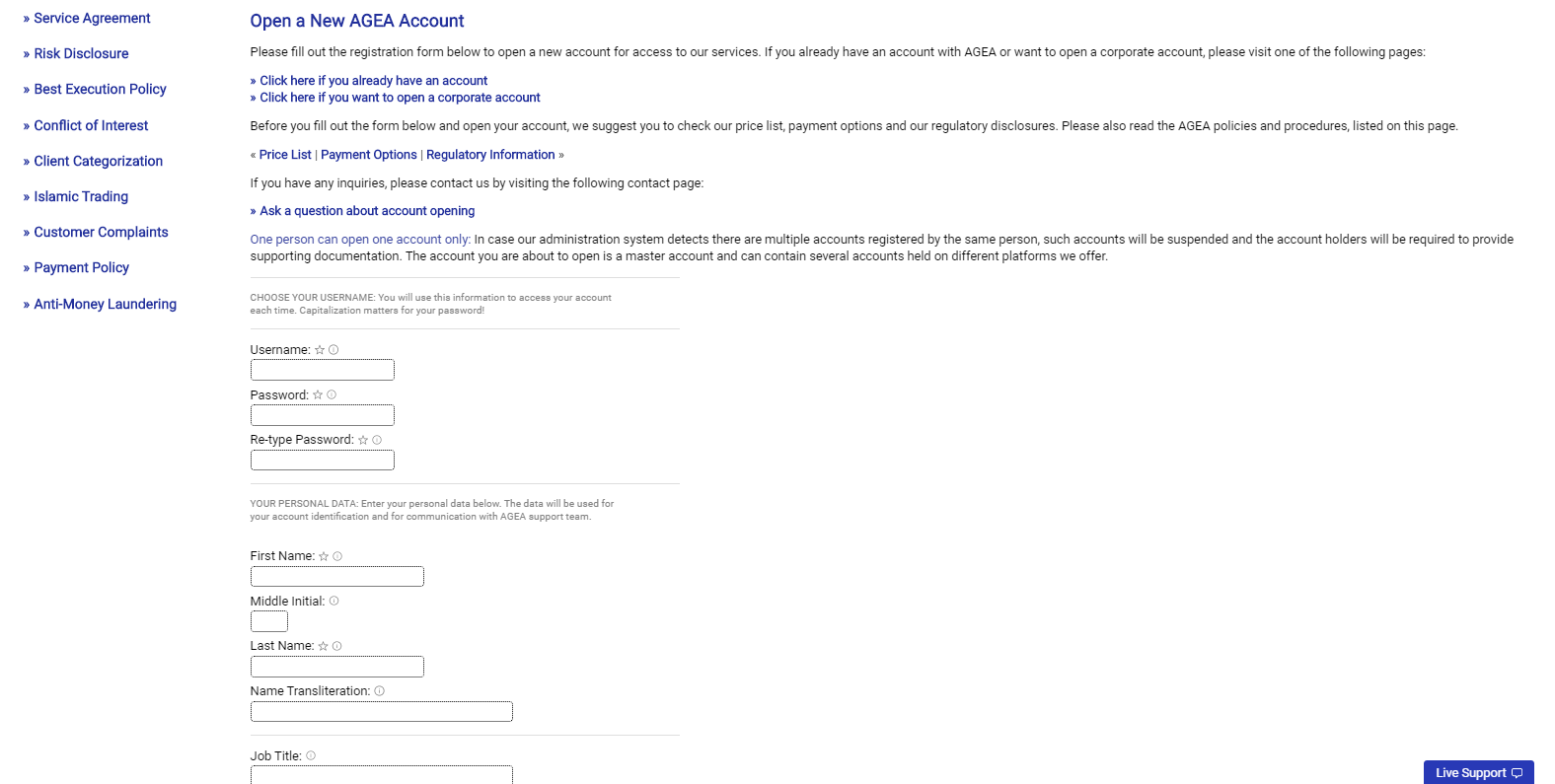

Opening an Account

The online account opening process is standard operating procedure for the brokerage industry. AGEA has implemented a crude and somewhat outdated approach for the process of opening a new account which could stand an immediate upgrade. Instead of providing multiple steps to complete the required process, a lengthy down scroll on a blank white page serves as the account opening form. This is inappropriate for any brokerage. New traders will have to submit a copy of their ID and a proof of residency document to satisfy KYC/AML procedures.

Deposits and Withdrawals

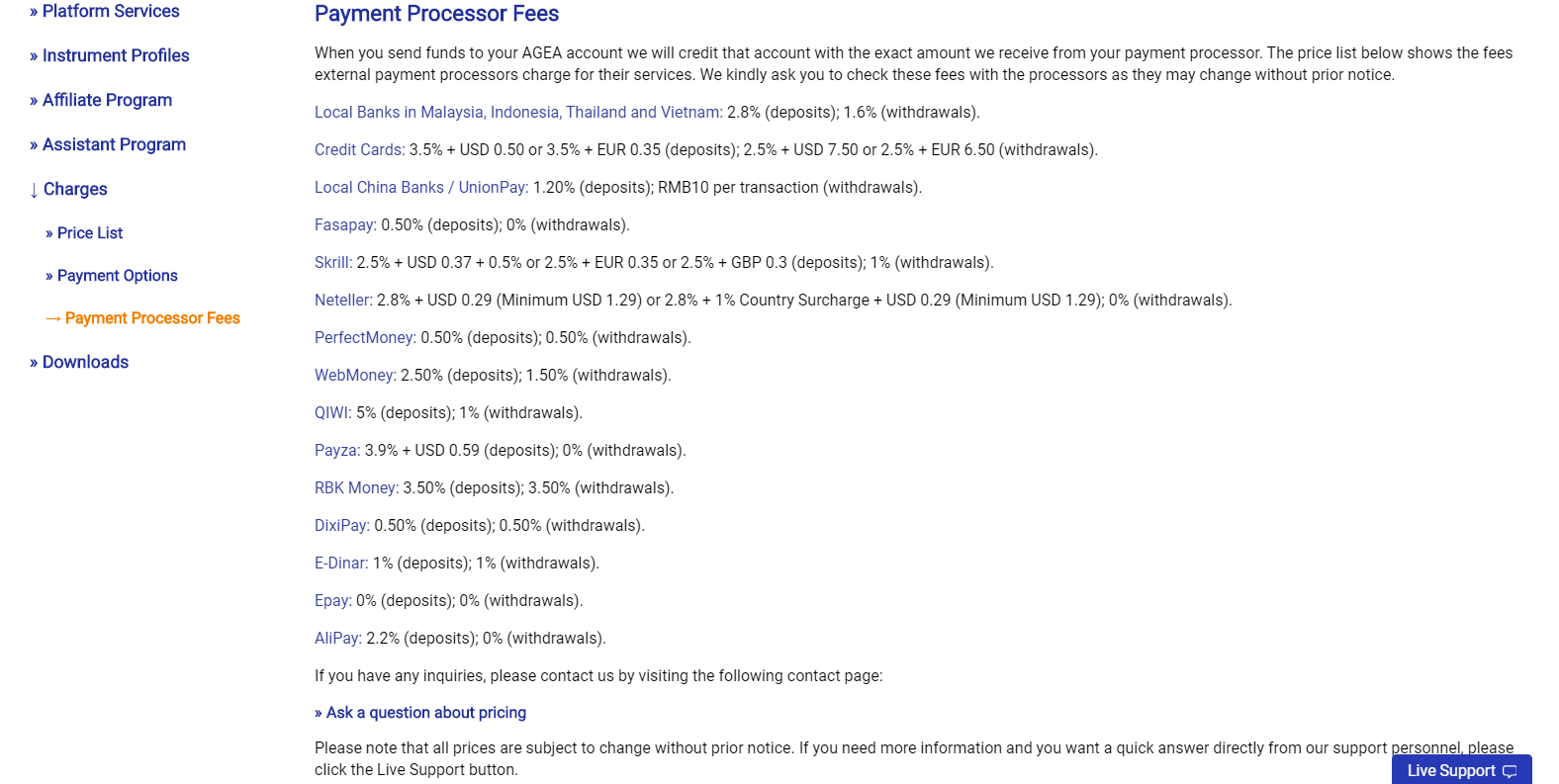

AGEA supports a surprisingly broad arsenal of payment processors. All deposits and withdrawals are processed from the Account Center. Traders may choose between bank wires, credit/debit cards, UnionPay, FasaPay, Skrill, Neteller, PerfectMoney, WebMoney, QIWI, Payza, RBK Money, DixiPay, E-Dinar, Epay, Alipay, and local bank transfers in Malaysia, Indonesia, Thailand, and Vietnam. Charges vary on the utilized payment option, but a $10 wire fee is charged. Online non-wire withdrawals are levied with a $7 fee for the first withdrawal. Of course, payment processors may also charge a fee for the service they rendered.

AGEA’s banking options:

Trading Platform

MT4 | |

|---|---|

MT5 | |

cTrader | |

Proprietary Platform | |

Automated Trading | |

Guaranteed Stop Loss | |

Scalping | |

Hedging | |

OCO Orders | |

Interest on Margin |

FAQs

Where is AGEA based?

Podgorica, Montenegro, is the location of the AGEA headquarters.

How does AGEA make money?

This broker charges spreads on all assets, notes commissions on certain assets without elaborating, and also benefits directly from losses of its traders due to its market maker execution model.

How can I deposit into an AGEA account?

Traders may choose between bank wires, credit/debit cards, UnionPay, FasaPay, Skrill, Neteller, PerfectMoney, WebMoney, QIWI, Payza, RBK Money, DixiPay, E-Dinar, Epay, Alipay, and local bank transfers in Malaysia, Indonesia, Thailand, and Vietnam.

What is the minimum lot size at AGEA?

The minimum transaction size for currencies is 0.01 lots.

When does a margin-call take place at AGEA?

No information regarding margin-calls was provided.

Is AGEA regulated?

AGEA International AD, the owner of AGEA, is regulated by the Montenegrin Commission for Capital Markets.

What is the maximum leverage offered by AGEA?

Retail clients have access to maximum leverage of 1:100.

How do I open an account with AGEA?

AGEA has an online application form, which is the standard operating procedure.

What trading platforms does AGEA offer?

AGEA provides traders with its proprietary Streamster and AGEA.Trade, plus the MT4 trading platform.