Admirals Editor’s Verdict

Admirals upgrades MT4/MT5 with the MetaTrader Supreme Edition and SteroTrader. Traders get 8,000+ assets, including share investments, fractional shares, and ETFs. Traders also benefit from an excellent pricing environment, quality education, and in-house research supplemented by services from Trading Central. I reviewed Admirals following its rebranding to determine if its promised cutting-edge product offerings deliver traders an edge. Does Admirals deserve a deposit from you?

Overview

Admirals maintains a competitive core trading environment with cutting-edge tools while catering to long-term investors via share dealing and fractional shares.

United Kingdom ASIC, CySEC, FCA, FSCS 2001 Market Maker $100 Other, MetaTrader 4, MetaTrader 5 0.1 pips ($1.00) 0.1 pips ($1.00) $0.03 $0.25 $125.60

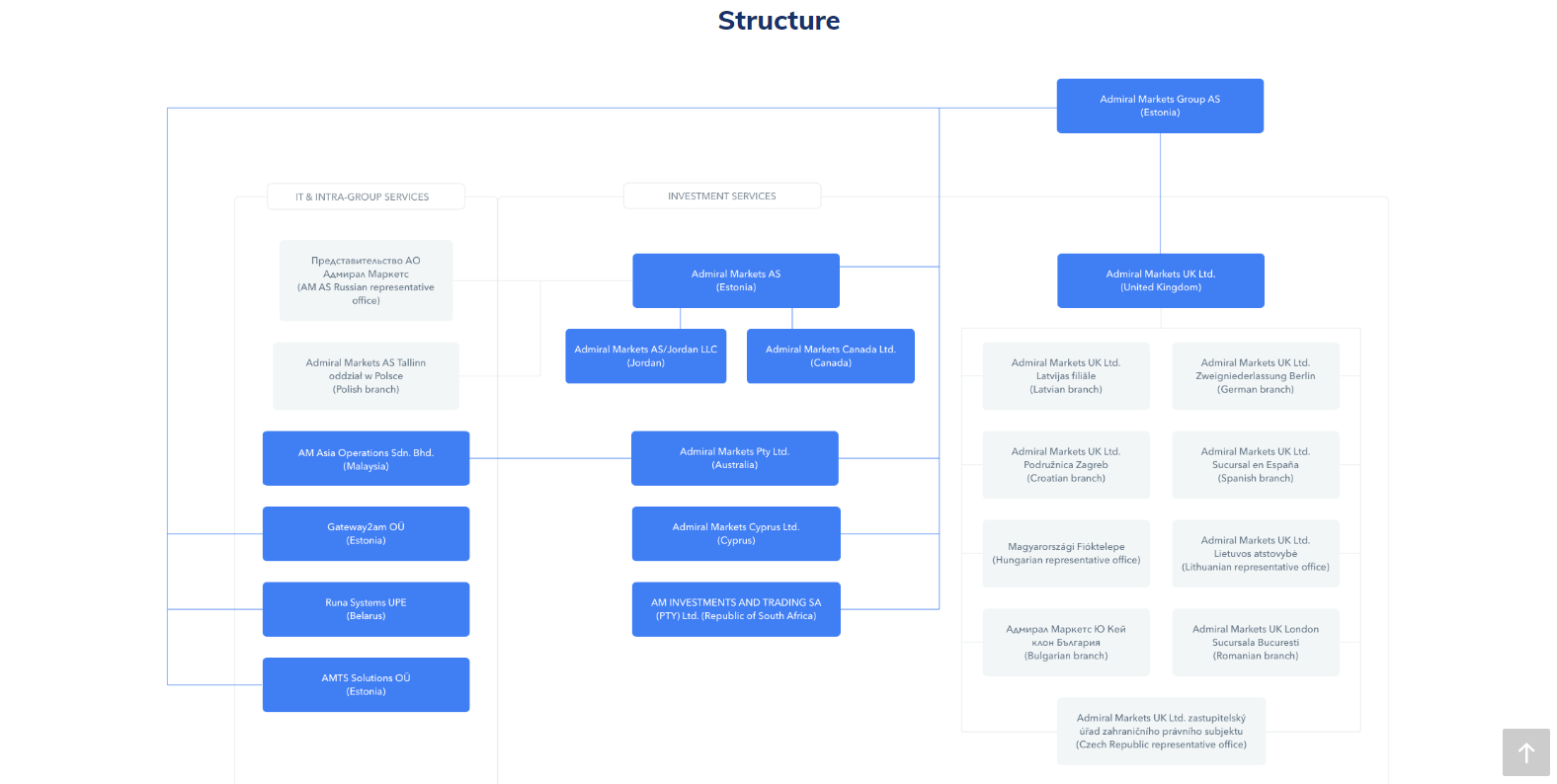

Admirals is a well-regulated Forex and CFD brokerage that has been in operation since 2001. It’s corporate owner, Admirals Group AS, is based in Estonia and consists of multiple operating subsidiaries. Admirals primarily caters to retail traders, and it does provide research and education for new clients. This broker offers its clients an excellent upgrade to the basic MT4 and MT5 trading platforms, with over 4,000 assets available which allow traders to conduct proper cross-asset diversification. Spreads are listed as low as 0.1 pips in the Zero MT4 account. The latest statistics show that approximately 82% of Admiral's clients operate at a loss. Since its inception, Admirals has steadily added to its services and assets. It continues to expand globally, quietly executing its business plan while increasing market share.

.jpg)

Regulation and Security

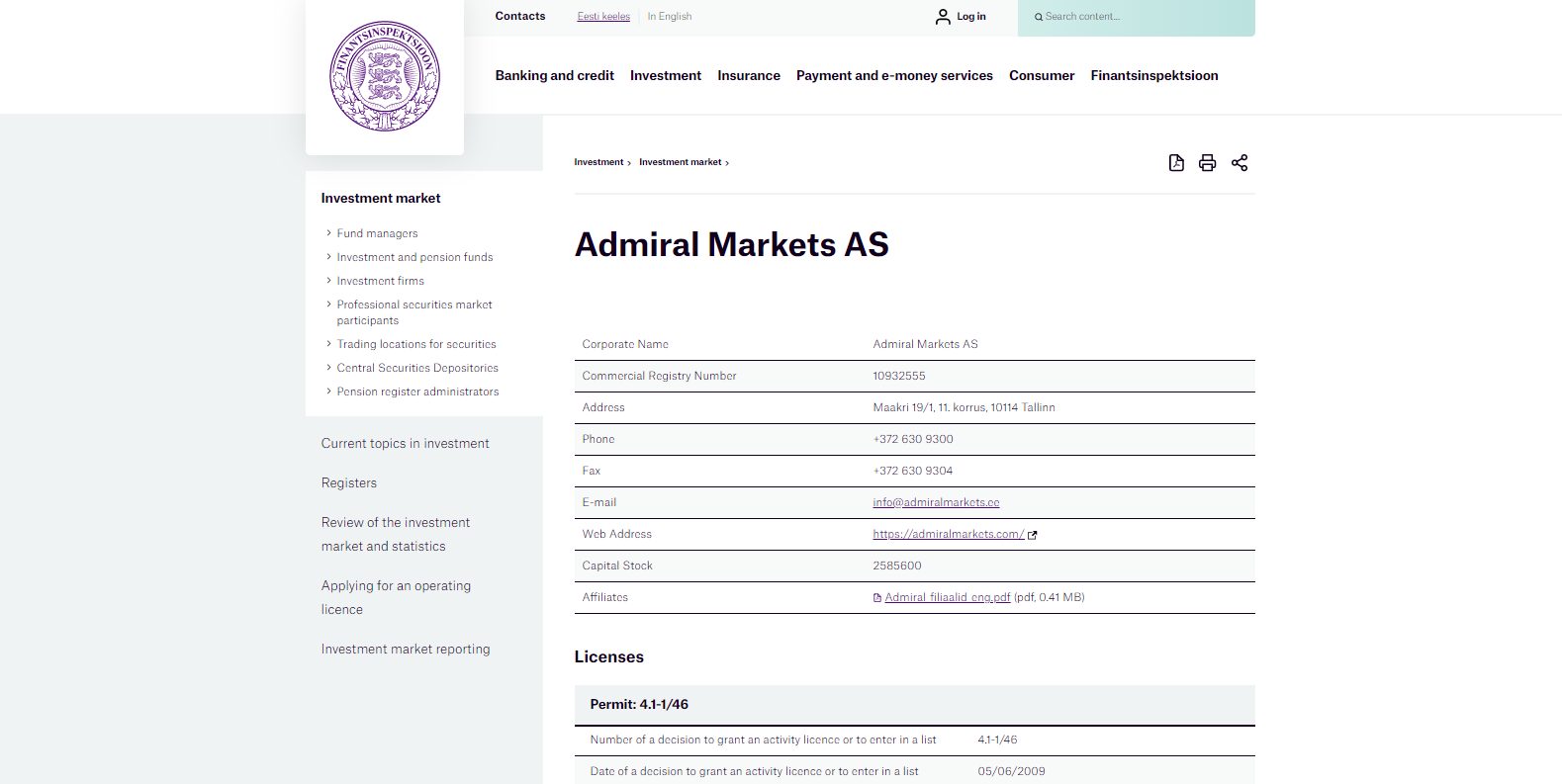

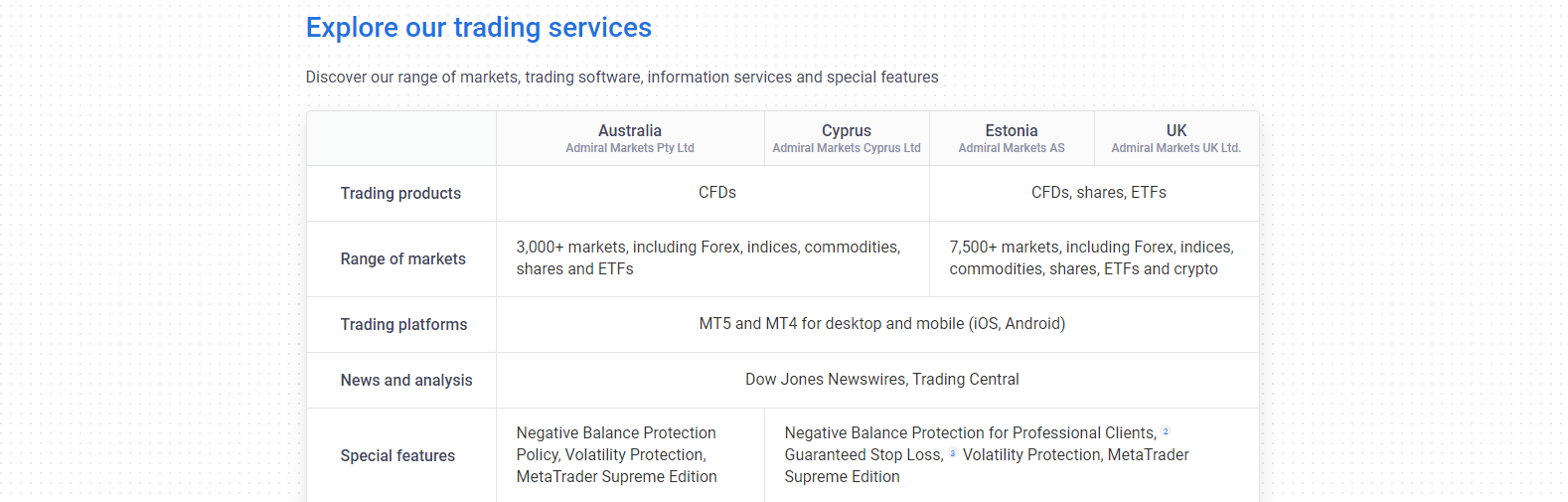

Admirals AS, the corporate owner of all three Admirals brokerages, is regulated in Estonia by the Estonian Financial Supervision Authority (EFSA) for principal investment and brokerage activities within the European Union and the European Economic Area (EEA). The company has a physical presence in sixteen countries and has clients from 110 countries. Admiral Markets UK LTD is regulated by the Financial Conduct Authority (FCA), while Admiral Markets Cyprus LTD operates under the Cyprus Securities and Exchange Commission (CySEC) framework. Admiral Markets Pty LTD holds an Australian Financial Services Licence (AFSL).

Each operating subsidiary is subject to a distinct set of rules, which directly impacts the services provided to traders. The UK subsidiary is a sister company of the Estonian registered firm. Client funds are handled according to Client Assets Sourcebook (CASS) rules, while the Financial Services Compensation Scheme (FSCS) protects deposits up to a maximum of £85,000. All traders who register under the CySEC regulated brokerage are subject to EU regulations. They include the Financial Instruments Directive 2014/65/EU or MiFID II, as well as the EU’s 5th Anti-Money Laundering Directive. Deposits are protected by the Investor Compensation Fund (CIF), per EU Directive 2014/49/EU, which protects deposits up to €20,000.

Since its inception, Admirals has earned a solid reputation as a trustworthy, transparent brokerage. Full compliance will all regulators, segregated client funds, and negative balance protection creates a secure environment for traders to manage portfolios. Admirals AS publishes financial reports on its website.

The Estonian Financial Supervision Authority (EFSA) is the primary regulator for Admirals AS.

An extensive group structure is present with three additional regulators ensuring a safe trading environment.

Fees

Average Trading Cost EUR/USD | 0.1 pips ($1.00) |

|---|---|

Average Trading Cost GBP/USD | 0.1 pips ($1.00) |

Average Trading Cost WTI Crude Oil | $0.03 |

Average Trading Cost Gold | $0.25 |

Average Trading Cost Bitcoin | $125.60 |

A combination of spreads and commissions accounts for the majority of revenues earned by Admirals. Two distinct account types implement a different pricing structure. One is a commission-free account with higher spreads for currency pairs, the other consists of a significantly lower spread for a fee. Equity CFDs and ETFs carry a commission. Given the number of assets, which cover a wide range of markets, each group is uniquely priced. Admirals is fully transparent about all fees and provides examples on its website. Traders may obtain all relevant information directly from inside the trading platforms.

What Can I Trade

Depending on the operating subsidiary, over 7,500 assets are made available to Admirals clients. Exposure to the Forex market with 49 currency pairs is acceptable, but far from outstanding. With 27 commodity CFDs and 32 cryptocurrency pairs, excellent diversification opportunities are present. The 3,398 equity CFDs and 43 indices, complemented by 396 ETFs, deliver proper cross-asset diversification. An attempt to add another asset class to the broad selection is evident with two bond CFDs.

Admirals provides traders with solid cross-asset diversification potential.

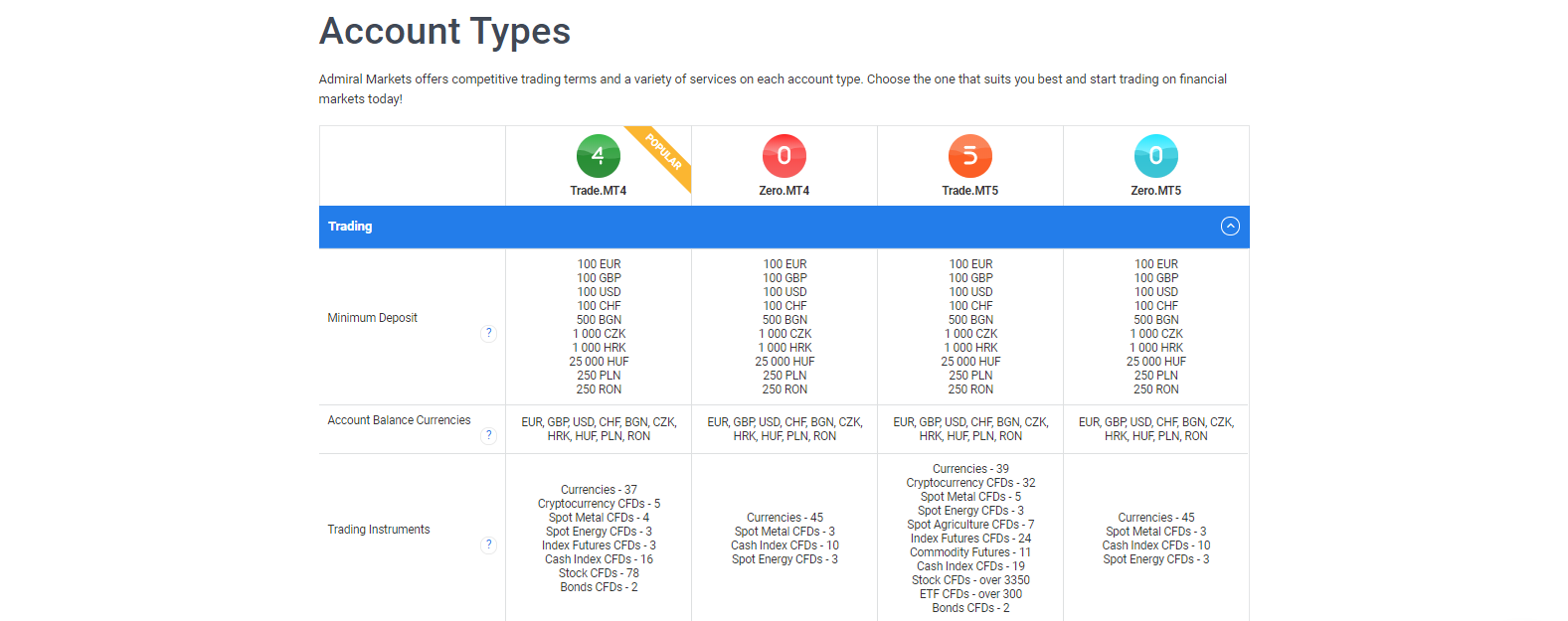

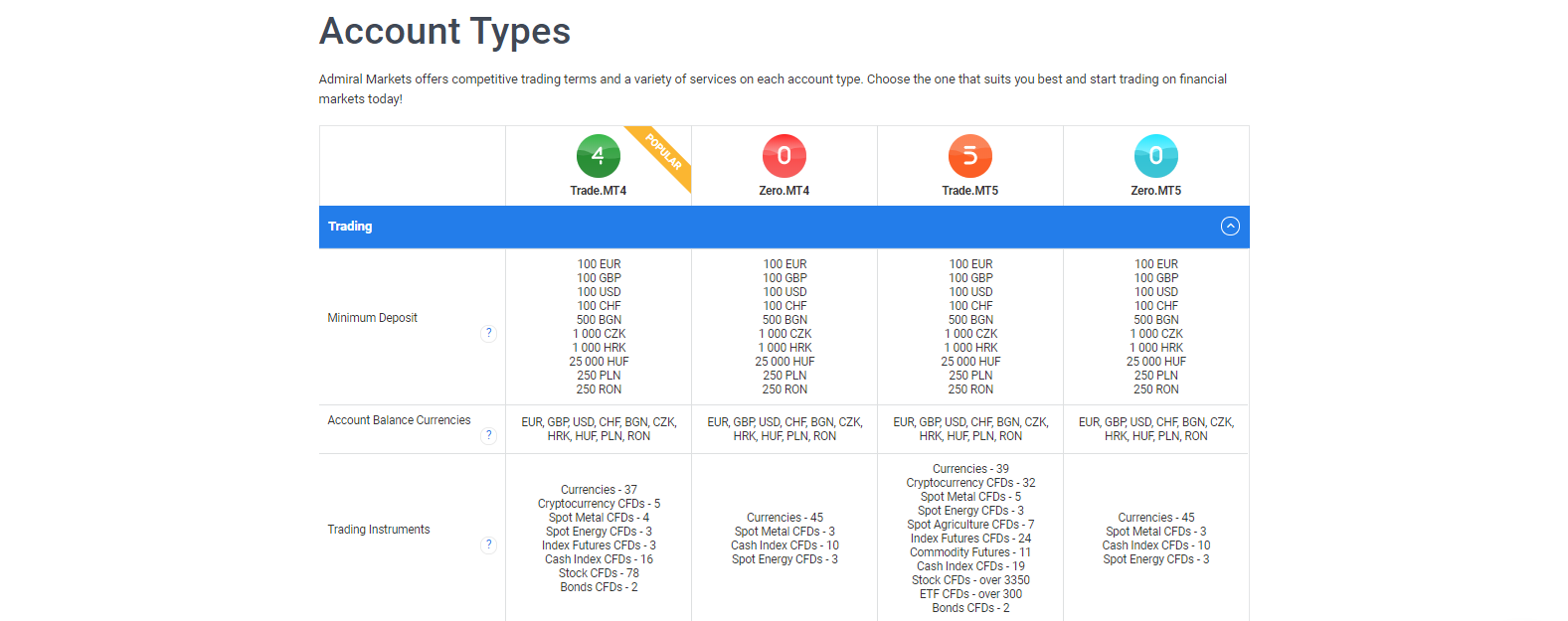

Account Types

Two distinct account types are available at Admirals. The Trade MT4/MT5 account represents a commission-free Forex account, where the advertised spread is 0.5 pips. Commissions on equity CFDs applies across the board. The Zero MT4/MT5 account carries a fee, but spreads are reduced to 0.1 pips and marketed as low as 0.0 pips. A volume discount is available, which significantly reduces trading costs for high-frequency traders. A swap-free Islamic account is available upon request, and qualified traders may ask for an upgrade to a professional account, labeled Admirals Pro.

Traders have a choice between two different pricing structures.

Eligible traders may ask for an upgrade to professional account status.

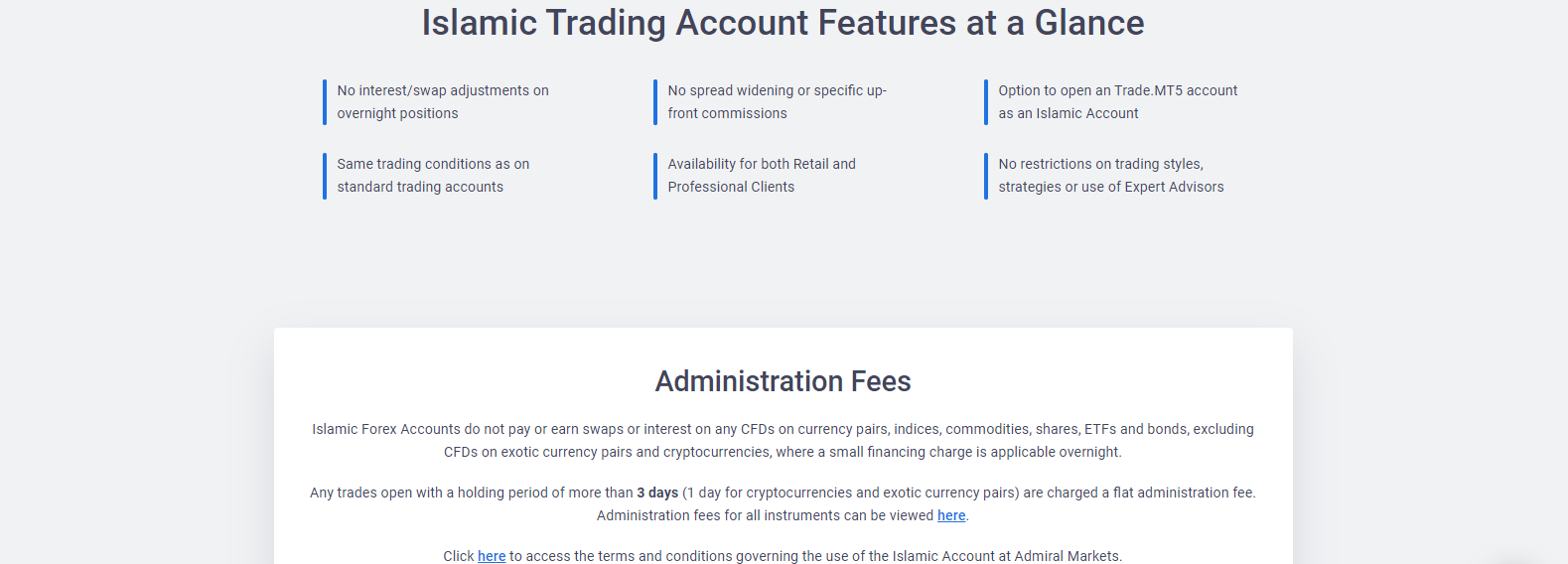

An Islamic account is also available.

Trading Platforms

MT4 | |

|---|---|

MT5 | |

cTrader | |

Proprietary Platform | |

Automated Trading | |

DOM? | |

Guaranteed Stop Loss | |

Scalping | |

Hedging | |

One-Click Trading | |

OCO Orders | |

Interest on Margin |

The MT4 and MT5 trading platforms, together with the MetaTrader WebTrader, are available. The MT4 and MT5 are the most popular trading platforms and a recognized market-leader in automated trading solutions; unfortunately, the MetaTrader WebTrader is generally considered as a failed successor platform, primarily because it lacks backward compatibility. Moreover, in order to access all of the assets provided by Admirals, a trader will be forced to use the MT5 platform. All classes are impacted, but it is most notable in the equity CFD selection. Mobile versions are available for either platform. This is, undoubtedly, one of the biggest drawbacks of Admiral Markets.

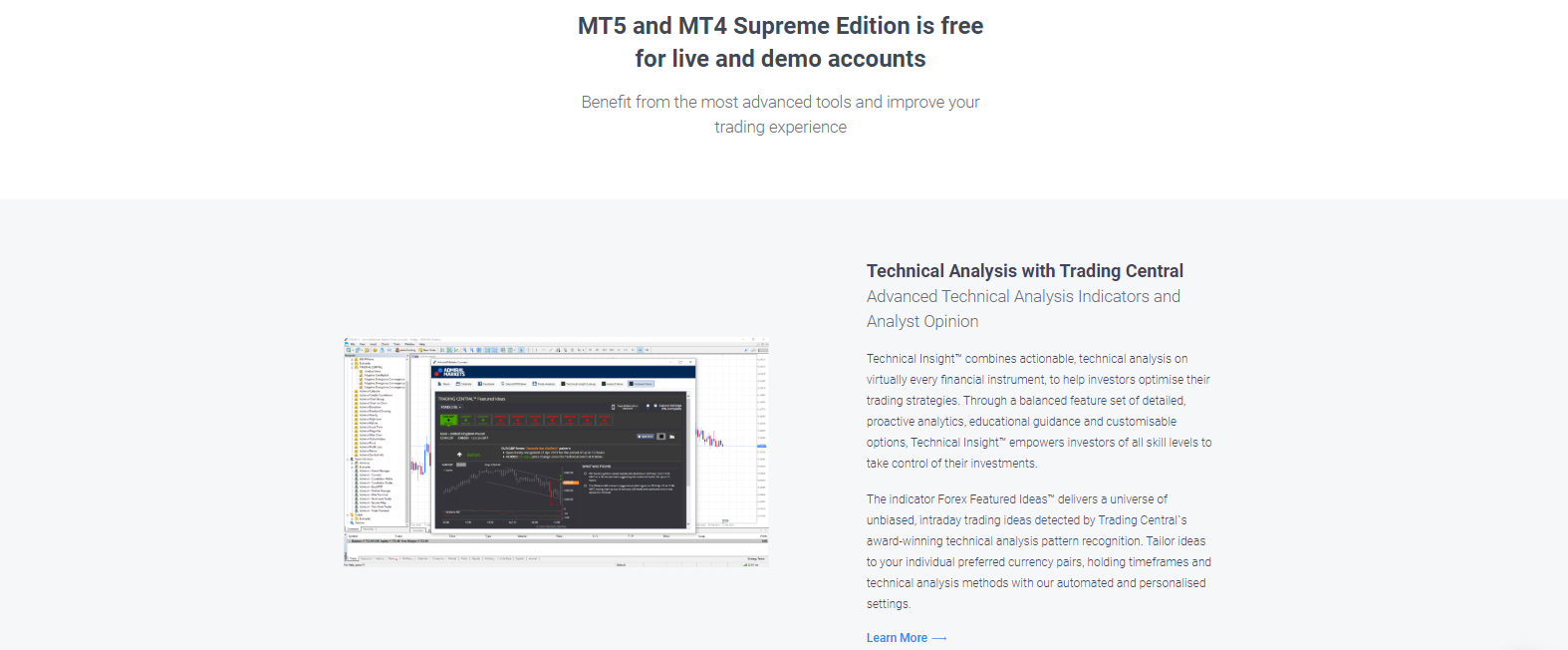

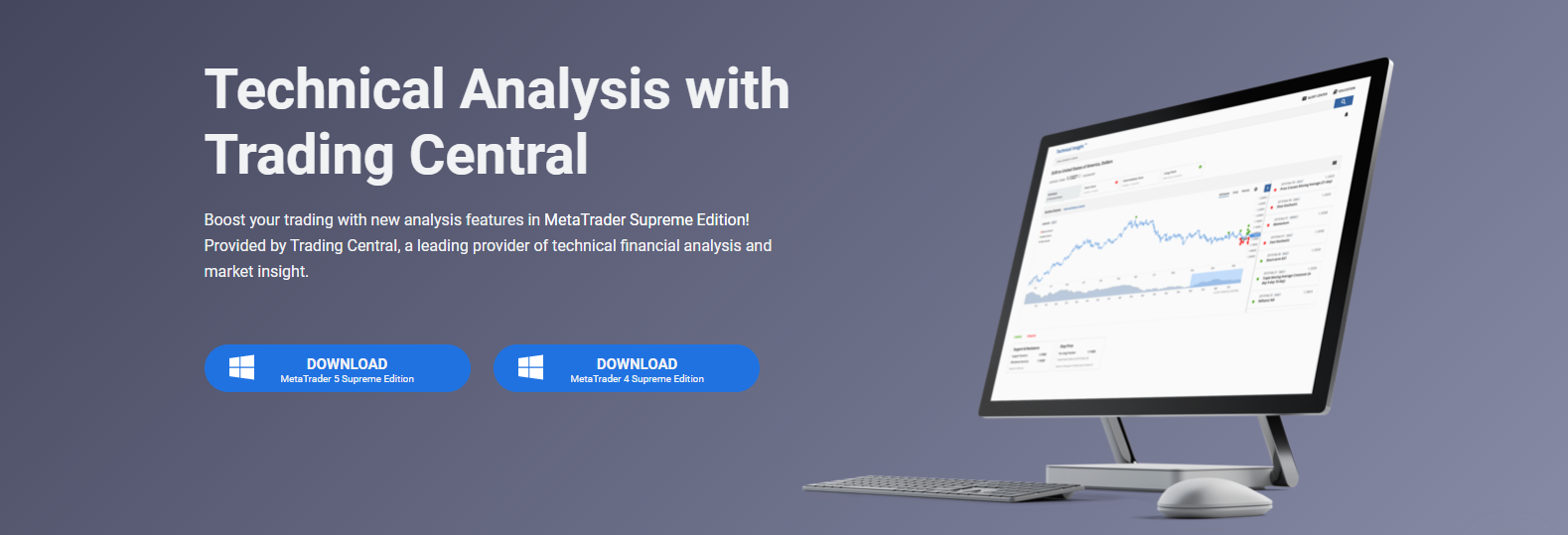

On a positive note, Admirals provides all clients with an excellent free upgrade, the MetaTrader Supreme Edition. It transforms the sub-standard MT4/MT5 basic versions to an outstanding trading portal with advances features that include, for example, widgets under the Global Opinion add-on, or analytics provided by Trading Central. It ensures traders manage their portfolios with a competitive edge.

Traders who rely on automated trading solutions will find fewer assets are provided inside the MT4 trading platform.

The full range of assets is available in the MT5 version which, unfortunately, lacks backward compatibility to MT4. That shortcoming renders the platform useless to traders with an existing set-up who are dependent on the MT4 infrastructure.

Admirals ensures a competitive trading environment for all manual traders with a free upgrade to the MetaTrader Supreme Edition.

Unique Features

Admirals offers a set of tools labeled Volatility Protection. They enhance the available order types to include predefined maximum slippage, cancellation of pending orders on price gaps, market execution and partial execution of limit orders, and activation of stop orders using reverse quotes. They enhance a traders' ability to manage portfolios during high-volatility events.

Professional clients qualify for an automatic cash-back program based on trading volumes. The basic rate is $1 for $1,000,000 in trading volume, which equals ten standard lots. It is unfortunate that not all traders have access to this program; in its current form, it is out of reach for the majority of clients.

The MetaTrader Supreme Edition, available for free to all accounts (including demo versions), represents the most significant value. It consists of upgrades to the inadequate basic versions of the MT4 and MT5 trading platforms. Besides the Trading Central plugin, the Indicator Package, Connect tool, and Global Opinion add-on, all provide a tremendous value to manual traders.

Through the Volatility Protection set, enhanced order types are available.

A cash-back program is available, but regrettably only to professional account holders.

The MetaTrader Supreme Edition represents the most valuable benefit available to traders at Admirals.

Research and Education

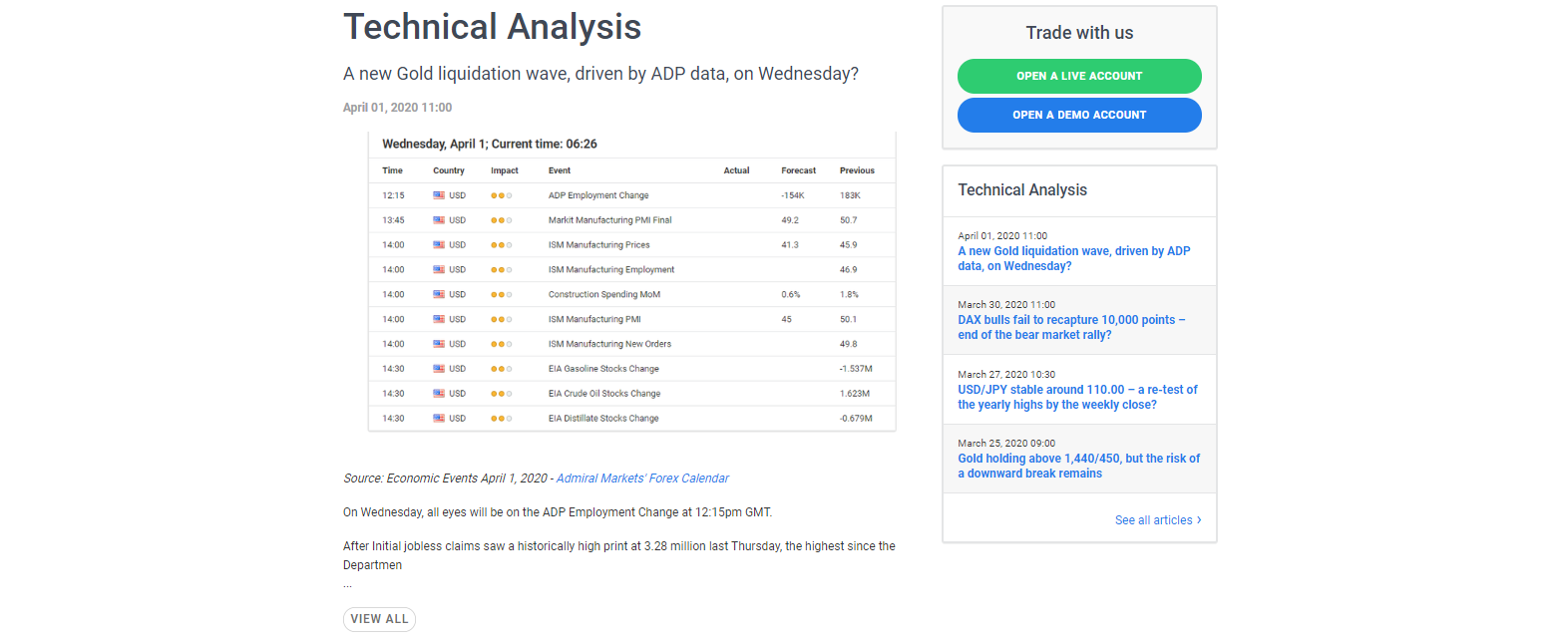

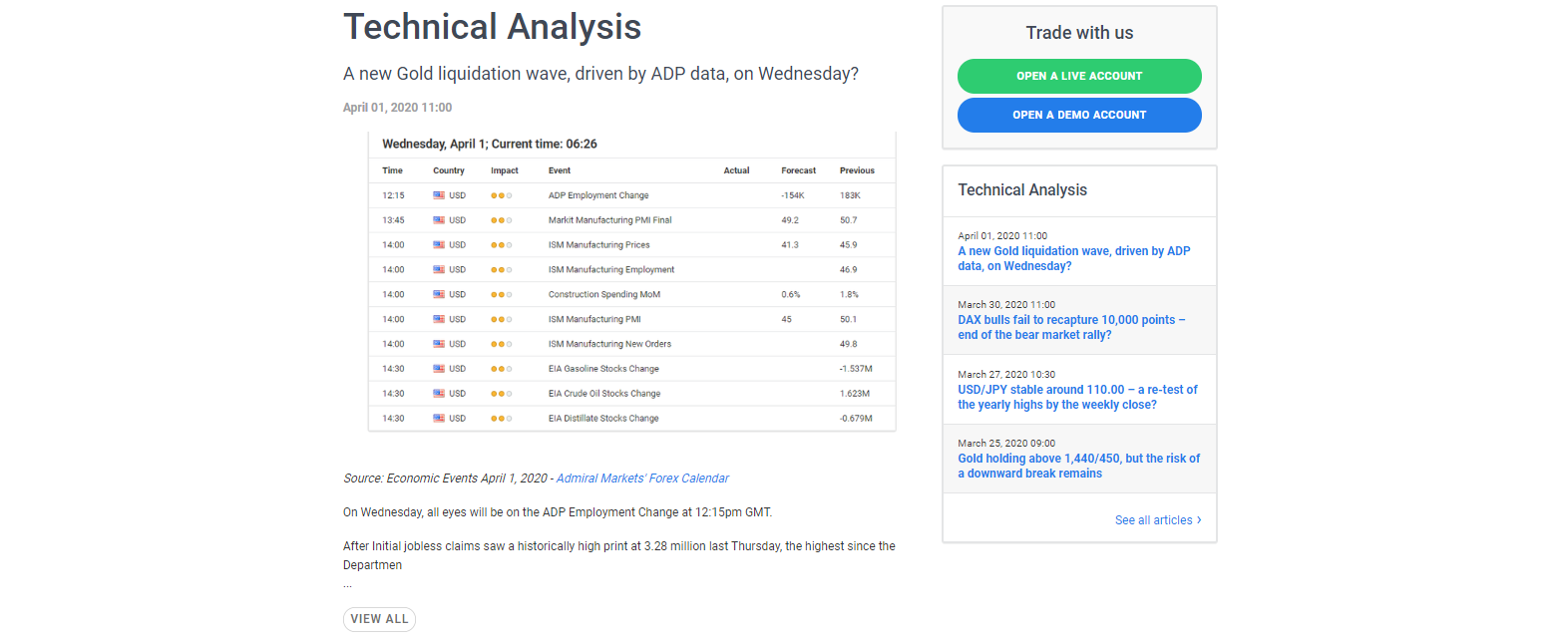

Admirals publishes in-house analytics, and this is an area where the broker could use some improvement, as the section is not especially well-organized, and is specifically lacking in the technical analysis section. They complement the research capabilities provided via Trading Central (which is embedded in the MetaTrader Supreme Edition). Premium Analytics are also available, powered by Dow Jones, Trading Central, and Acuity; the service is free but requires traders to sign-up. The inclusion of in-house analytics further enhances auxiliary trading services already provided to manual traders. The Trader’s Blog covers fundamental topics in a well-presented format. Other research tools include a Heat Map, Market Sentiment indicators covering in-house positions, the Cryptocurrency Bubble-O-Meter, and an economic calendar.

The infrequency of fundamental analytics could use improvement.

The technical analysis section consists primarily of fundamental analytics, a significant misstep by Admirals.

Trading Central remains at the core of the research provided.

Premium Analytics is free of charge but requires traders to sign-up.

Traders may access additional fundamental research published on the Trader's Blog.

Through the nine-lesson Forex 101 trading course, new traders are provided with an excellent foundation to enhance their understanding and knowledge base. The initial three lessons are available to all traders but a free demo account is required to unlock the remaining six lessons. Complementing the course are free webinars, which are hosted weekly. Proper risk management was assigned a unique place as part of the more extensive educational content, which is a commendable decision on the part of Admirals' management. Thirteen articles and tutorials, which encompass a wide range of quality, topic-specific content, are also available. A Trader’s Glossary provides a brief explanation of terminology, while a seminar section is available but without scheduled events.

The Forex 101 trading course is a recommended first step for new traders.

Admirals hosts free weekly webinars.

Risk management was assigned a unique section, stressing the importance of the topic.

A wide range of topic-specific educational content can be easily accessed.

Customer Support

Customer Support Methods |   |

|---|---|

Support Hours | 24/5 (presumed) |

Website Languages |  |

At any well-executed brokerage, customer support is rarely required. However, when necessary, Admirals' customer support team is easily accessible via e-mail, a webform, phone, or live chat. Remote assistance for technical issues is also available. An extensive FAQ section attempts to answer most questions. Support hours are not noted on the website, but the standard 24/5 support hours are assumed to be in place.

Bonuses and Promotions

Aside from the cash rebate program which is, regrettably, only available for professional clients, no bonuses or special promotions are offered.

Opening an Account

Per the industry's standard operating procedure, a simple online application form processes new account applications. The process grants new traders access to the Admirals Trader’s Room. New accounts require verification, as stipulated by regulators, which is accomplished by sending a copy of the trader’s ID and a proof of residency document. After the AML/KYC requirements are satisfied, full account features are made available.

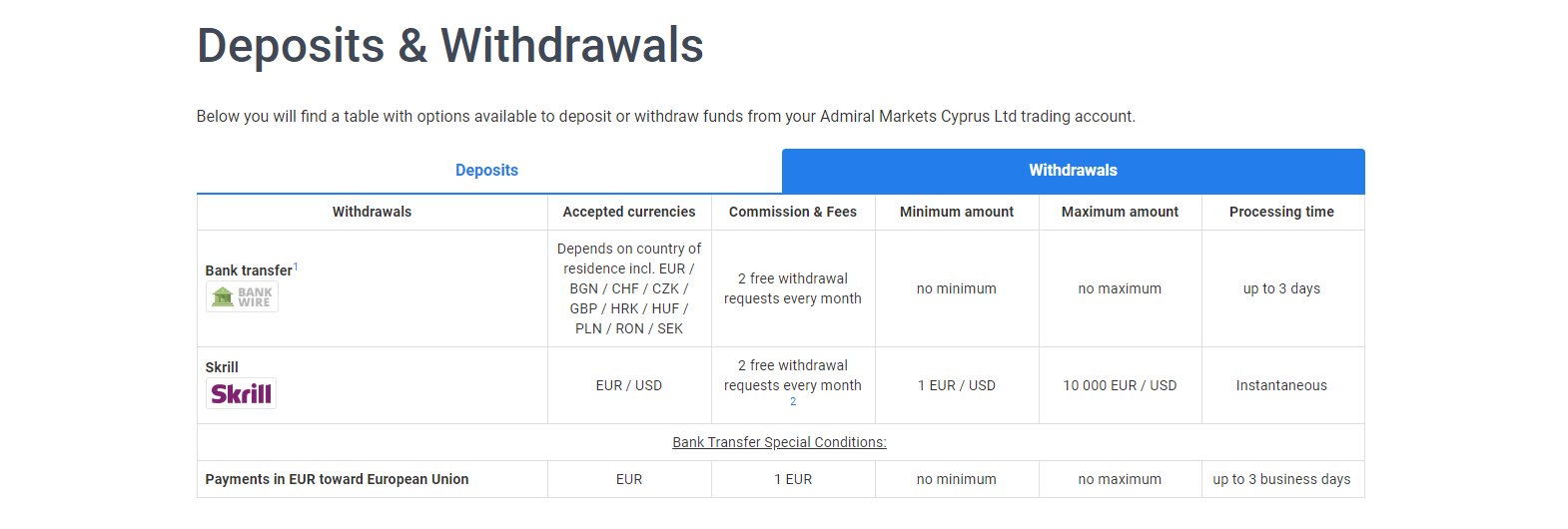

Deposits and Withdrawals

Deposit and withdrawal options are, unfortunately, limited to only bank wires, credit/debit cards, and Skrill. Given the ever-growing list of global alternative payment providers, this area represents one at Admirals that is desperately in need of improvement. Skrill carries a fee of 0.9% with a minimum fee of $1/€1. The other options are free of charge, but third-party charges are generally applicable. Two free withdrawals each month are sufficient to eliminate most fees. Processing times range from instant to three business days. While the overall process does follow industry standards, more payment options are desperately needed.

Admirals only supports bank wires, credit/debit cards, and Skrill.

Traders have two free monthly withdrawals at their disposal, which is disappointing and unusual.

Summary

Admiral Markets established itself as a reliable retail brokerage. From its humble origin, it grew into a massive operation, with a physical presence in sixteen countries, and now home to over 120,000 traders from 110 countries. This broker ensures its clients manage their portfolios in a competitively priced trading environment. Admiral Markets offers its traders an outstanding asset selection for proper cross-asset diversification.