- Bitcoin had a mixed performance during Wednesday's trading session, with market participants oscillating between bullish aspirations and concerns of potential overextension.

- While many are eager to propel the cryptocurrency to new heights, there is a growing sense that a pullback may be on the horizon, and such a correction could be deemed a welcome development.

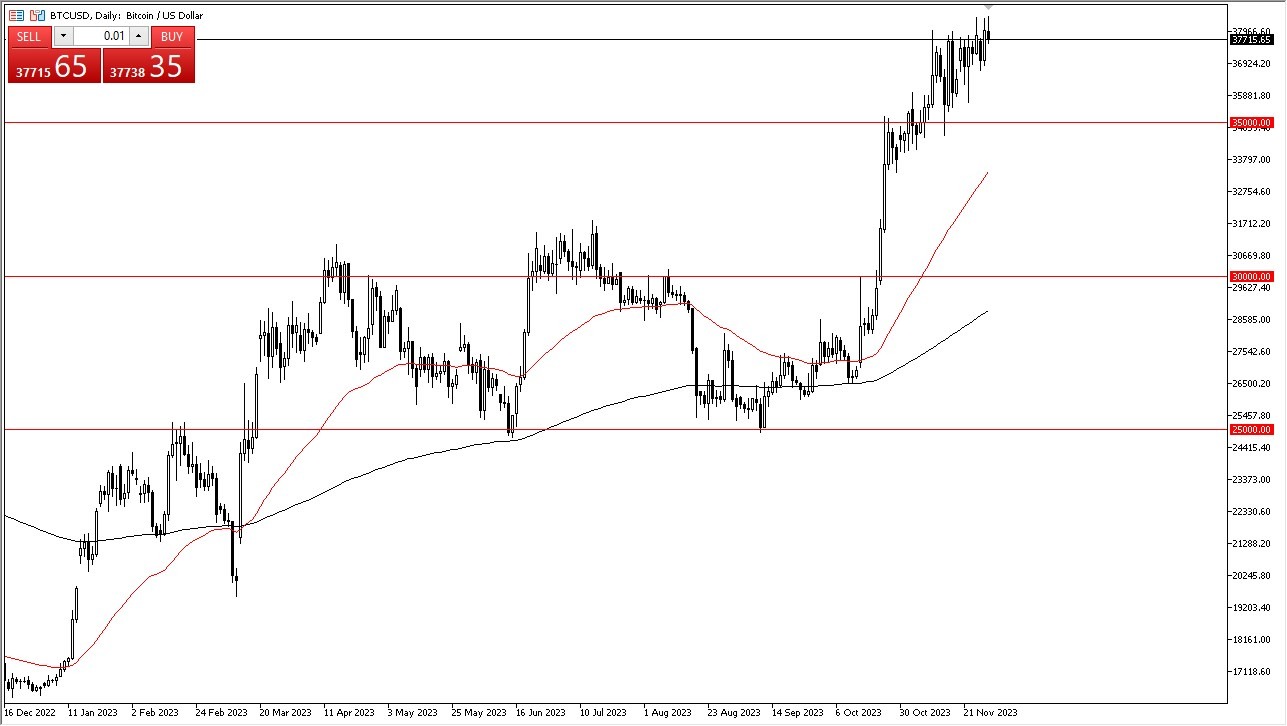

- In particular, a drop to the $35,000 mark is an enticing prospect, one that would inject a dose of health into the market's dynamics.

The 50-day Exponential Moving Average has been making a determined ascent, poised to converge with the $35,000 level in the near future. Such a confluence of factors would undoubtedly present a compelling case for prospective buyers, thus meriting close observation.

Beneath the surface, the $30,000 level looms as another layer of support, although a descent to this threshold might rattle the nerves of some market participants. It is vital to recognize that the primary driver of Bitcoin's fortunes, especially in the eyes of institutional investors, revolves around the movement of interest rates in the United States. A decline in these rates could potentially provide a tailwind for Bitcoin, offering support as it navigates its path forward. However, it is undeniable that the cryptocurrency market's momentum has surged ahead of itself, prompting the need for caution.

What if we Just Go Higher?

A potential breakout to the upside would open the door to the formidable $40,000 level, a zone that is expected to unleash a formidable wave of resistance. The breach of this level could unleash seismic shifts in the market's landscape, thereby altering the status quo.

In the grand scheme of things, adopting a "buy on the dips" strategy appears to be the most prudent course of action. Chasing rapid price movements in the cryptocurrency market has proven perilous, given Bitcoin's recent $8,000 surge over just a few weeks. The presence of institutional players in the market has dampened the likelihood of seeing explosive 15% gains within a single day, unless underpinned by a massive transformation in the economic backdrop. Thus, exercising patience and seizing opportunities when the market presents value is the modus operandi in the Bitcoin arena.

Furthermore, keeping an eye on the bond market becomes paramount, as any indications of monetary loosening could serve as a catalyst for Bitcoin's ascent. In the current landscape, staying attuned to both market dynamics and broader economic trends in the bond markets will be crucial to sort out the next move.

Ready to trade Bitcoin in USD? We’ve shortlisted the best MT4 crypto brokers in the industry for you.

Ready to trade Bitcoin in USD? We’ve shortlisted the best MT4 crypto brokers in the industry for you.