While I believe that knowing how to conduct a technical market analysis is essential to profitable trading, it’s also important to begin an analysis by looking at an economic calendar, just so you can gauge what’s moving the markets and their general direction.

However, I don’t execute my trades based off economic calendars or such events as CPI or PPI readings, interest rate announcements, or the like. I really find my trade entries by looking at technical price charts. Specifically, I divide price charts into two categories: one category I call the higher timeframes, which include the weekly, daily and four-hour charts, which I use for my analyses. The second category I call the lower timeframes, which include the hourly, the 15-minute and the five-minute charts, and these I use for the actual trade execution.

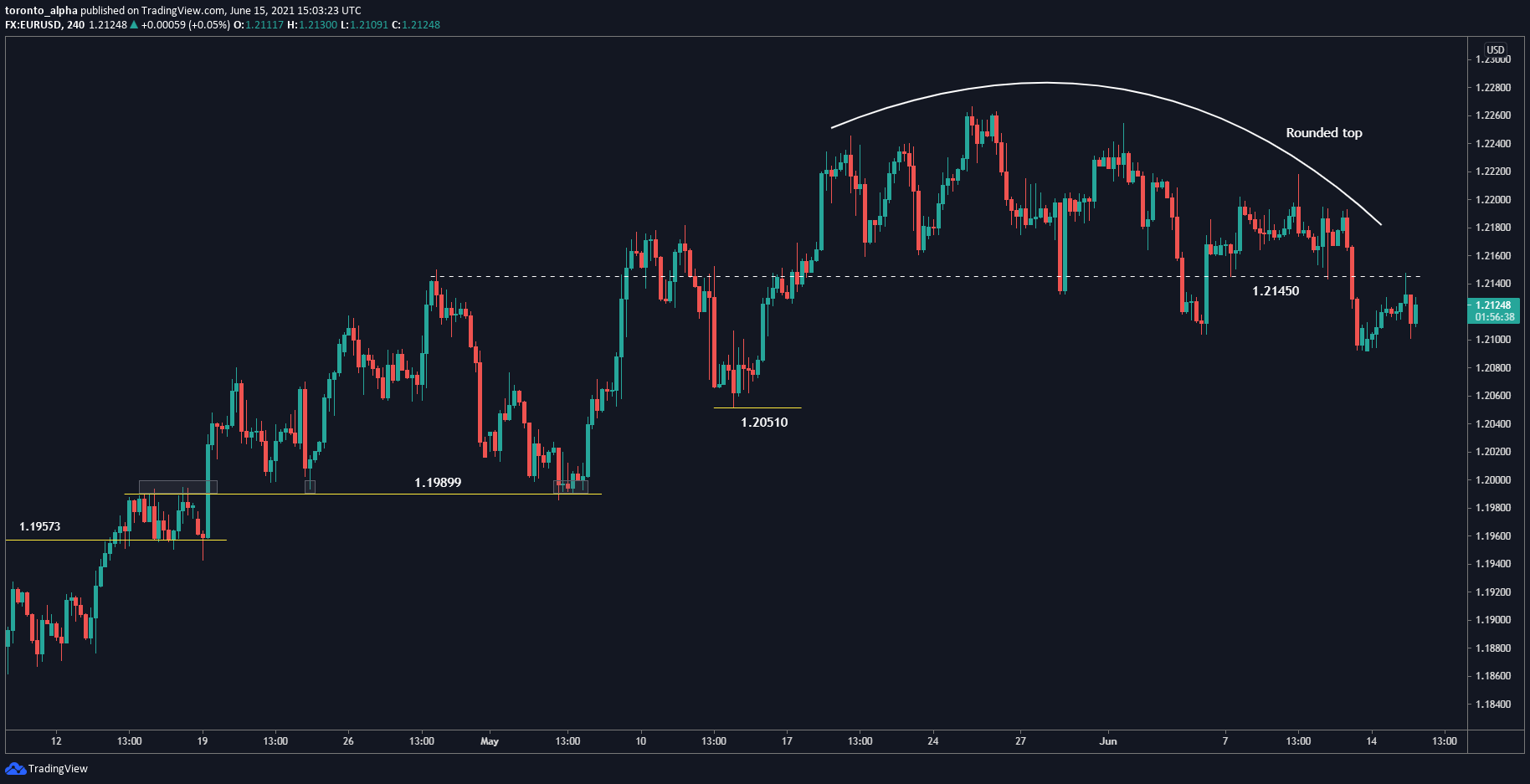

That being said, let’s look at the current price charts for some of the major Forex pairs, beginning with the EUR/USD:

The uptrend that started in early 2020 seems to be stalling as the price reaches a previous resistance that was formed in early 2020. This resistance also is in a significant 50-61.8% retracement zone. The price also made a lower high this year, with a deep retracement in between.

A key level on the daily is 1.19573, which has the potential to act as support should the price go down there:

On the 4-hour chart, there’s a rounded top formation, and a short-term resistance level of 1.21450, giving us a bearish outlook:

The GBP/USD is in a similar state to the EURUSD:

The pair's uptrend that started in early 2020 is now slowing down as it comes into the same region as resistance, which was made in early 2018. That resistance level is also at a significant 50% retracement level.

On the daily chart, a double-top has formed at 1.42410:

On the 4-hour chart, the price has formed a rounded top and broken a recent support of 1.40906, giving us a bearish outlook:

Now let's take a look at the AUD/USD pair, beginning with the weekly chart:

AUD/USD is near a long-term resistance at 0.81358, first made in mid-2015, and touched again twice in mid- and late-2018. It also coincides with a long-term 50% retracement level.

On the daily chart, the price is sideways, but with a resistance at 0.78492 and a support at 0.75812:

On the 4-hour chart, the price is sitting on a recently made support of 0.76749. If the price breaks that, we’re near-term bearish:

The USD/JPY has been in an uptrend since the beginning of 2021, reversing the downtrend of 2020.

That said, it’s at a key resistance level of 109.850. The price must remain above that for us to be bullish.

The USD/CAD presents an interesting pair:

The USD/CAD recently bounced off a support level made in 2017 at 1.20613, which coincides with a long-term 50% retracement level. The price could be reversing the previous 18-month downtrend, but right now, we will have to wait for price action to unfold for a few weeks to know if the support will hold.

Let's now look at the weekly chart for the NZD/USD:

The NZD/USD in early 2021 hit a key long-term resistance level at around 0.7484, which is also in a long-term 50-61.8% retracement zone.

On the 4-hour chart, the price has made a sideways channel, but it is currently sitting at the bottom of that channel at 0.71043.

Our outlook is bearish if price breaks through that channel and stays below it (ideally testing the same level as resistance).

We are neutral on USD/CHF:

The price has been in a downtrend since early April, but it has been going sideways in the last month and formed a support at 0.89303. Could the price be stalling to reverse? Further price action will have to unfold to give us a clearer picture.

In general, if a price chart is unclear to you, stay away from it and either trade a different timeframe or wait for a better chart altogether. The less guesswork involved in your trades, the higher the chances you can profit and the lower the chances of loss.

On a final note, always remember to mind your risk. The best technical analysis and trade entries in the world will mean nothing if you don’t practice wise risk management. This means setting stop losses, making sure you set up good ratios, etc.