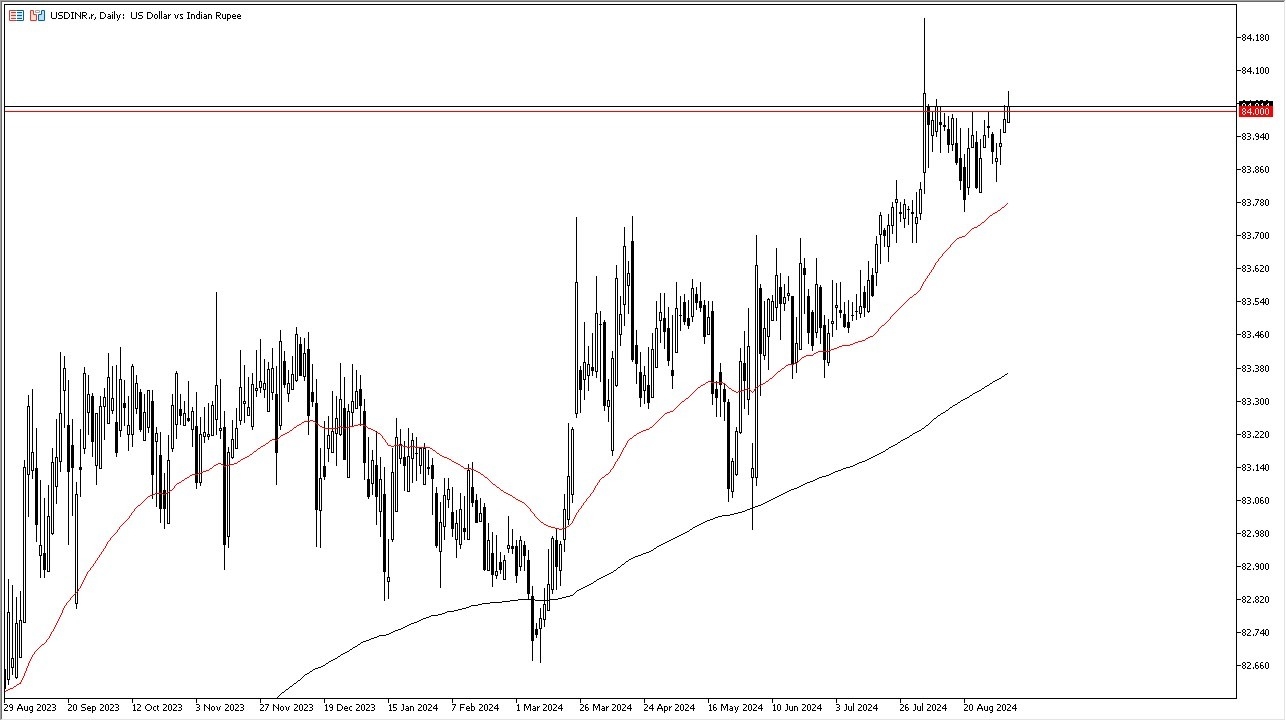

- The US dollar initially rallied during Wednesday's session, breaking above the crucial 84 level.

- This area typically attracts significant attention, and while the breakout suggests potential gains, caution is needed.

- The Bank of India is likely to intervene to limit excessive upward movement.

I do think it is probably only a matter of time before we go looking to the 84.20 level and perhaps even beyond that. The Bank of India manipulates this currency pair, it doesn't allow it to free float. I think you've got a situation where traders are looking at this as a buy on the dip scenario, but it's also a grind higher. Keep in mind that the U S dollar of course is considered to be a safety currency, and the Indian rupee of course is considered to be an emerging market currency. That means that we need more of a risk on attitude to get excited about owning the Indian rupee.

Top Regulated Brokers

The Global Economy Will Have Its Say Here

With all of this being said, it's worth noting the Chinese demand has recently shrank and that might have traders a little bit concerned on dips. I do think that you'll see plenty of support extending all the way down to the 50 day EMA, which is near the 83.80 level. Anything below there would be a bit of a surprise, but at this point, I think you've got a situation where you will find buyers willing to take advantage of cheap greenbacks as the global economy slowing down will almost certainly have a major influence on what happens next in this pair.

Ultiamtely, this is a slow paced currency pair, but it favors the US dollar over the longer term, and I think this is what you should be focused on. The Bank of India isn’t going to change policy anytime soon, so it is likely to remain the same type of market going forward.

Want to begin trading the daily USD/INR analysis? Get our most recommended Forex brokers in India here.