- The US dollar initially fell during the early hours on Thursday but turned around to show signs of life again against the Swiss franc.

- In my daily analysis of the USD/CHF pair, I recognize this is an asset that had been sold off quite aggressively, and probably far too much.

- With that being said, the likelihood of the Federal Reserve cutting interest rates has had a major influence on this pair, but let’s not get it mixed up here, the reality is that you still get paid to hold this pair.

- It would take an unreal amount of interest rate cuts to make the interest rate swap neutral.

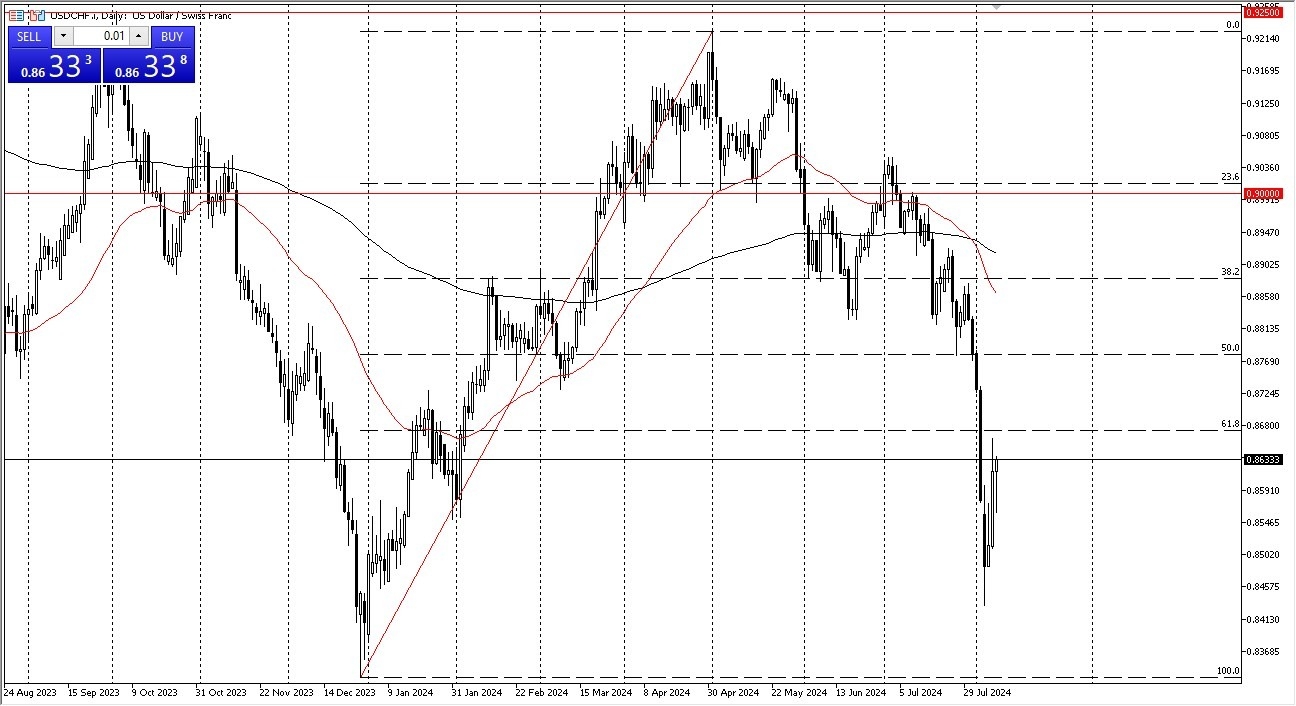

Underneath, we have seen the 0.8450 level offer support, and it does make a certain amount of sense that it held due to the fact that it was a major swing low previously. In this environment, I think you continue to see money flow into the US Treasury market, and that of course demands US dollars. As long as that’s going to be the case, I think we got a situation where you have to look at this through the prism of “cheap greenbacks.”

Top Forex Brokers

Going Forward

On a break above the 0.87 level, I think you are starting to see more momentum come back into this market, and I think you will see the US dollar rally significantly at that point in time. It’s also worth noting that a lot of of signals out there suggest that we have a global slowdown coming, and while the Swiss franc of course is considered to be a safety currency, when it comes the huge funds, unless of course they are in the European Union, the first thought is almost always to put money into the greenback or treasury markets, which is essentially the same thing.

If we can break above the 0.90 level eventually, that would obviously be an extraordinarily bullish sign. I think at this point in time, we are just looking at a market that got oversold and it is trying to correct itself in the short term. Whether or not it continues to rally remains to be seen.

Ready to trade our daily forex forecast? Here are the best online trading platforms in Switzerland to choose from.