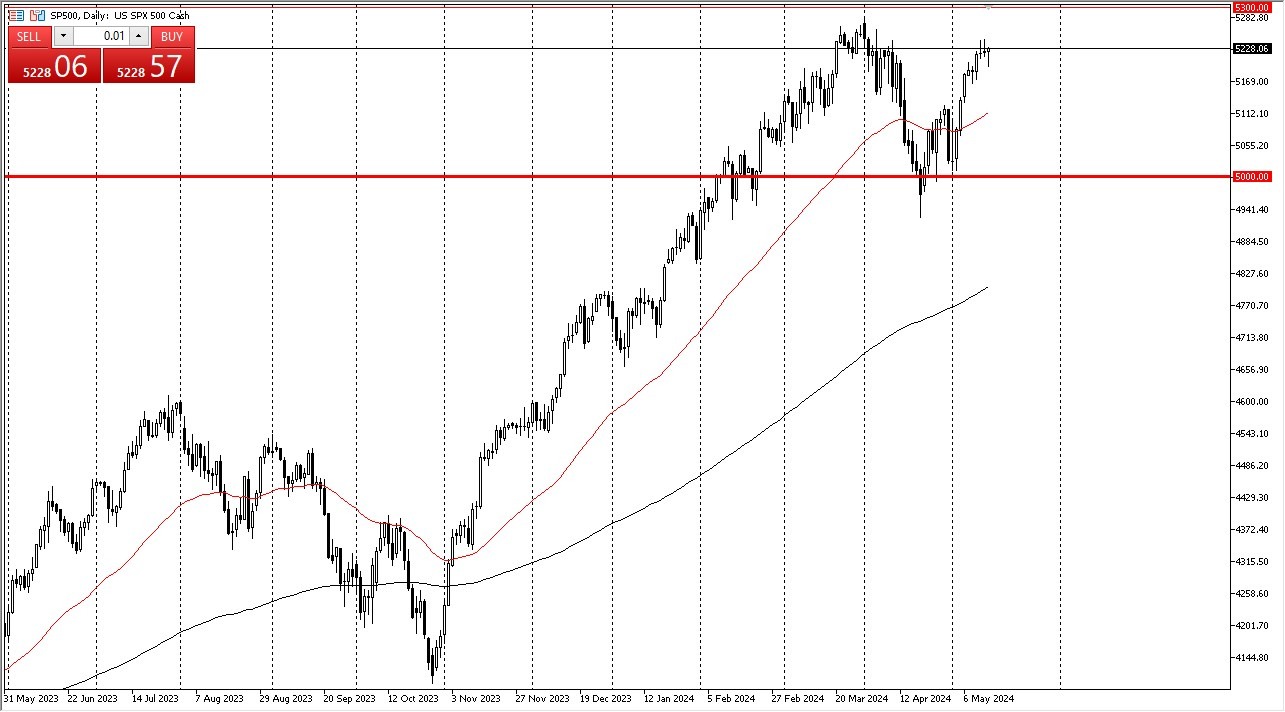

- Early during the trading session on Tuesday, we have seen the S&P 500 dip, but since then we have seen it turn right back around and show signs of strength.

- By doing so, I think this is a market that will eventually try to get to the 5300 level, an area that repudiated the market previously.

- We have seen a couple of shooting stars in a row, so I think this is an area that's going to be difficult.

It's probably worth noting that the producer's price index was a little hotter than anticipated, but the market has recovered quite nicely since then, as it looks like traders are simply willing to ignore that.

Top Forex Brokers

Chasing the Market Mentality May Prevail Regardless

If that's going to be the case, then we have a situation where we are more likely than not to have a buy-on-the-dip mentality return to the market. And at that juncture, I do think that any dip has to be looked at through the prism of perhaps offering a bit of value. The 50 day EMA sits above the 5100 level, which of course in and of itself would be psychologically important. And then of course, we have the 5000 level, which is a major floor in the market, a large round psychologically significant figure and an area where we've seen a lot of action at previously.

Because of this, I assume that the $5000 level is a hard floor in the market at the moment, and I do think it would be very difficult to break down below there. Keep in mind that the S&P 500 is driven by a handful of companies anymore, so this is essentially an ETF that you are trading. If the top 5 or 6 companies continue to flourish, so will the S&P 500. It doesn’t seem like many people were out there willing to bet against this trend, and therefore I think you have a situation where stocks go higher sooner or later, unless we get some type of major shock to the system. Keep your position size reasonable, and therefore somewhat small until the market has proven you correct.

Ready to trade the S&P 500 Forex? We’ve shortlisted the best Forex brokers for CFD trading in the industry for you.