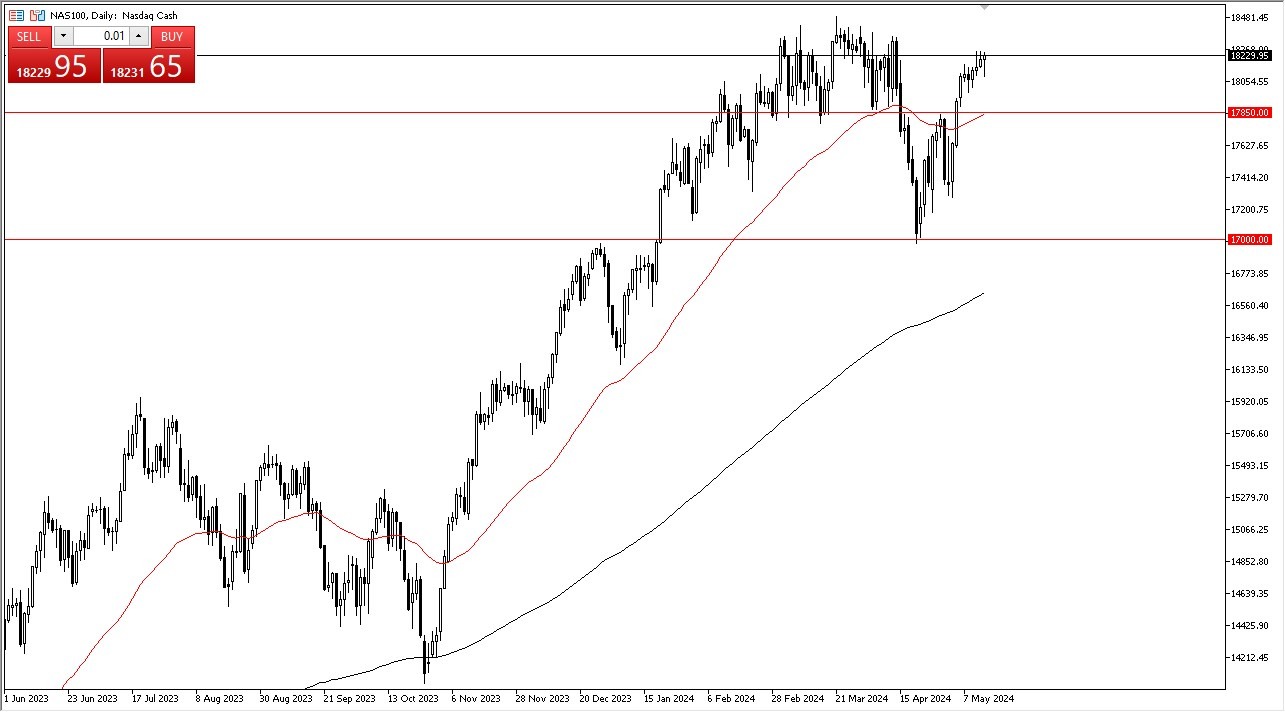

- The Nasdaq 100 initially fell during the trading session on Tuesday but turned around to show signs of strength again.

- By doing so, it looks as if the market is going to continue to find plenty of buyers, and it will try, at least, to get to a fresh new high.

- A new high would entail breaking above the crucial $18,400 level, but ultimately, I think this is a situation where you are probably going to see the market take off much further than that if we do break out.

I would anticipate a potential move to the 20,000 level, which is the next large round, psychologically significant figure, with the exception of 19,000, but I don't think that means much. With this setup that we have right now, I look at the 50-day EMA at the crucial 17,850 level as a major support level, and I also recognize it as important.

Top Forex Brokers

Dips Are Value It Appears

The market participants are paying close attention to each dip as a potential value trade. The Nasdaq 100 is driven by just a handful of stocks, it really should be called something like the Nasdaq 5, so as long as all the big names are still rallying, it does make sense that the Nasdaq 100 moves right along with it. Ultimately, I think this is a situation where buyers come in to take advantage of each and every dip as they look at it as a cheap contract price. If we can finally break out, I expect to see a lot of momentum enter this market, and everybody who had shorted at the highs will be forced to quickly cover their short positions, adding even more momentum to the upside.

In that environment, I would fully anticipate a bit of “FOMO trading" to enter the arena, thereby pushing the NASDAQ 100 much higher. Keep in mind that Nvidia reports in about a week, and that of course could be the straw that broke the camel’s back in so much as so many market participants pay attention.

Ready to trade the NASDAQ? We’ve made a list of the best online CFD trading brokers worth trading with.