- The S&P 500 was rather quiet during the trading session on Tuesday as we wait for the Consumer Price Index figures.

- Ultimately, this is a market that will continue to be very noisy, but I think it’s probably only a matter of time before we start to pick up momentum in the upward direction yet again.

- After all, this is a market that is focusing almost solely on the idea of cheap money.

We do have earnings season coming and that of course has a major influence on what could happen in the short term, but longer term it’s going to be about interest rates as per usual. Currently, it looks like the Federal Reserve will be cutting by the end of the year, but it may be as little as to interest rate cuts now. That being said, Wall Street still has plenty of hope for more, so I think you will continue to see a lot of noisy behavior in the short term.

Consumer Price Index

In the short term, traders will be paying close attention to the Consumer Price Index numbers coming out on Wednesday, because it gives us an idea as to what inflation is doing in the United States, which directly influences what the Federal Reserve will not going. As long as inflation remains stubbornly high, the amount of interest rate cuts will continue to dwindle. Remember, there was a point in time where Wall Street anticipated 6 interest rate cuts between now and the end of the year. We are now favoring the idea of 2 or 3.

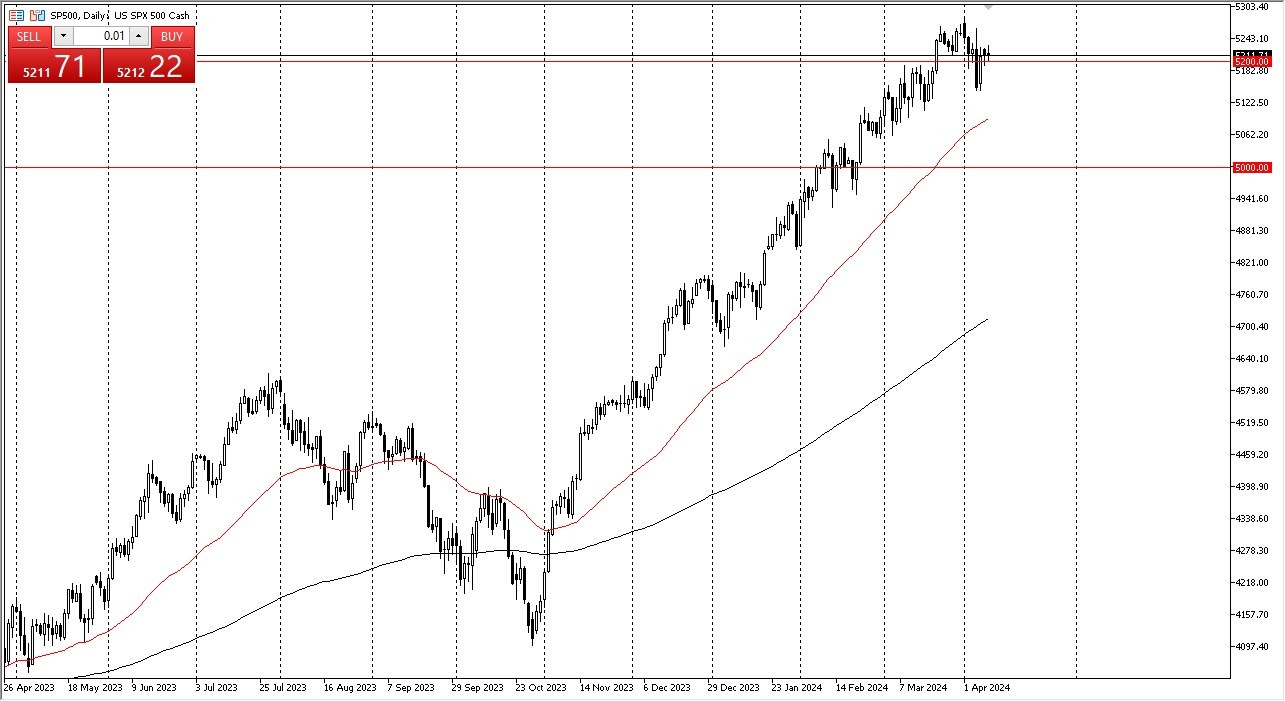

If we do rally from here, the 5300 level is an area that a lot of people will be paying attention to as it has shown itself to be massive resistance previously. If we can break above there, then the market is likely to continue to go to the 5500 level. If we break down from here, the 5100 level should be a significant amount of support with the 50-Day EMA sitting just below it is offering support as well. Either way, I don’t really have any interest in trying to short this market, because it has been far too relentless. Worst case scenario, I suspect that we go sideways.

Ready to trade the S&P 500 Forex? We’ve shortlisted the best Forex brokers for CFD trading in the industry for you.