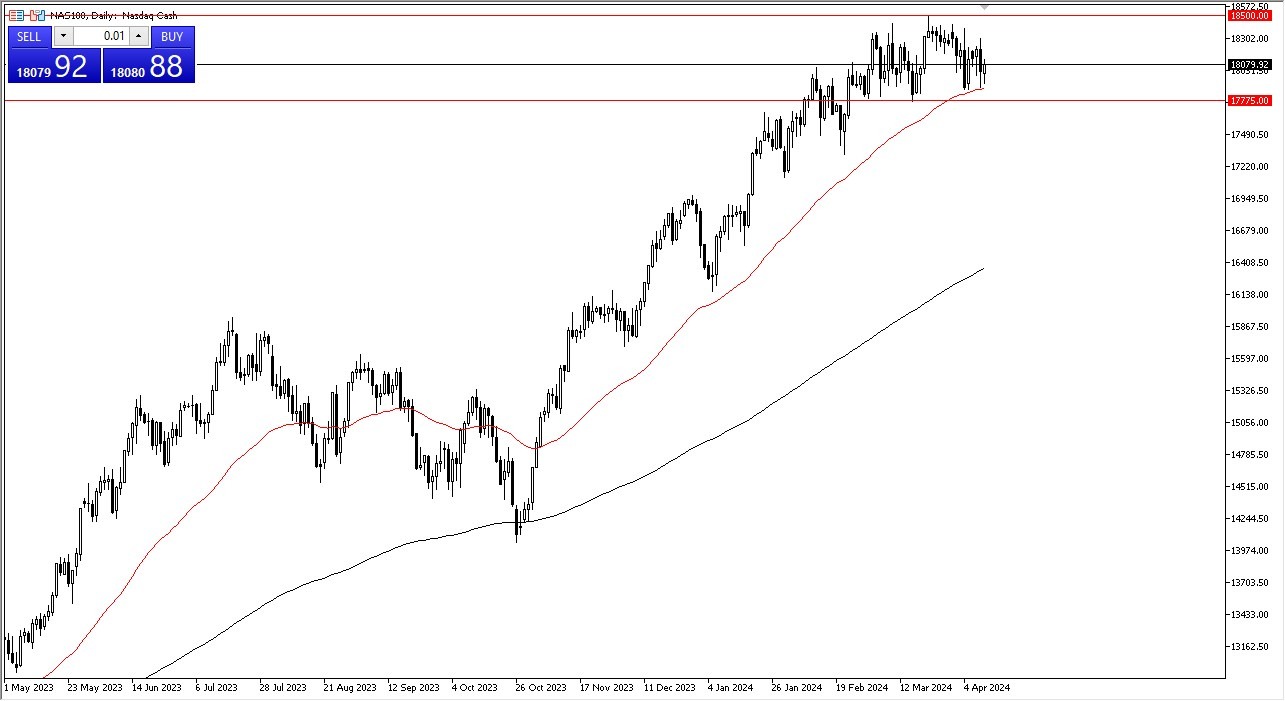

- The Nasdaq 100 initially fell during the trading session on Thursday, but then turned around to show signs of strength just above the 50 day EMA.

- With that being said, the market looks as if we are still consolidating and given enough time. I think the 17,775 level will end up being a major support.

The 50 day EMA sits just above there and with all of that being said, I think it's probably only a matter of time before we have to make a bigger decision here. What we could be doing is then the simple act of consolidating after a huge shot higher, and that would make a certain amount of sense as well. However, there are some things to pay attention to coming out of the Federal Reserve.

The Fed May Not Cut

The Federal Reserve was projected to make seven interest rate cuts this year at one point, and now it's projected to do two. And some pundits now are even starting to talk about the possibility that they won't cut it all this year. If that's the case, I think the stock market probably takes a bit of a plunge. In the meantime, it looks like we are just killing time.

And as we have a well-defined range between 17,700 and 75 on the bottom and 18,500 on the top. It's not until we break out of this range that we can tell whether or not the trend will continue to go higher, or if we get a deep correction. Either way, right now, I think if you're a sideways and rangebound trader, the Nasdaq 100 might be shaping up to be a very interesting market. I still favor buying over selling, but we'll be paying close attention to that support.

In general, this is a market that traders run to first when trying to place money into the markets, as the tech giants still continue to dominate a lot of the inflow. However, Wall Street may have gotten ahead of itself at this point in time, so that is worth thinking about as well.

Ready to trade the NASDAQ 100 Index? Here are the best CFD brokers to choose from.