- The NASDAQ 100 has rallied significantly during the trading session on Friday, as we have received the jobs number from the United States.

- Ultimately, this is a market that has been very bullish for some time, and it does make a certain amount of sense that we recover.

- After all, although the jobs number was very strong, it does seem as if traders are willing to look past it and expect to see continuation of the overall uptrend.

- Ultimately, this is a market that has been extraordinarily bullish for quite some time, and I just don’t see how that changes anytime soon.

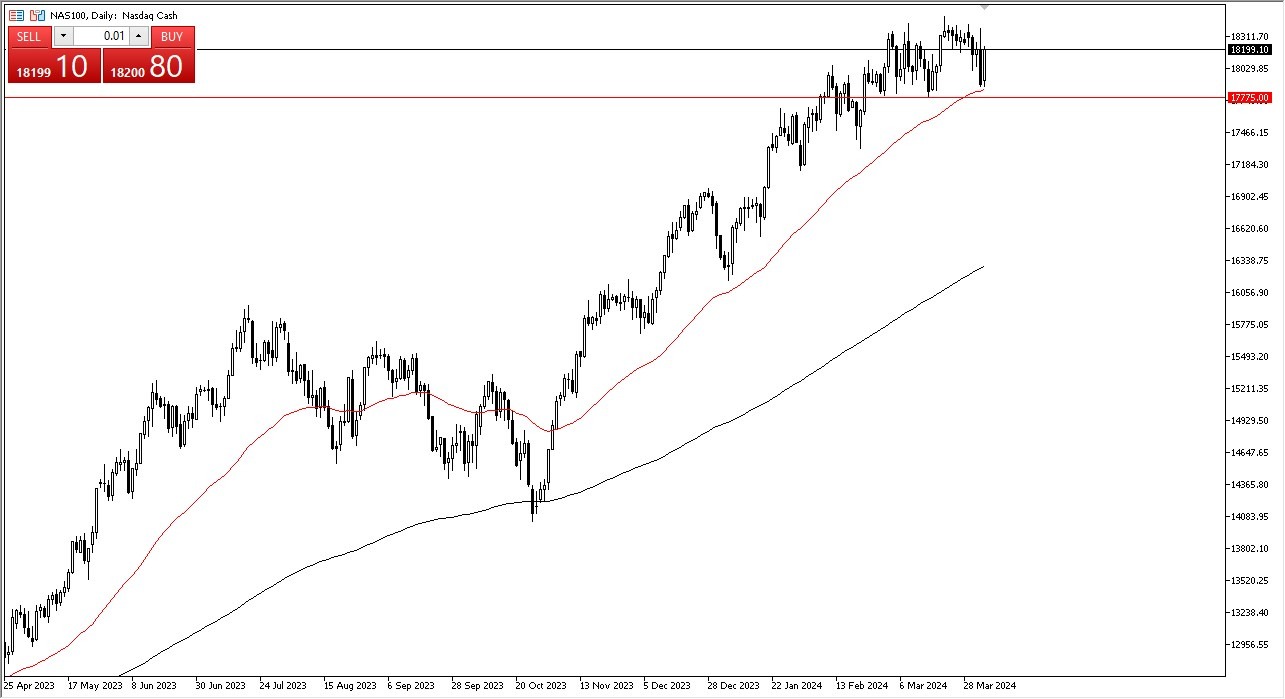

That being said, I think this is a market that not only solve the jobs report as something that doesn’t change the trajectory of rate cuts coming out of the Federal Reserve, but it also saw quite a bit of technical support underneath that came into play. After all, we tested the 50-Day EMA, which is an indicator that a lot of people pay close attention to. Adding to the fact that it was sitting just above support at the 17,775 level, makes a lot of sense that traders were waiting to pick up cheap contracts as they appeared.

Top Forex Brokers

Longer term uptrend

We remain in a longer term uptrend, and I just don’t see anything here that will have changed that attitude. Because of this, I think we will go looking toward the top of the overall range that we have been in over the last couple weeks, and therefore I think it is a scenario where we will try to get to the recent highs, but I do think that we break above that level given enough time.

If we were to turn around and break down below the 17,775 level, then it’s likely that we could go down to the 17,400 level. The 17,400 level is an area that I think a lot of people would be paying attention to as well, and would look at that as a value trade. In other words, I have no scenario in which a willing short this market at the moment.

Ready to trade our NASDAQ 100 forecast? Here’s a list of some of the best CFD trading brokers to check out.