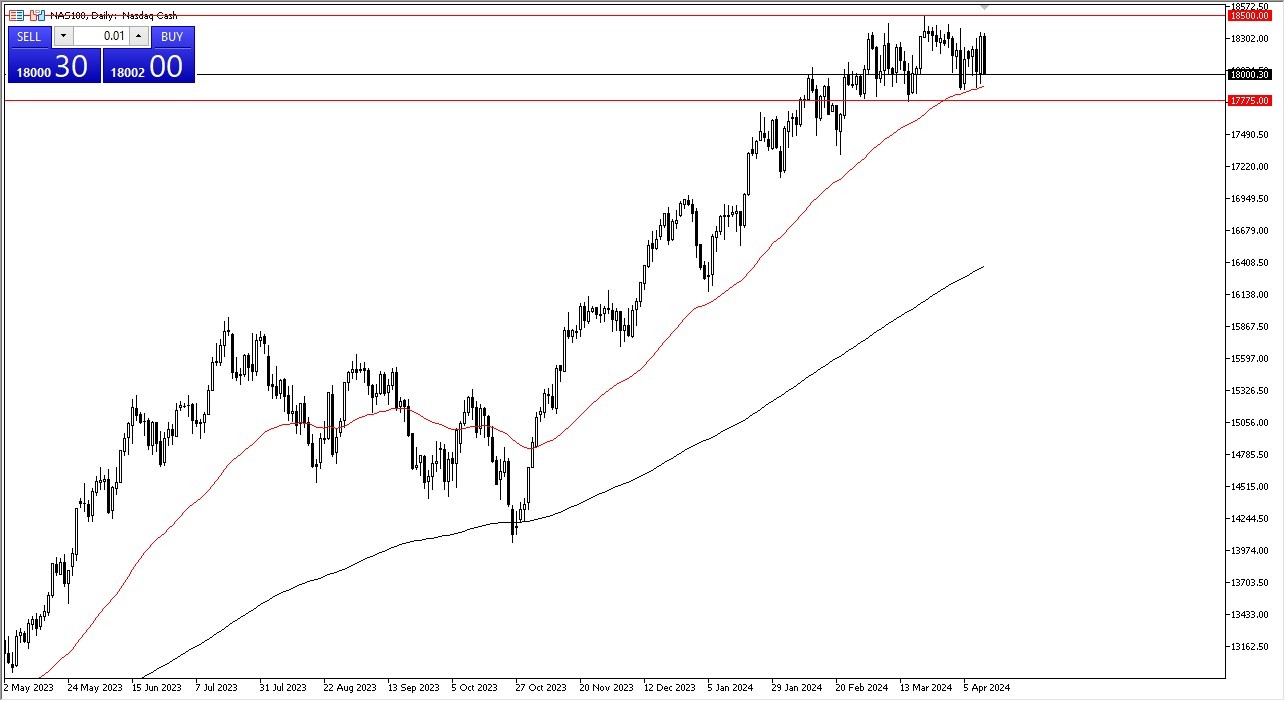

- The NASDAQ 100 has fallen significantly during the trading session on Friday, as we continue to see a lot of noisy behavior.

- Ultimately, this is a market that has been consolidating for a while so even though this has ended up being a very negative session, it really hasn’t changed much as we continue to simply chop back and forth, and the fact that we are heading into earnings season also probably has its part to play here as well.

Consolidation

All things being equal, the market is continuing to consolidate, and I don’t think that has changed despite the fact that Friday was so bad. The 50-Day EMA underneath offers a significant amount of support, right along with the 17,775 level. This is an area that has been important multiple times over the last month or so, and previously had been a significant resistance barrier. With that being the case, I think you get a situation where a certain amount of “market memory” comes back into the picture. If we were to break down below that, then obviously consolidation would be over.

At the top of the consolidation area, we have the 18,500 level, which has recently been touched, but has turned the market back around. As we drift into earnings season, I believe it makes quite a bit of sense that we will see more consolidation as traders will be watching the latest earnings reports to determine where the economy might be going. Furthermore, they also have to get used to the fact that it may just be that just a handful of stocks are driving everything anymore either.

Longer Term Uptrend

We are still in a long term uptrend. This is something that we have to pay close attention to the fact that the markets continue to pay close attention to the idea that the Federal Reserve might cut interest rates between now and the end of the year. If that’s the case, Wall Street will celebrate this with more risk taking, as it is what they have been trained to do since the Great Financial Crisis.

Ready to trade the NASDAQ 100? We’ve shortlisted the best Forex brokers for CFD trading in the industry for you.