Signals for the Lira Against the Dollar Today

- Risk 0.50%.

Best Buying Points:

- Open a buy order at 31.99.

- Set a stop loss at 31.85, that’s below the support level.

- Move the stop loss to the entry point and follow the profit with a price movement of 50 points.

- Close half the contracts at a profit of 70 points and leave the rest until the strong resistance levels at 32.25.

Best Selling Points:

- Place a sell order at 32.25.

- Set a stop loss is above 32.35.

- Move the stop loss to the entry point and follow the profit with a price movement of 50 points.

- Close half the contracts at a profit of 70 points and leave the rest until the support levels at 32.10.

Turkish lira Analysis: The dollar-lira pair stabilized during Thursday's trading near its all-time high of 32 liras per dollar. Investors followed the new measures of the Turkish Central Bank, which seeks to reduce liquidity within the Turkish banking system and stimulate changes in deposit interest rates.

The Central Bank of Turkey (CBRT) announced a series of new measures regarding reserve requirements. These measures, which are scheduled to take effect from March 15, 2024, to January 5, 2025, aim to reduce liquidity in the banking system and raise the deposit interest rate.

Meanwhile, one of the main changes introduced by the CBRT involves adjustments to the application of reserve requirements for banks. Banks will be required to hold increased Turkish lira reserve requirements with the central bank, in order to tighten the liquidity available to the Turkish lira in the banking system. Also, the expected decrease in funds available for lending or other activities due to liquidity tightening is projected to lead to higher deposit interest rates, affecting both short-term and long-term deposits.

In addition, the CBRT has started to pay interest on reserve requirements allocated to short-term Turkish lira deposits. Thus, this move is assumed to further contribute to higher short-term deposit interest rates, providing an additional incentive for banks to maintain higher reserves.

Furthermore, the CBRT's guidelines set specific requirements for banks based on their asset sizes. Banks with assets above certain thresholds will be required to hold a percentage of their reserve requirements to cover restricted account liabilities. For banks with assets over 500 billion Turkish liras, this ratio is 25%, while banks with assets over 100 billion Turkish liras will need a reserve of 15%.

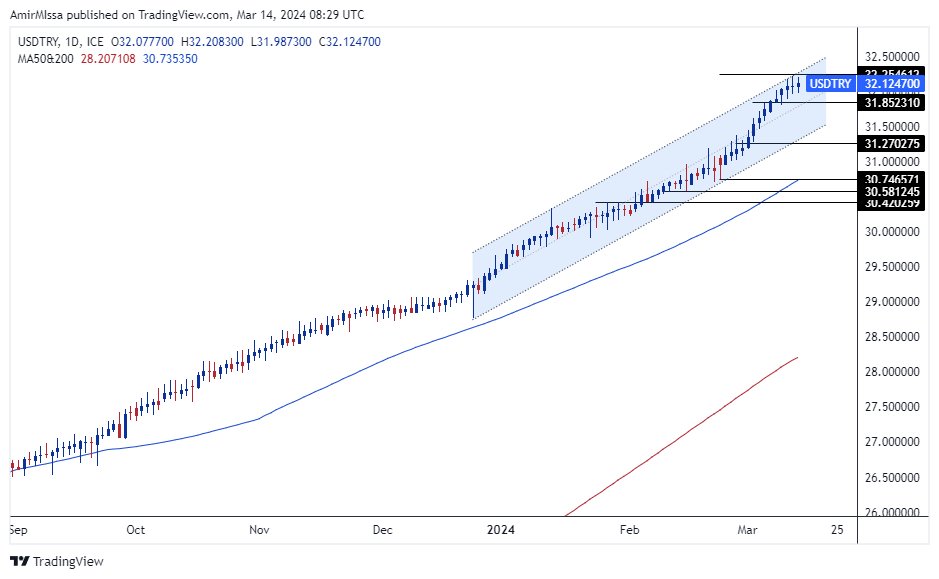

TRYUSD technical Analysis and Expectations Today:

TRYUSD pair stabilized in early trading this morning, with the pair trading near its all-time high of 32.11 liras per dollar. Currently, the price is trading at the upper end of the ascending price channel on the daily time frame, as shown in the chart for the third consecutive day. At the same time, the pair stabilized above the 50 and 200 moving averages, which are positively crossed upwards, on most time frames starting from four hours up to the weekly time frame. Clearly, there is an indication of the dominance of the general upward trend on the pair. If the pair rises, it will target levels of 32.25 and 32.50, respectively, while if the price falls, it will target levels of 32.00 and 31.90, respectively.

Ultimately, the Turkish lira price forecast is for the pair to continue rising, targeting levels of 32.35 and 32.50 liras, and each dip represents an opportunity to reinforce buying contracts. Furthermore, we recommend adhering to the mentioned recommendations and maintaining capital management rules.

Ready to trade our Forex daily analysis and predictions? Here are the best Turkish brokers to choose from.