Signals for the Lira Against the Dollar Today

- Risk 0.50%.

Best Buying Points:

- Open a buy order at 31.40.

- Set a stop loss at 31.25.

- Move the stop loss to the entry point and follow the profit with a price movement of 50 points.

- Close half the contracts at a profit of 70 points and leave the rest until the strong resistance levels at 31.75.

Best Selling Points:

- Place a sell order at 31.75.

- Set a stop loss at 31.85.

- Move the stop loss to the entry point and follow the profit with a price movement of 50 points.

- Close half the contracts at a profit of 70 points and leave the rest until the support levels at 31.50.

The dollar/lira pair rose in early trading on Monday morning. The pair hit a new record high after the Consumer Price Index data was released this morning. Investors followed the data released early this morning by the country's Statistical Institute (TUIK), which showed that inflation in February rose by 4.53% on a monthly basis, compared to analysts' expectations of 3.8%. Also, Inflation rose on an annual basis to 67.07%, compared to analysts' expectations of 66%.

At the same time, the core inflation rate (which excludes the most volatile items) rose to 72.89% in February, compared to 70.48% in February last year. Moreover, the restaurant and hotel services sector led the highest increase compared to February last year, after rising by 94.78%

Simultaneously, the Producer Price Index rose by 3.74% in February on a monthly basis, compared to 4.14% in January. Also, the index rose on an annual basis by 47.29%, compared to 44.20% in the same month last year.

It is worth mentioning that concerns have been renewed about inflation despite the tightening monetary policy pursued by the Turkish central bank, due to government decisions regarding tax amendments and raising the minimum wage. Recently, the Turkish central bank had kept the interest rate unchanged last month, not ruling out further increases in interest rates, which have already reached 45% in case inflation rates rise.

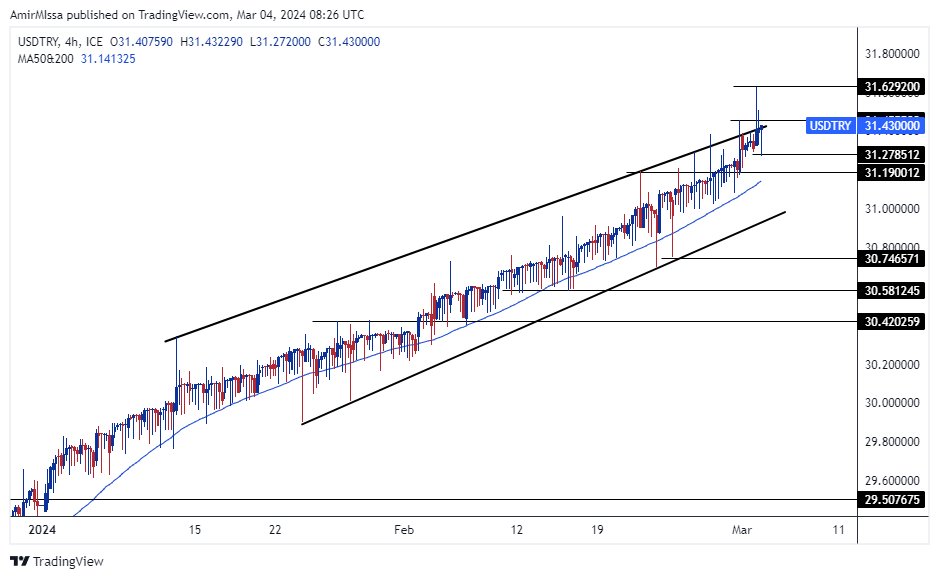

TRYUSD technical Analysis and Expectations Today:

TRYUSD pair rose in early trading this morning, breaking through the high recorded last week, and hit an all-time high of 31.62 lira per dollar. With the general upward trend dominating the pair, which is recording new highs consecutively. Currently, the price is trying to break through and close above the upper limit of the rising price channel on the four-hour time frame, as shown in the chart.

Also, the price is moving above the 50 and 200 moving averages, which are positively intersecting, on most time frames, starting from the four hours to the weekly time frame, indicating the dominance of buyers. Therefore, if the pair rises, it will target 31.75 and 31.95 levels respectively, while if the price falls, it will target 31.50 and 31.30 levels respectively.

Ultimately, the forecasts for the Turkish lira include the continuation of the pair's rise, targeting levels around 31.50 lira, where every decline represents an opportunity to strengthen buying contracts. Finally, we recommend adhering to the mentioned recommendations and maintaining capital management rules

Ready to trade our Forex daily forecast? We’ve shortlisted the top forex brokers in the industry for you.