- The euro has gone back and forth during the trading session on Thursday, as we continue to see a lot of lackluster trading.

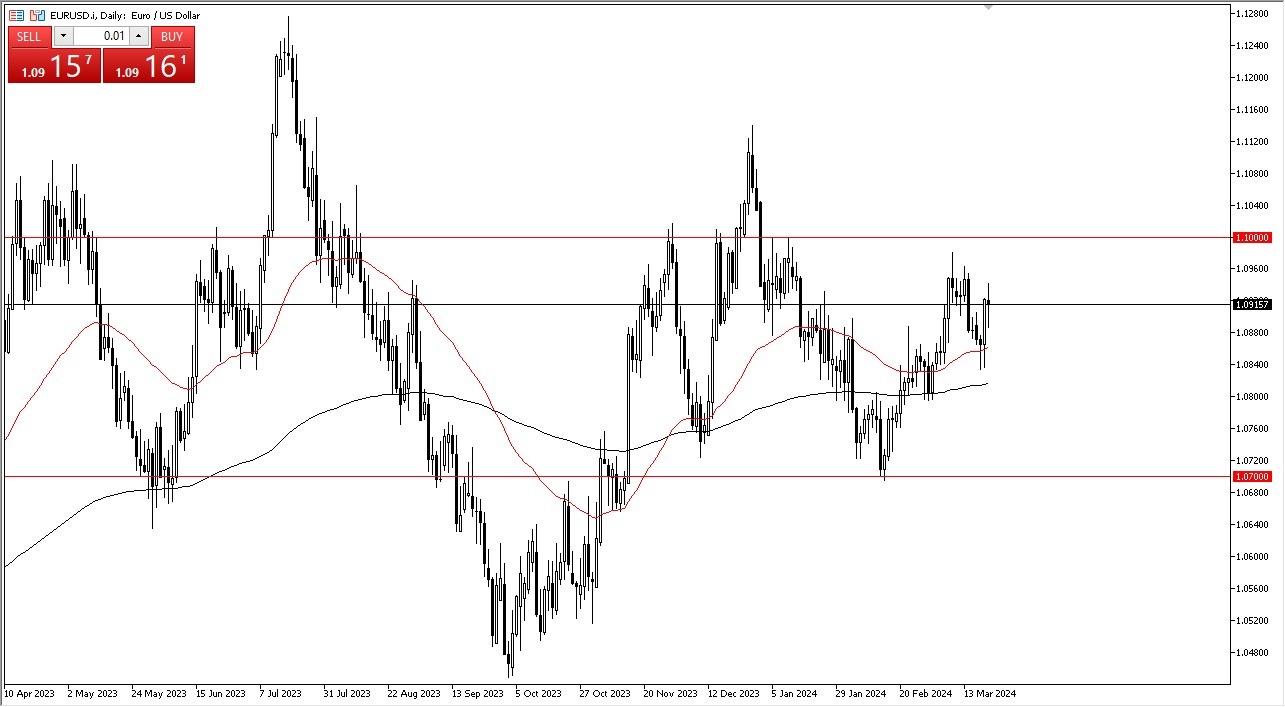

- We’re sitting right around the crucial 1.09 level, an area that a lot of people will be paying attention to, and an area that previously has seen a lot of action.

- Ultimately, this is a pair that continues to put people to sleep, and of course it makes quite a bit of sense if you understand the fundamentals under this markets hood.

Central Bank Malaise

Both central banks are likely to cut rates later this year, and as inflation drops in the United States, there has been a lot of attention paid to the US economy and the Federal Reserve in general. However, the European Central Bank also has to worry about the German economy, which is in a significant recession, so therefore it’s likely that you will continue to see a lot of liquidity measures being taken by the Europeans, which means looser monetary policy. In other words, both central banks are going to do what they can to liquefy the market, and while that’s good for asset pricing, there is no real clear winner here and therefore I think we more likely than not will stay in the same range bound area that we were in last year.

When I look at this chart, I have a couple of consolidation areas that I am paying attention to. The “inner consolidation region” would be between the 1.07 level on the bottom, and the 1.10 level on the top. Because of this, I think if you are a swing trader you have to wait until you test one of those areas, and perhaps fail to break out, giving you a nice barrier. We also have the “outer consolidation region”, which is at the 1.1250 level above, and the 1.05 level underneath. That would be an extreme part of the range, and I do believe that most of this year spends grinding time in that “inner consolidation region.” As we are somewhat close to the middle of that, there’s not a whole lot of reasons to get overly aggressive at this point in time and I do believe the chart is probably better used as a gauge for US dollar strength or weakness around the Forex world.

Ready to trade our daily Forex forecast? Here’s a list of some of the top forex brokers in Europe to check out.