- The euro drifted a little bit lower during the trading session on Wednesday as we waited for the Federal Reserve.

- The Federal Reserve won’t necessarily do anything to change interest rates, but most traders would be paying close attention to what they have to say via the press conference more than anything else.

- The statement of course will be parsed rather significantly, as traders look for clues as to when the Federal Reserve will start cutting rates.

Both Central Banks Likely to Be Dovish

At this point in time, both central banks are likely to be somewhat dovish, due to the fact that central banks around the world do tend to move in coordinated manners. Furthermore, you also have to keep in mind that the Federal Reserve is already came out and explicitly said that they were going to be cutting later this year. The European Central Bank has to deal with Germany going into a recession, which of course is a major deal. The German economy is the largest in the European Union by far, so as it goes, so does the ECB over the longer term.

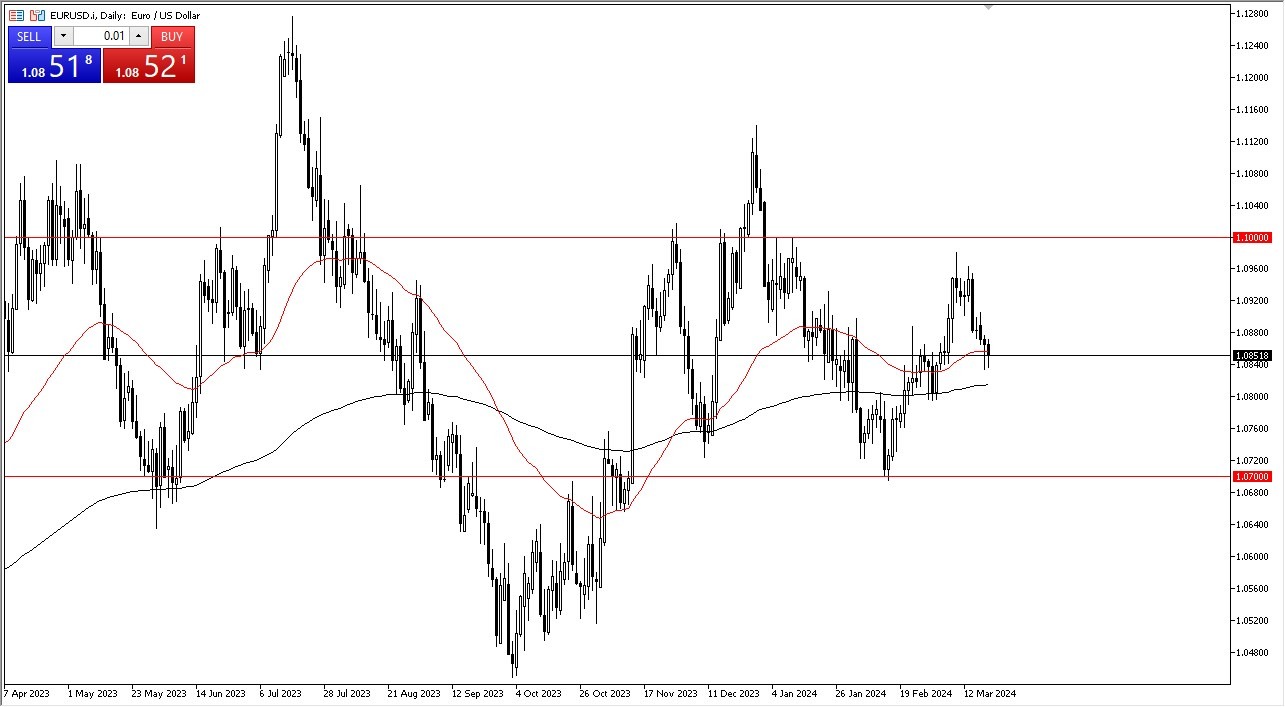

It’s worth noting that we are hanging around the 50-Day EMA, an indicator that a lot of people pay attention to. We are trading in a larger consolidation area with a 1.10 level above being a major resistance barrier, and the 1.07 level underneath the unit major support level. As we are basically in the dead center of this range, there isn’t a whole lot to do at the moment. A lot of this will come down to the reaction after the central bank noise from Washington DC. Quite frankly, what I’m looking for is the market to go to one of the extreme levels of the range and then show signs of failure.

If we were to break out of this range, that would obviously be a huge deal, but at this point in time I just don’t see how that happens easily. With this being the case, the market is likely to continue to be very noisy and choppy, so if you are a swing trader you were just simply killing time at the moment, much like I am. However, if you are a short-term trader, this might be a scenario where you employ some type of range bound short-term system.

Ready to trade our Forex daily analysis and predictions? Here are the best European brokers to choose from.