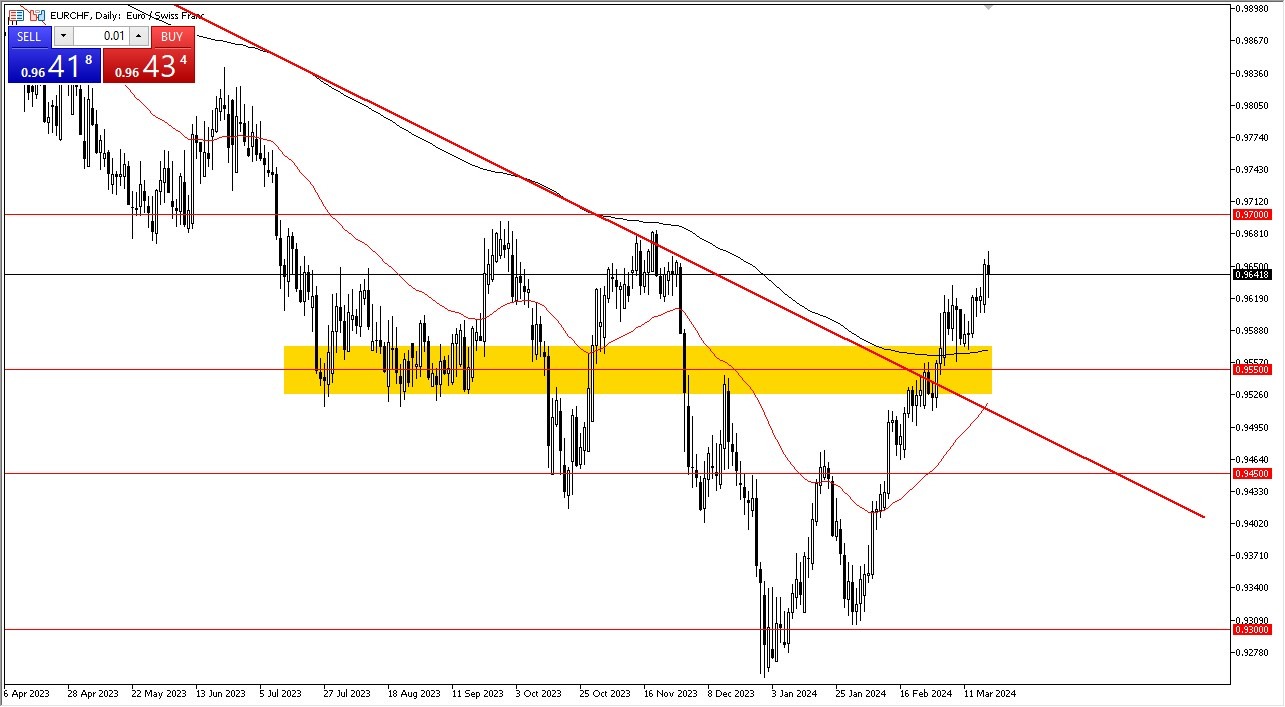

- The euro initially fell against the Swiss franc on Tuesday but has seen buyers near the 0.96 level to show signs of life.

- Ultimately, this is a market that I think is worth paying close attention to as we have the Swiss National Bank offering an interest rate decision in the next 48 hours, and of course this is one of the main measuring sticks for Swiss franc strength or weakness.

Has the tide turned?

When I look at this chart, and other CHF-related pairs, I recognize that the Swiss franc seems to be losing a lot of strength. The question now is whether or not the tide has turned for a longer-term move? I think you’ve got a situation where buyers will continue to look at this through the prism of whether or not the Swiss National Bank will end up being dovish later this year or perhaps even sooner rather than later. Out of all of the major central banks, it’s very likely that the Swiss will move first. This is especially true after the Bank of Japan has already stepped into the foray during the previous session, raising rates for the first time in 8 years. This will put more pressure on the Swiss franc as a funding currency, and I think that might be the main theme this year.

Top Regulated Brokers

Short-term dips will more likely than not be buying opportunities. The 200-Day EMA is an indicator that I’m paying close attention to, near the 0.9575 level. Ultimately, this is a market that I think given enough time probably has to be paid close attention to, as it could be a “sleeper market” for most retail traders. This is because they have been trained to think that the Swiss franc is not very volatile, and most of the time it isn’t. However, once it does finally move, and quite often ends up being quite drastic. Keep in mind that the Swiss will have no issues whatsoever in this pair rising because 85% of their exports end up in the EU, so that means that they would prefer a cheap currency in order to spur demand for their goods and services.

Ready to trade our daily Forex analysis? We’ve made this forex brokers list for you to check out.