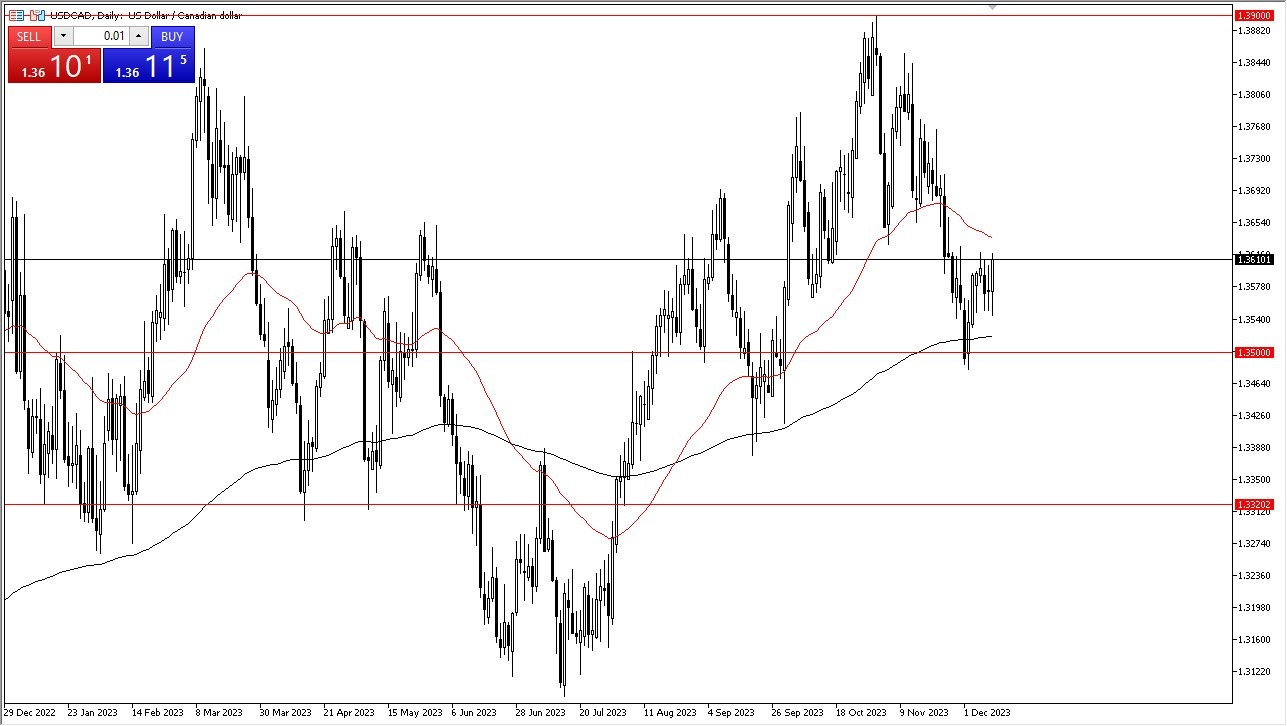

- The USD/CAD initially pulled back just a bit during the early hours on Tuesday but has turned around to show signs of life again.

- The Federal Reserve meets during the trading session on Wednesday, and therefore I think we will see a lot of noisy behavior.

- Ultimately, we could go even higher than we are currently, perhaps trying to break above the 1.36 level. A group like that would clear the 50-Day EMA, opening up the possibility of a bigger move to the 1.39 level.

Top Forex Brokers

Looking at the chart, the 200-Day EMA sits below, and does offer a significant amount of support right along with the 1.35 level. Because of this, I think you have a situation where the pair is just simply trying to break out in general, because the central bank in the United States appears to be tighter than the one in Canada, and of course the oil markets have been an absolute disaster. Having said that, the market is currently sitting between the 200-Day EMA and the 50-Day EMA indicators, typically an area where you would see a bit of a squeeze.

Assessing Opportunities in the USD/CAD Range

Volatility is likely to continue to be a major issue, but at the end of the day we are closer to the bottom of the overall range, and therefore I think it does make a certain amount of sense that the buyers come in to try to take advantage of “cheap greenbacks.” If we do break down from here, the 1.35 level would have to be overtaken to the downside in order for it to suddenly be negative, and therefore I think it’s very unlikely to happen. We could get a little bit of a pullback, but I think that pullback just brings in more value hunters. If we take out the 50-Day EMA, then it’s likely that we go much higher, perhaps even as high as the 1.39 level above.

A lot of this could come down to crude oil, but I think in the short term and has more or less to do with Jerome Powell and what he has to say during the press conference on Wednesday. Because of this, you can expect to see a lot of volatility, but ultimately it still looks like it’s easier to go higher from here.

Ready to trade our daily Forex analysis? We’ve made a list of the best forex brokers accepting Canadian clients to trade Forex worth using.