The difference between success and failure in Forex / CFD trading is highly likely to depend mostly upon which assets you choose to trade each week and in which direction, and not on the exact methods you might use to determine trade entries and exits.

So, when starting the week, it is a good idea to look at the big picture of what is developing in the market as a whole, and how such developments and affected by macro fundamentals, technical factors, and market sentiment. There are some valid long-term trends in the market right now, which might be exploited profitably. Read on to get my weekly analysis below.

Fundamental Analysis & Market Sentiment

I wrote in my previous piece on 15th January that the best trade opportunities for the week were likely to be long of Gold in USD terms and the EUR/USD currency pair, and short of the USD/JPY currency pair also. Gold in USD terms gained by 0.30%. The USD/JPY currency pair ended the week higher by 1.33%, and the EUR/USD currency pair ended the week higher by 0.21%. These trades gave a small average loss of 0.27%, so this was not a great call overall.

The news is currently dominated by a more risk-on tilt seen in the markets at the end of the week, with stocks moving a bit higher and the US Dollar almost unchanged over the week. The main event was the Bank of Japan’s policy release, which some analysts were looking to for a hawkish surprise, but in the end the Bank maintained its full course of policies. On Friday, the Bank of Japan governor Kuroda reaffirmed the Bank’s yield curve control measures and indicated a continuation of dovish monetary policies, sending the Yen lower.

The other major news of the week was UK inflation fell slightly as expected, but is still showing an annualized rate above 10%, so the market is seeing more rate hikes from the Bank of England, sending the Pound higher. Canadian inflation fell as expected.

Asian stock markets ended the week mostly higher, with the Hang Seng Index seeing its highest level in six months, the Nikkei 225 Index rising, and the S&P 500 showing signs that a bull cross will probably arrive within the next few weeks. Several commodities are also rising. The Forex market saw greatest strength in the New Zealand Dollar last week, with the Japanese Yen the weakest major currency.

Rates of coronavirus infection worldwide again dropped last week for the fifth consecutive week according to official data, with the lowest overall numbers seen since July 2020. However, there are credible reports suggesting millions of new infections after China’s “zero covid” measures were recently scrapped, and this week’s Chinese New Year holiday is likely to boost that. The most significant growth in new confirmed coronavirus cases overall right now is happening in China.

The Week Ahead: 22nd January – 27th January 2023

The coming week in the markets is likely to see a similar or higher level of volatility compared to the past week, as there are some major data releases scheduled including the Bank of Canada’s monthly policy report. The scheduled major releases, in order of importance, are:

- US Core PCE Price Index

- US Advance GDP

- Australia CPI

- New Zealand CPI

- Bank of Canada Overnight Rate, Rate Statement, and Policy Report

- US Flash Services PMI

- British Flash Services and Manufacturing PMI

It is a public holiday in China all week due to the Chinese New Year. It is also a public holiday in Australia on Wednesday.

Technical Analysis

U.S. Dollar Index

The weekly price chart below shows the U.S. Dollar Index printed a small doji candlestick, which typically signifies directional indecision. The low of the week rejected the support level shown at 101.07, which is a negative sign for bears.

We see the Dollar within a long-term bearish trend, with the price continuing to trade well below its levels of both 3 and 6 months ago.

I do not like to trade against long-term trends, so I will still look to only be in trades which are short of the greenback this week. However, there are signs that the bearish trend is now going to pause or make a deeper bullish retracement, so traders should be cautious and watch out for this.

Advertisement

XAU/USD (Gold)

Last week Gold printed a small bullish near-doji candlestick which made the highest weekly close seen since April this year. The price also reached a new long-term high and closed above the high of last week - these are bullish signs.

There are no overhead resistance levels nearby, so the price can probably advance quite easily to the big round number at $2,000.

Despite the near-doji candlestick, which can signify indecision in the market, the technical picture still looks bullish.

The price of Gold is likely to continue to rise this week.

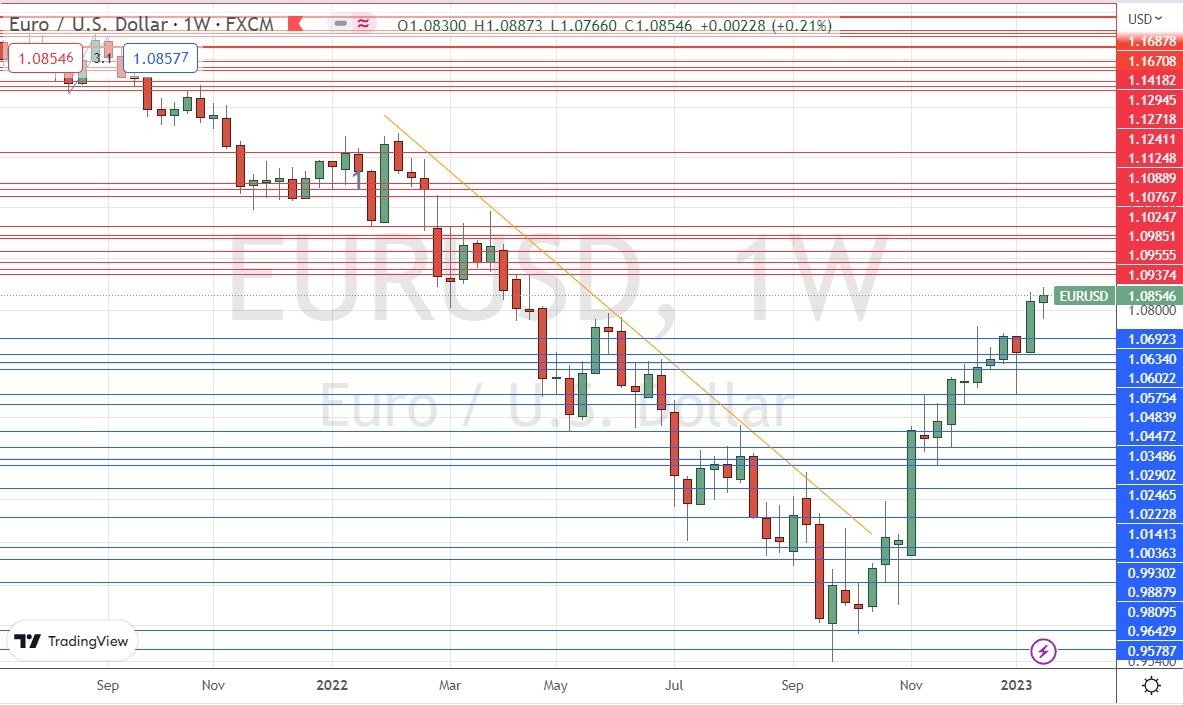

EUR/USD

Last week saw the EUR/USD currency pair print a small bullish near-doji candlestick which made the highest weekly close in ten months. The price also reached a new long-term high - these are bullish signs, but it must be said the bullishness is looking a bit weak

There are no overhead resistance levels nearby, so the price can probably advance quite easily to $1.0937 at least.

Despite the near-doji candlestick, which can signify indecision in the market, the technical picture still looks bullish.

The price of this currency pair is likely to continue to rise this week, in line with its long-term trend. Long-term trends are statistically notably reliable in this currency pair.

GBP/USD

Last week saw the GBP/USD currency pair print a sizable bullish candlestick which made the highest weekly close in more than seven months. The price closed near the top of the week’s range, which is another bullish sign, suggesting healthy momentum in the British Pound.

The advance by the Pound was boosted by relatively high UK inflation data, currently sitting at an annualized rate of 10.5%, which is making the market think that the Bank of England will be very likely to make further rate hikes soon.

The price of this currency pair is somewhat likely to continue to rise this week, in line with its long-term trend. However, bulls should watch out for the yearly high at $1.2437, which is likely to act as strong resistance, at least when first next touched.

BTC/USD

The last two weeks have seen Bitcoin rise strongly, with above-average range and closes very close to the top of the ranges. The price reached its highest level since August after many weeks consolidating above $16k.

This is a technically significant development and suggests the beginning of a new bullish long-term trend, which has tended to be statistically quite dependable in Bitcoin.

The main thing bulls need to watch out for is the key resistance levels currently sitting between $25,400 and $23,162 – it will not surprise me if this area halts the advance, at least temporarily.

Bottom Line

I see the best opportunity in the financial markets this week as likely to be long of Gold in USD terms and the EUR/USD currency pair.

Ready to trade our weekly Forex analysis? We’ve made a list of the best brokers to trade Forex worth using.