Today's recommendation on the TRY/USD

The risk is 0.50%.

Best buying entry points

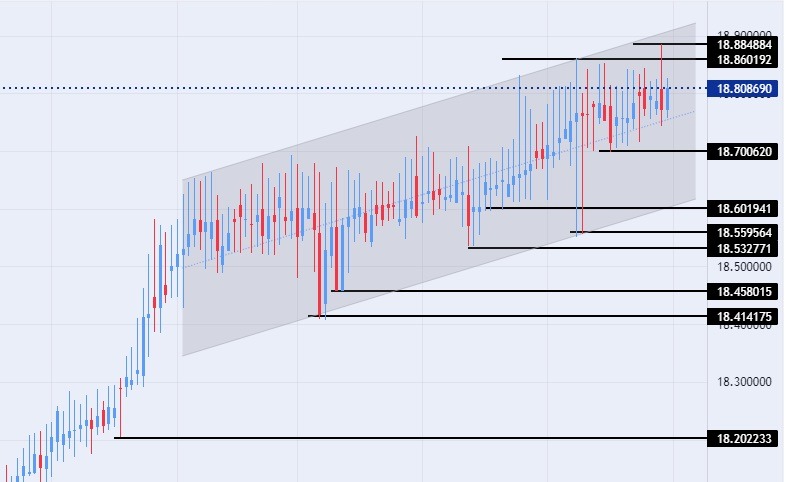

- Entering a buy order pending order from the 18.70 level.

- Place a stop loss point to close below the support level at 18.45.

- Move the stop loss to the entry area and follow the profit when the price moves by 50 pips.

- Close half of the contracts with a profit equal to 70 pips and leave the rest of the contracts until the strong resistance level at 19.00.

Best-selling entry points

- Entering a sell order pending order from the 19.00 level.

- The best points to place a stop loss close to the highest level of 19.15.

- Move the stop loss to the entry area and follow the profit when the price moves by 50 pips.

- Close half of the contracts with a profit equal to 70 pips and leave the rest of the contracts until the support level at 18.75.

The TRY/USD stabilized during early trading today, Tuesday, a day after the lira recorded new levels of decline during yesterday's trading, as the lira reached its lowest level ever against the dollar. Investors followed the statements issued by an alliance opposing the Turkish president called the Six Group, consisting of a group of opposition party leaders, as they pledged to restore freedom to the country's central bank, which is effectively controlled by the Turkish president.

The Turkish president sacked a number of governors of the Turkish Central Bank in 2018, in an indirect intervention in the direction of the bank's monetary policy. Most of the dismissals were after decisions to raise the interest rate in the country, which contradicts Erdogan's economic policy.

The Turkish president believes that the interest rate is the mother of all evils, and the Turkish president has exerted many pressures on the Turkish Central Bank over the past two years with the aim of reducing the interest rate to the single digits, which was already done during the meeting of last November, when the interest rate was reduced to 9 levels. %.

USD/TRY Technical Analysis

On the technical front, the dollar pair traded stable against the Turkish lira, after the pair rebounded from its all-time highs, which were recorded during early trading this morning. The pair hit the 18.88 level, before retreating to the trading range in which the pair had settled for several months.

The USD/TRY continued trading within the bullish channel levels in today's time frame, which reflects the upward movement of the pair, albeit at a slow pace. The USD/TRY is also trading above the moving averages 50, 100, and 200 on the daily time frame as well as on the four-hour time frame, in a sign of the general bullish trend for the pair. Currently, the USD/TRY is trading above the support levels of 18.70, 18.60, and 18.53, respectively.

On the other hand, the pair is trading below the resistance levels at 18.83 and 18.88, which represents the highest price for the pair ever. It is also trading below the psychological resistance levels at 19.00. Any drop in the pair represents an opportunity to buy back again. Please adhere to the numbers in the recommendation, while maintaining capital management.

Ready to trade our Forex daily forecast? We’ve shortlisted the best Forex brokers in the industry for you.