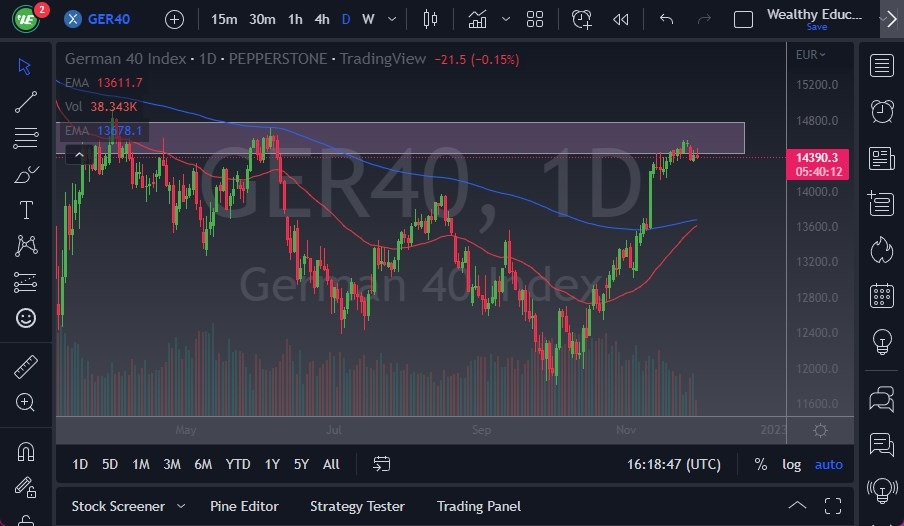

- The DAX has initially rallied during the trading session on Wednesday but gave may gain as we filled the gap from the open on Monday.

- At this point, the market looks as if it is running into a significant barrier, and if we continue to hold that, then it’s likely that we would see a lot of downward pressure.

- Furthermore, you need to keep in mind that there are a lot of questions right now when it comes to the European economy, which of course the DAX is highly sensitive to as Germany is such an export-driven economy.

The 50-Day EMA is currently rallying toward the 200-Day EMA, suggesting that we may get the “golden cross” which is when that happens. That is typically a bullish sign longer-term, but ultimately, I think we got a lot of questions as to whether or not we have the ability to continue going higher. The text of course also has to worry about the local economy not having enough energy, while ConocoPhillips is coming to the rescue, it’s not can it be until 2026, at the earliest?

Volatility is Going to be an Issue

I do think that the €14,800 level above is going to offer a significant amount of resistance, if we can break above there that would be an extraordinarily bullish sign for the DAX. On the other hand, if we turn around and break down below the €14,200 level, it could open up further downward pressure. The market will continue to be noisy, but I think at the very least we need to work off some of the excess froth. You can also make an argument for a little bit of a rising wedge but is probably early to call that.

Ultimately, this is a situation where volatility is going to be a major issue, and therefore I think you got a scenario where you need to be cautious with your position size, but we are getting rather close to a bigger move based upon the level we are at, and the choppy behavior that we have seen. The noisy behavior will only last for so long, and now we have to see whether or not people are actually willing to throw more money into this market, which obviously would be a very “risk-on move.” As things stand, we got a scenario where we are testing major resistance.

Ready to trade our DAX analysis? Here are the best CFD brokers to choose from.