The difference between success and failure in Forex / CFD trading is highly likely to depend mostly upon which assets you choose to trade each week and in which direction, and not on the exact methods you might use to determine trade entries and exits.

So, when starting the week, it is a good idea to look at the big picture of what is developing in the market as a whole, and how such developments and affected by macro fundamentals, technical factors, and market sentiment. There are some strong short-term trends in the market right now, which might be exploited profitably. Read on to get my weekly analysis below.

Fundamental Analysis & Market Sentiment

I wrote in my previous piece on 13th November that the best trades for the week were likely to be making short-term trades short of USD/JPY targeting ¥137.04 and long of XAU/USD targeting $1809. These were not good calls as neither target was reached and both assets ended the week having moved in the opposite direction.

The news is currently dominated by FOMC member Bostic calling for a slowing of the Fed’s current pace of rate hikes, down from the recent series of 0.75% rate hikes. Bostic sees only about a further 0.75% to 1.00% of hiking left in the current cycle. The increasing feeling that inflation has peaked is leading the market to expect something of a more dovish tilt from the Fed going forward. This feeling has persisted despite British inflation rising again to a new 41-year record high, while Canadian inflation also remains quite elevated despite it also showing signs of topping out.

Markets began the week with improving risk sentiment, with the US Dollar continuing to sell off and stock markets rising weakly. However, this changed towards the end of last week. There are still some episodes of residual strength from the greenback. The 2-year US treasury yield rose strongly on Thursday and Friday.

In other major news from the USA, the Republican party has taken a narrow control of the US House of Representatives. This will make things harder for President Biden, but the Republicans will have to be mindful of their very small majority. House Republicans have stated their top priority will be to investigate the President and his son Hunter, who is already facing a legal investigation.

The other important market news last week was the lower-than-expected PPI data in the USA, which came in with a 0.2% month on month increase, below the 0.4% which had been expected. This adds weight to the theory that US inflation has finally begun to make a meaningful decline. The US also saw strong retail sales data which outperformed expectations.

The Forex market saw greatest strength in the New Zealand last week. The weakest currency was the Swiss Franc.

Rates of coronavirus infection remained stable at a historically low-level last week, continuing a trend of decline which began 4 months ago. Raw numbers have not been this low since the end of the first wave in the summer of 2021. The only significant growths in new confirmed coronavirus cases overall right now are happening in China, Japan, the Solomon Islands, and Tuvalu.

The Week Ahead: 21st November – 25h November 2022

The coming week in the markets is likely to see a low level of volatility, as although there are a few major data releases scheduled, none of them are likely to have a strong impact. We also have already seen volatility decline strongly last week. The scheduled releases are:

- FOMC Meeting Minutes

- RBNZ Official Cash Rate and Monetary Policy Statement

- US Flash Services PMI data

- UK, German, and French Flash Services & Manufacturing PMI data

It will be a public holiday in the USA on Thursday and in Japan on Wednesday.

Technical Analysis

U.S. Dollar Index

The weekly price chart below shows the U.S. Dollar Index printed a small bullish hammer candlestick which rejected the support level shown in the price chart below at 104.92. This could be seen to be a bullish sign, but the weekly candlestick had a relatively small range which decreases its impact as a bullish indication.

The long-term bullish trend in the US Dollar is in serious trouble and may well be over as we have finally seen inflation numbers which are declining meaningfully, suggesting that the Fed will not be under as much pressure to make further strong rate hikes – this is supported by Bostic’s recent comments. This is logically going to bring a lower value for the US Dollar, but higher values for stocks, commodities, and other risky assets.

It is very hard to predict short-term direction in the US Dollar now, so it may be wise to stand aside from the Forex market this week, or to carefully look for short-term trades which do not involve the US Dollar.

GBP/USD

Last week saw the GBP/USD currency pair print a weakly bullish candlestick which closed with a significantly large upper wick.

The strongly bullish long-term trend in the US Dollar is now likely over, and the Pound showed some short-term strength, although this evaporated towards the end of last week.

Despite the overall rise in price over the past week, sentiment will have to turn sour on the greenback again before we can see a further rise. This may happen as markets open Monday following FOMC member Bostic’s comments hoping for no more than another 1% of rate hikes remaining within the current tightening cycle.

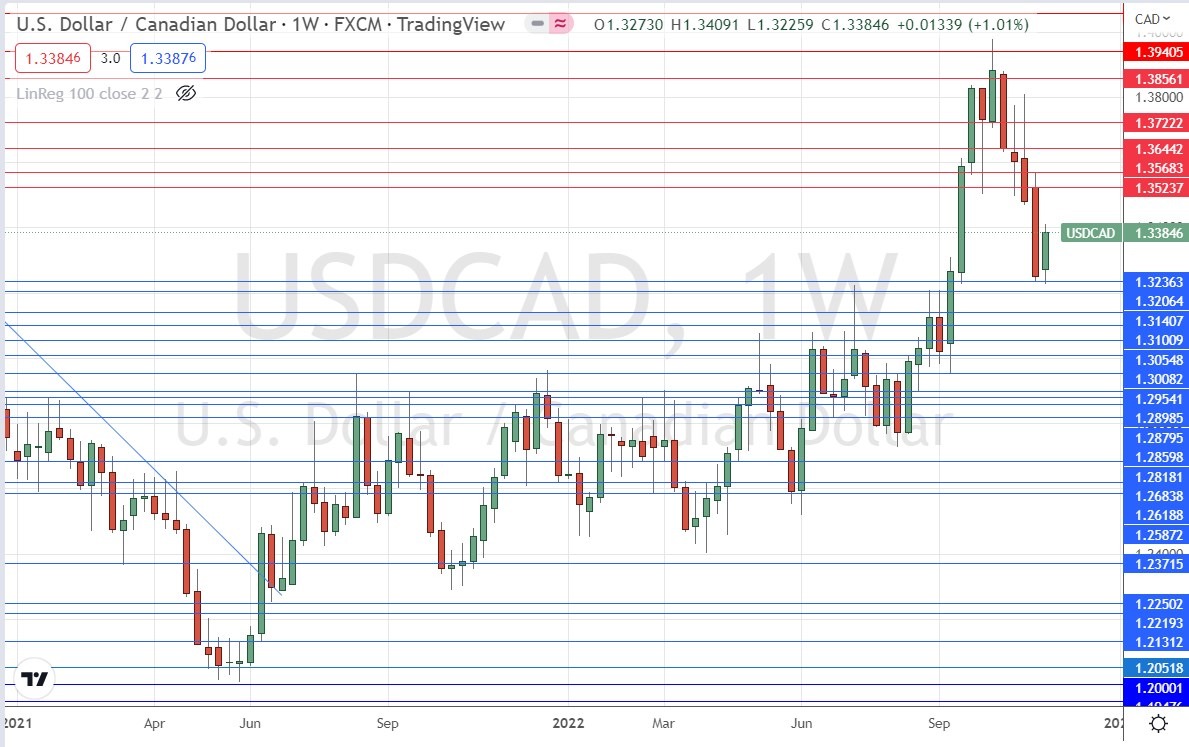

USD/CAD

Last week the USD/CAD price printed a reasonably large bullish candlestick which closed near the top of its weekly range. The weekly candlestick was close to being an inside candlestick, but it broke the previous week’s low by a few pips.

This currency pair stands out as one which saw the US Dollar make a clear advance, so we are seeing some relative weakness in the Loonie, which may be boosted by weakness in the price of WTI Crude Oil which tends to lead the Canadian Dollar as Canada is such a major crude oil producer.

There are no clear resistance levels until $1.3524 so the price can have a lot more room to rise.

Bottom Line

I see the best opportunities in the financial markets this week as very unclear, with the best opportunities likely to be short-term trades either long of USD/CAD if sentiment on the US Dollar is bullish, or long of GBP/USD if sentiment on the US Dollar turns bearish again.

Ready to trade our weekly Forex analysis? We’ve made a list of the best brokers to trade Forex worth using.