Today's recommendation on the TRY/USD

Risk 0.50%.

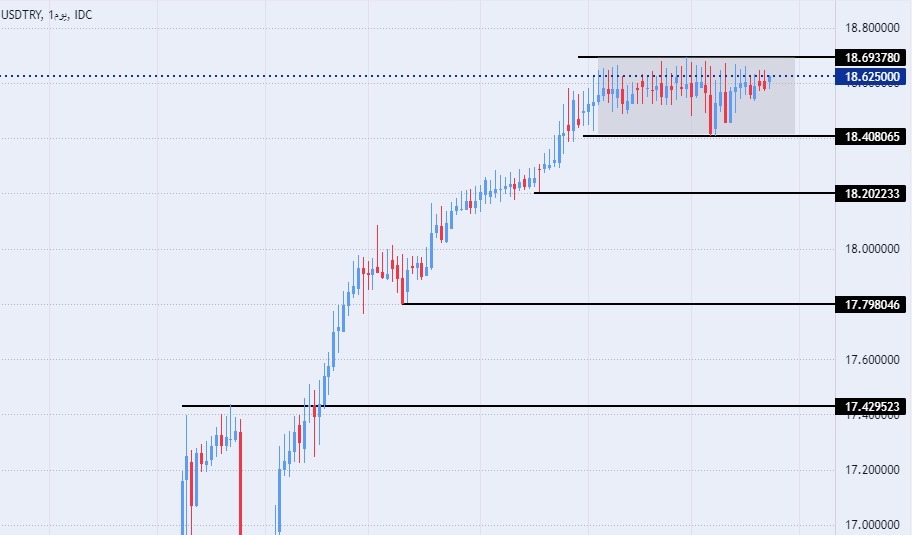

Best buying entry points

- Entering a long position with a pending order from levels of 18.50

- Set a stop-loss point to close below the 18.25 support levels.

- Move the stop loss to the entry area and continue to profit as the price moves by 50 pips.

- Close half of the contracts with a profit of 70 pips and leave the rest of the contracts until the strong resistance levels at 18.99.

Best-selling entry points

- Enable a short position with a pending order from levels of 18.99

- The best points for setting stop-loss are closing the highest levels of 19.15.

- Move the stop loss to the entry area and continue to profit as the price moves by 50 pips.

- Close half of the contracts with a profit equal to 70 pips and leave the rest of the contracts until the 18.55 support levels.

The Turkish currency maintained a limited range against the US dollar during trading today, Wednesday. Investors are awaiting the interest decision from the Turkish Central Bank tomorrow, although it is not expected that the possible cut in the country’s interest rate will significantly affect the interest rate amid the Turkish Central Bank’s control of the lira exchange rate. This directly supports the lira by pumping foreign currencies into the markets, especially After reports showing that Saudi Arabia deposited about $ 5 billion with the Central Bank of Turkey.

In this regard, it was reported that discussions had entered the "final" stage to provide support by depositing the amount with the Central Bank. Turkish and Saudi relations improved after years of political conflict. It is noteworthy that the Turkish president has changed his country's foreign policies in the context of his efforts to obtain support from the Gulf countries to support the Turkish economy, which has been exhausted for several years. Turkish President Recep Tayyip Erdogan has previously said that the foreign exchange reserves of his country's central bank will reach about 130 billion dollars soon.

TRY/USD Technical Analysis

On the technical front, there is no change, the Turkish lira’s trading has stabilized against the dollar, as it recorded slight changes within a narrow range that has continued for nearly two months. These averages on the four-hour time frame as well as on the 50-minute time frame indicate the divergence that the pair is recording over the medium term. The pair traded within the rectangle range shown in the four-hour time frame, which is shown on the attached chart.

The pair maintained its highest levels of support, which are concentrated at levels of 18.40 and 18.20, respectively. On the other hand, the lira is trading below the resistance levels of 18.70 as well as the psychological resistance at 19.00. Any drop in the pair represents an opportunity to buy back again. Please adhere to the numbers in the recommendation with the need to maintain capital management.

Ready to trade our free Forex signals? We’ve shortlisted the best Forex trading brokers in the industry for you.