Spot natural gas prices stabilized at an increase in recent trading at intraday levels, to record daily losses until the moment of writing this report, by -1.62%. They settled at the price of $8.709 per million British thermal units, after rising slightly for the fourth day during trading on Friday, by 0.72%. Last week, natural gas rose by 9.39%.

Natural gas futures fell throughout the Friday session, despite the slight change in daily prices. September gas futures contracts in Nymex settled at $8.768 per million British thermal units, down 10.6 cents from Thursday's close. The October contract fell 11.9 cents to $8,744.

There's no doubt it's been an interesting week in the gas market, as futures have risen for most of this week in the face of cold weather. Early on Friday, the outlook for continued cold seemed to be in the cards. The Nymex contract for September touched a low of $8,516 before the opening but rose after That comes to $8,919.

Meanwhile, weak Chinese economic data raised concerns about demand in the world's largest energy importer, as government data showed that China's economy slowed unexpectedly in July, while refinery production fell to 12.53 million barrels per day, the lowest level since March 2020.

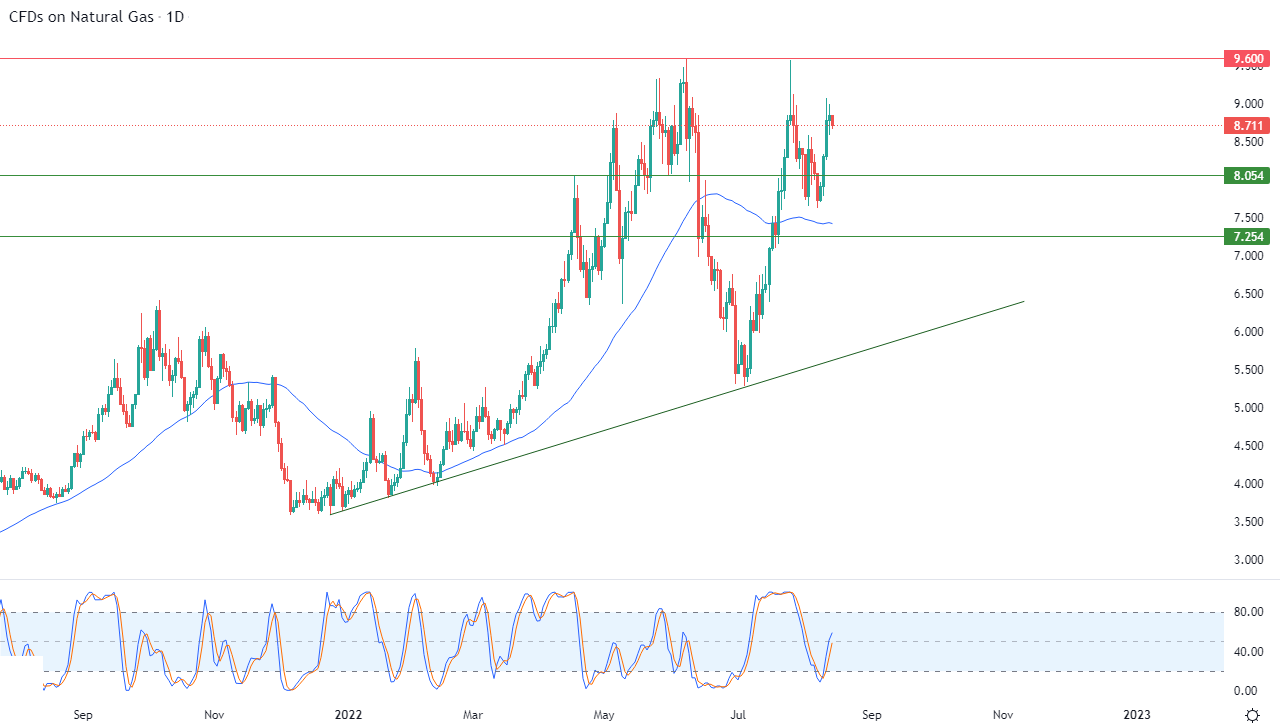

Technical Analysis

Technically, natural gas is trying to reap the profits of its recent rises and gain some positive momentum that may help it recover and resume the rise, amid the dominance of the main bullish trend in the medium and short term along a slope line, as shown in the attached chart for a (daily) period of time, with continued pressure. It is trading above its simple moving average for the previous 50 days, and we also notice in the midst of that the influx of positive signals on the relative strength indicators, after reaching oversold areas.

Therefore, our expectations suggest that natural gas will rise during its upcoming trading, as long as the support 8.054 remains intact, to target the pivotal resistance level 9.600.

Ready to trade FX Natural Gas? Here are the best commodity trading platforms to choose from.

Ready to trade FX Natural Gas? Here are the best commodity trading platforms to choose from.