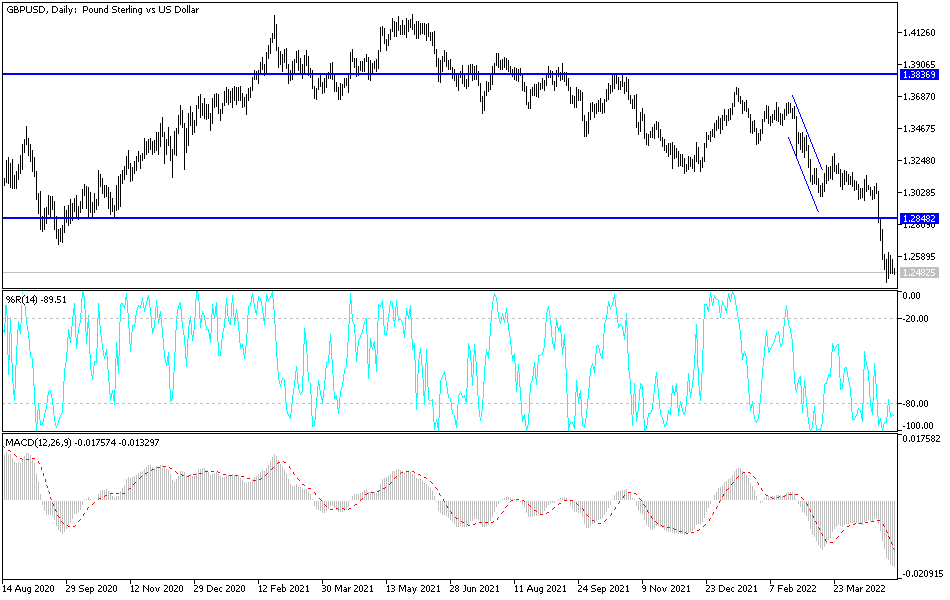

So far, the attempts of the GBP/USD currency pair have not succeeded in recovering from its recent sharp losses, which brought it to the support level 1.2411. Attempts to recover did not exceed the 1.2615 level, and the currency pair settles around the 1.2470 level at the time of writing the analysis. GBP/USD awaits important and influential events today. The first of which is the decisions of the US Federal Reserve, and tomorrow the policy decisions of the Bank of England, the tone of the announcements of these banks, will be the main driver for the sterling-dollar pair in the coming days.

Amid cautious stability and anticipation of stimulus, the Federal Reserve (Fed) may need to postpone the expected start of the process of reducing the balance sheet known as quantitative tightening in order to avoid further losses and restore its balance in a more sustainable way.

While other factors such as risk appetite in the global market have been at play, the recent losses in the pound sterling reflect the emerging gap between the Federal Reserve and the Bank of England (BoE) as in everything else, while also true of other currencies. Monetary policy, its impact on US bond yields and the comparative advantage it gives, the dollar will come back into focus this week when the Federal Reserve announces its latest policy decision on Wednesday and before Thursday's equivalent from the Bank of England.

The Fed is widely expected to raise the US interest rate by 50 basis points, with the Fed raising the range to between 0.75% and 1%, after Governor Jerome Powell confirmed that this would be on the table at the May meeting. The bank is also seen as likely to announce its plan for a balance sheet cut known as quantitative tightening (QT) and it's around that part where market expectations may be in danger of collapsing on Wednesday.

For his part, US Central Bank President Jerome Powell said of the QT announcement at the press conference last month: "We will take into account the broader financial and economic contexts when making the decision on timing, and we will use our tools to support financial and macroeconomic stability." "We always want to use our tools to support macroeconomic and financial stability and we want to avoid adding uncertainty to an already very uncertain situation," he added.

This was noteworthy in the context of recent dollar strength and losses in other currencies, which are an inflationary headache that risks causing the European Central Bank (ECB) and Bank of England (BoE) to raise interest rates sooner or faster than they otherwise would. Commenting on this, Stephen Gallo, FX analyst at BMO Capital Markets, says, “Judging by recent remarks from Philip Lane and President Lagarde, a weak euro is a concern for the ECB.”

It is also possible that a stronger dollar and US bond yields have prompted the People's Bank of China (PBoC) to hesitate to provide stimulus in China as coronavirus containment measures accelerate the earlier slowdown and heighten market concerns about the global economic outlook.

According to the technical analysis of the pair: The general trend of the GBP/USD currency pair is still bearish. The recent losses have moved some technical indicators towards oversold levels. The continuation of the weakness factors mentioned above may push forex traders to push the pair to deeper descending levels, and the closest to it is currently 1.2420 and 1.2300 respectively. As mentioned before, the tone of the central banks this week will remain the main driver of the currency pair in the coming period. According to the performance on the daily chart, the currency pair needs to break the psychological top 1.3000 in order to make a shift in the current general bearish trend.