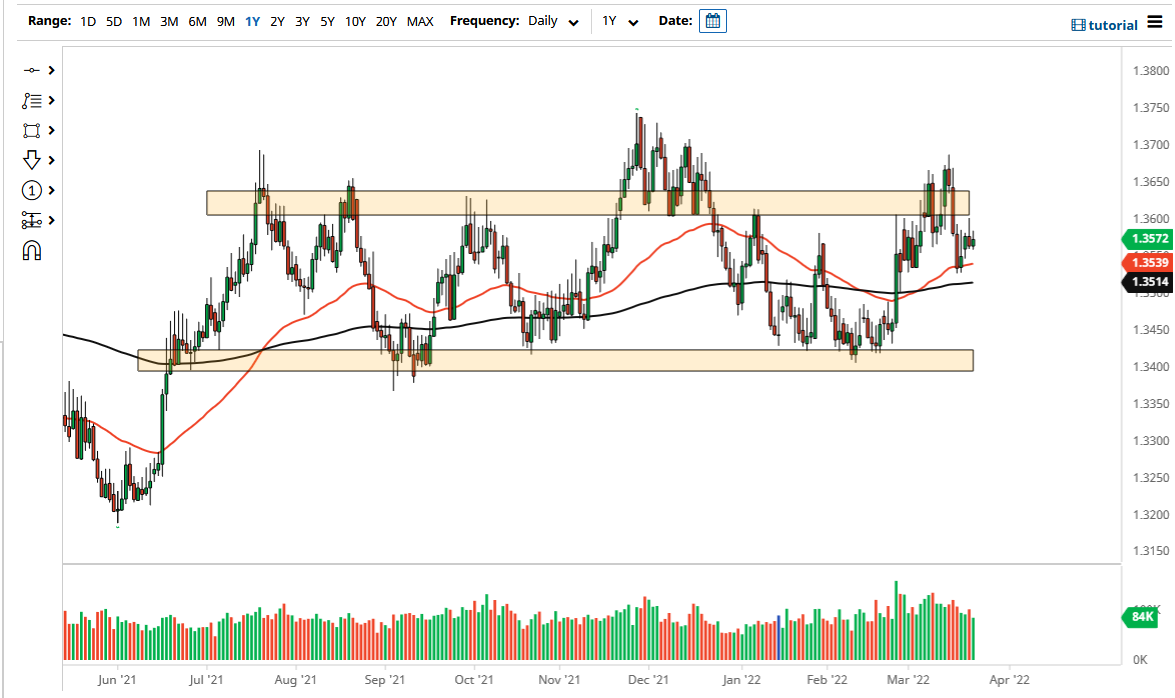

The US dollar went back and forth with a slightly positive tilt on Wednesday against the Singapore dollar. That being said, the market still sees quite a bit of resistance just above, especially near the 1.3650 region. This is an area that has been quite difficult to overcome, so it is not a huge surprise to see that we cannot break above there during the day. However, if we were to go higher and break above the 1.37 handle, then it would open up more of a “buy-and-hold” type of scenario.

This is a pair that does not move very quickly most of the time, so you almost by definition have to pay attention to the longer-term trend and trade accordingly. It looks as if we are trying to form a bit of a cup and handle pattern, although it is not necessarily the cleanest example of one. Ultimately, the US dollar has been strengthening against most currencies for the long run, but we have seen quite a bit of volatility across the Forex world.

On the downside, if we were to break down below the 50-day EMA, we could go looking towards the 200-day EMA, perhaps even down to lower levels such as the 1.34 level, which is the bottom of the overall consolidation range. Keep in mind that both of these are considered to be somewhat “safe currencies”, so we need to keep in mind that will determine how this market moves. In other words, it is very quiet because the Singapore dollar is essentially the “Swiss franc of Asia.”

Looking at the last couple of days, you can see just how choppy this has been, but it is worth noting that the longer-term attitude has been overall bullish. There were a couple of very negative days recently, but we have started to stabilize and look like we are getting ready to go on the upswing. The US dollar continues to be bullish longer-term, but it had gotten a bit overdone. Whether or not it continues to go higher is a completely different question in the short term, but it does look like we have formed a bit of a longer-term basing pattern. It takes an incredible amount of patience to trade this market.