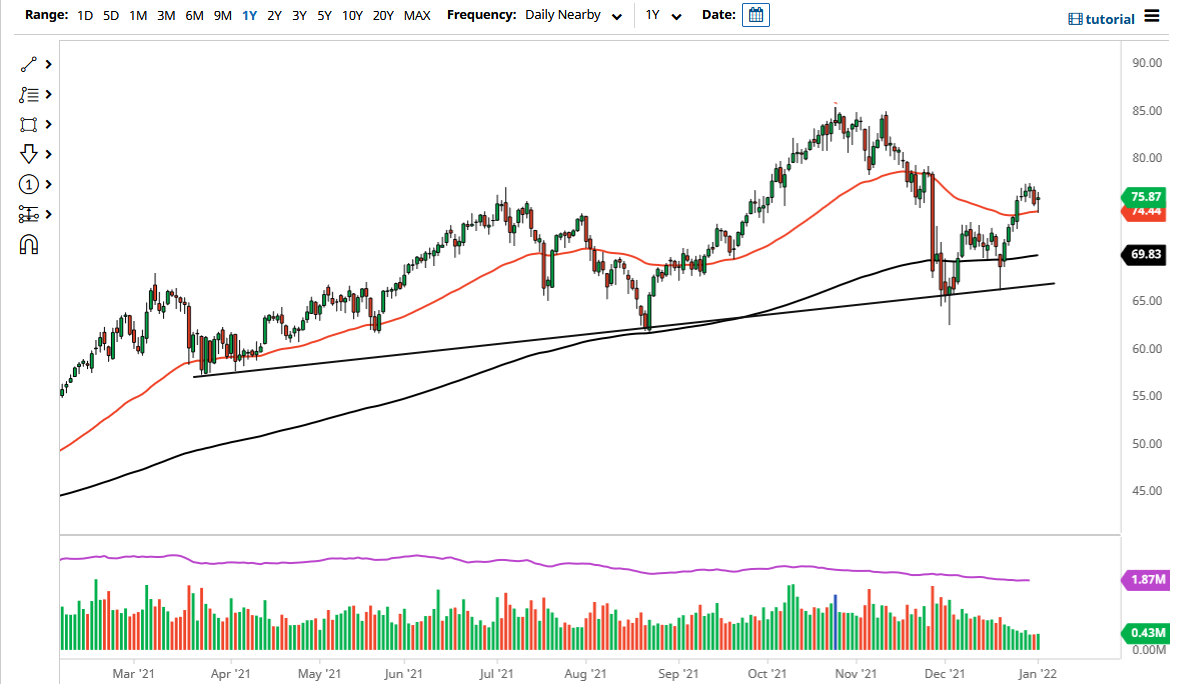

The West Texas Intermediate Crude Oil market initially plunged on Monday but found buyers at the 50-day EMA. By turning around the way we have, we ended up forming a bit of a hammer right on an important technical indicator. This is a good-looking candlestick at the right spot, so it is very possible that we will see a bit of a continuation.

I do believe that given enough time, the market could very well try to get to the $80 level based upon the momentum that we have been building. You could make a little bit of an argument for a bullish flag at the moment as well, so that is something else to keep your eye on. While I do not necessarily know that we will follow the perfect path of a bullish flag, it does give the impression that perhaps we could go as high as $86, which coincides quite nicely with the recent highs.

The US dollar will have its say, although both the greenback and oil can rise at the same time, depending on what is going on around the world. That being said, as a general rule, wherever the dollar goes, commodities go in the opposite direction. In this particular scenario, there is a question as to whether or not the reopening trade will continue to strengthen, because if it does, that it is obviously very bullish for crude oil. Crude oil is a great way to play inflation and economic growth in general, and right now it looks like we still have the idea that there is going to be plenty of growth. However, this is not necessarily the same in every part of the world, so you should keep that in the back of your head.

Currently, it looks like the United States is going to continue to try to drag the rest of the world out of the slowdown, but it should also be noted that at the same time, US oil producers are starting to pick up production a bit so that could come into play, albeit down the road. Currently, it looks like we are going to make a move towards those highs again, but it does not necessarily have to be an easy thing to happen. If we were to break down below the bottom of the candlestick for the trading session on Monday, then we could drop towards the $73 level to try to find support again, an area that was significant resistance.