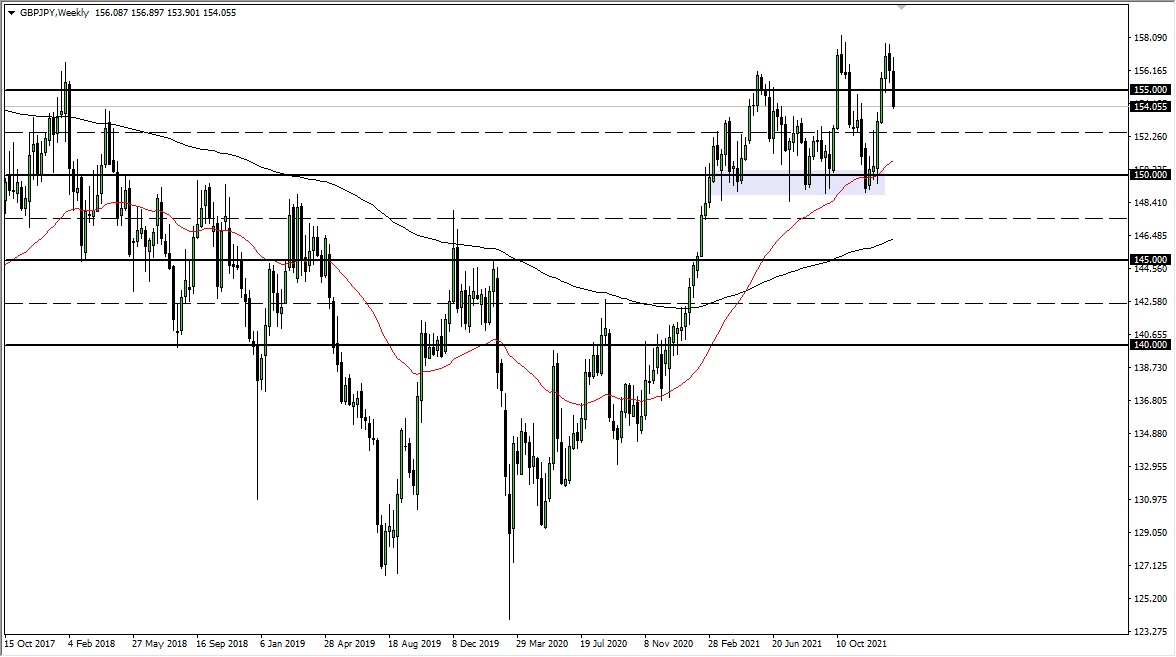

GBP/JPY

The British pound cratered against the Japanese yen to reach down towards the ¥154 level at the end of the week. That being said, the market is more than likely going to continue to show signs of negativity, as we have closed towards the bottom of the range, and we have seen a lot of negativity in other markets as well. Keep in mind that the pair is highly sensitive to risk appetite, so as long as we continue to see a lot of negative behavior out there, this pair will fall towards the ¥152.50 level.

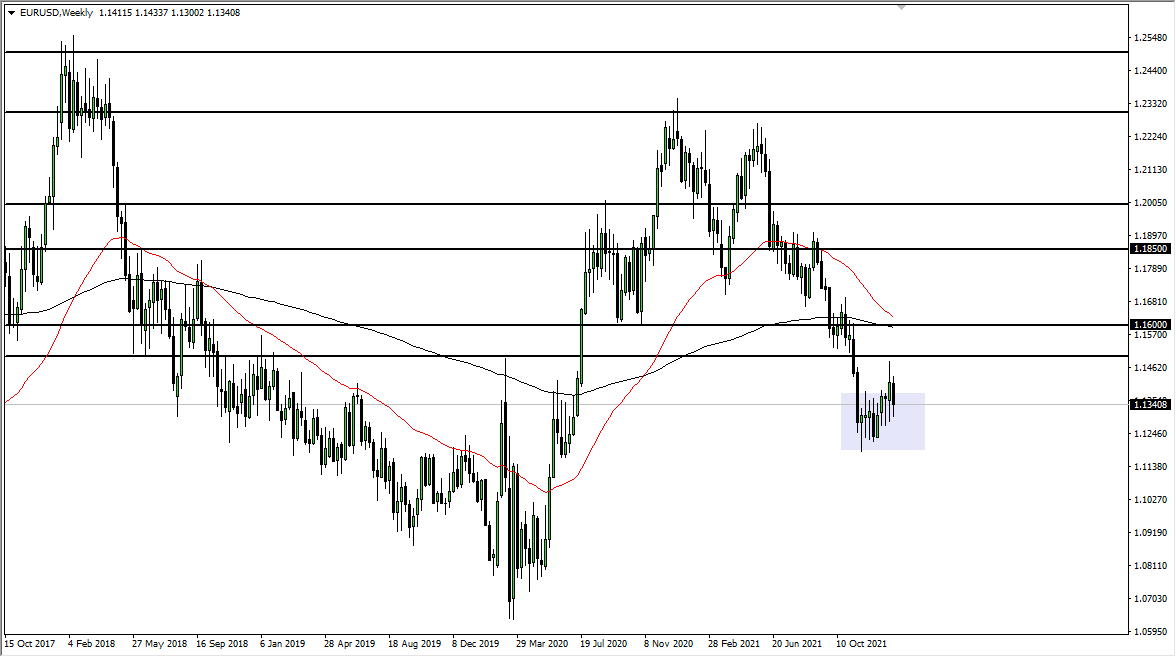

EUR/USD

The euro gave up its gains last week from the previous week. That being said, the market looks as if it is trying to form some type of base near the 1.13 level, and I anticipate that we will see more of the same as the market simply has nowhere to be. Keep in mind that this pair is trying to break out, so if we can get a daily close above the 1.14 level, that might be bullish enough to send this market looking towards the 1.15 handle, followed by the more important 1.16 level where we had broken down from. Below 1.12 opens up the door to 1.10 underneath.

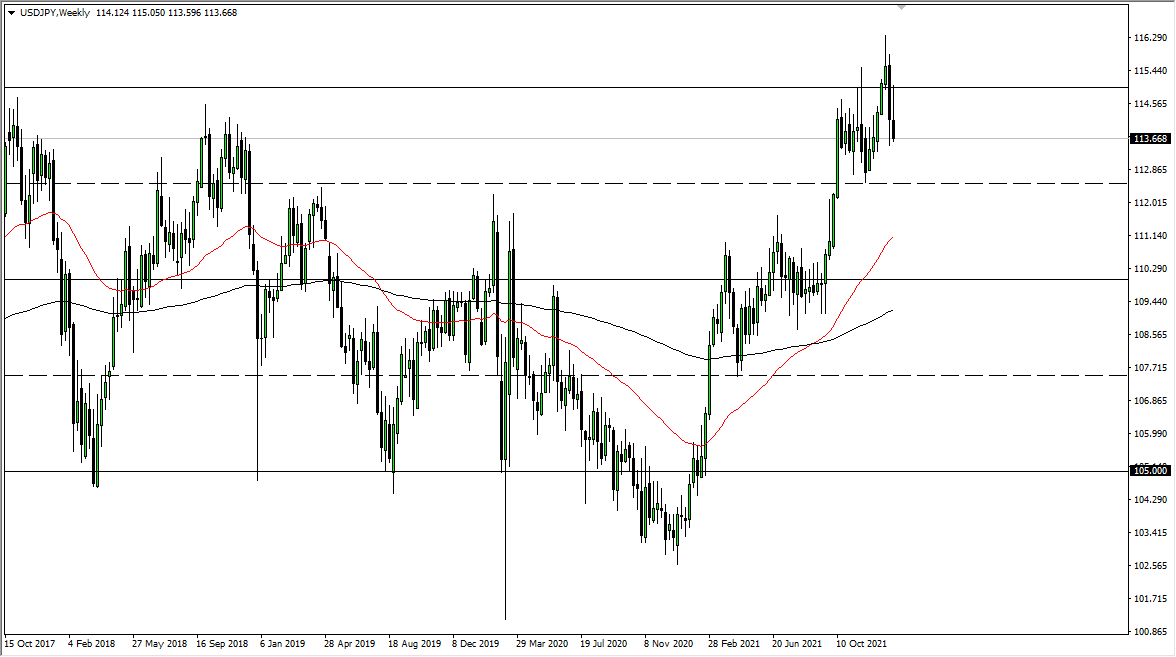

USD/JPY

The US dollar initially rallied last week to reach towards the ¥115 level. That is an area that is a large, round, psychologically significant figure, and now it looks like we are ready to continue breaking down in the short term. The ¥112.50 level underneath could be a potential support level, and perhaps a potential target. At this point, we will continue to move based upon risk appetite more than anything else. I do believe that we will continue to see a lot of noisy behavior, but I think ¥112.50 is the target.

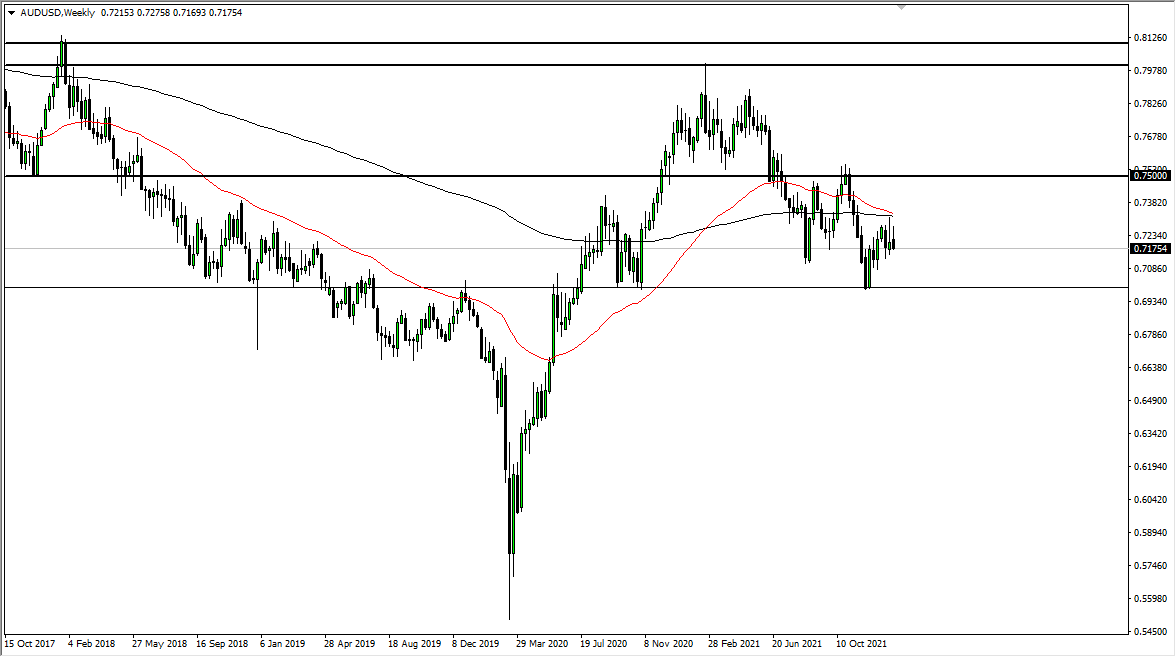

AUD/USD

The Australian dollar initially tried to rally last week but has found selling pressure yet again. Ultimately, the Aussie looks as if it is ready to go lower, perhaps reaching towards the 0.70 level, especially if we continue to see a lot of risk-off behavior. At this point, it should be noted that the markets closed in a very bad way, so unless we get some type of monetary or fiscal help from the central banks, it is likely that we would see this market continue to go lower. The news over the weekend will drive everything, and if there is no news, that is probably worse.