At the end of last week’s trading, the price of the USD/JPY currency pair moved amid bearish momentum, which subsequently moved towards the 113.46 support level before settling around the 113.85 level at the time of writing the analysis. The Federal Reserve’s decision tomorrow, Wednesday, is the most prominent event of the week for the US dollar pairs and the markets in general. It represents the bank’s first opportunity to address the acceleration of US inflation in December to a new multi-decade high of 7%, which some analysts see increases the risks of taking a decision.

In addition, this week sees a slate of fourth-quarter earnings from US technology, financial and industrial companies - leaving US stocks in a weak position with bond yields also rising. In terms of data, we'll take a first look at US Q4 21 GDP data - expected to be close to 5% quarterly annually after the soft December numbers.

After the Fed's decision and Thursday's preliminary estimate of fourth-quarter US GDP data, market attention could quickly turn to Friday's release of the December PCE price index, the Fed's preferred measure of inflation which was already at 5.7% in November.

The recent sell-off in the stock market may be the catalyst to support the dollar.

US stock market indexes fell on Monday, although they trimmed some of their losses. Towards the end of the trading session, the Dow Jones Industrial Average was down more than 500 points, the S&P 500 was down 1.4%, and the Nasdaq Composite was down nearly 200 points. Investors were pressing the sell button mainly on the impact of the Federal Reserve's decisions, which are expected to raise interest rates in the next two months in response to rising inflation. The US central bank has also reduced its asset purchases that have pumped trillions of dollars into Wall Street and Main Street since the early days of the coronavirus pandemic.

The US Composite Purchasing Managers' Index (PMI) fell from IHS Markit to 50.8. The manufacturing PMI fell to a reading of 55, while the services PMI fell to a reading of 50.9. All three PMIs showed the same thing: labor and material shortages and rising prices. New order growth slowed, while production levels remained roughly the same.

Business confidence improved to its highest level in November 2020 due to expectations of improved supply flows and a slowdown in the pandemic.

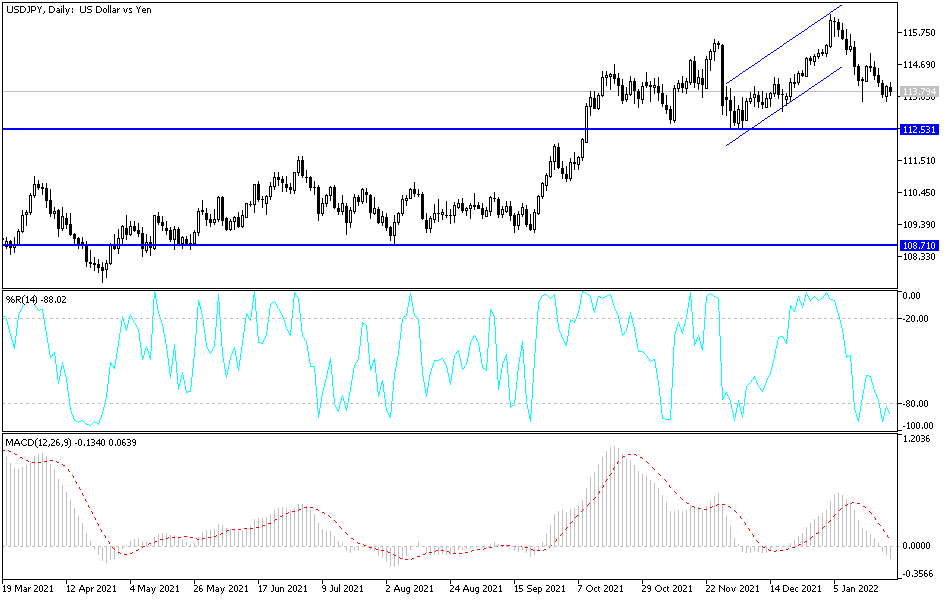

According to the technical analysis of the pair: the bears’ success in pushing the price of the US dollar against the Japanese yen currency pair USD/JPY towards the support level 113.30. It brought it back to the neutrality area with more bearish tendency. The performance on the daily chart broke the psychological support 113.00, the most important for more strength and control of the bears. From there, it had support at 112.65 while Forex investors may start thinking about buying the currency pair.

The psychological resistance of 115.00 is still the most important for the bulls' return to control the trend. I still prefer buying the pair from every bearish level. The currency pair will be affected today by the risk appetite of investors as well as the reaction from the announcement of US consumer confidence.