The US dollar lost much of its value heading into the midweek session after hawkish comments from Federal Reserve officials (Fed) followed by a flurry of profit taking that weighed on US exchange rates ahead of the December inflation data. This came in stronger than expected and supported the expectations of raising US interest rates, but the markets reacted more to Jerome Powell's comments. In the case of the USD/JPY currency pair, it moved amid bearish momentum. Profit-taking has indicated a lot of its potential since the pair tested its highest in five years last week. It is settling around the 114.37 support level, the lowest in two weeks.

The US dollar crosses suffered a setback from the statements of US Federal Reserve Governor Jerome Powell and other members of the Federal Open Market Committee (FOMC), followed by widespread and heavy losses that some analysts attributed to profit taking.

Fed Chairman Powell emphasized at his congressional re-nomination hearing on Tuesday that an acceleration in ending the Fed's quantitative easing program could be followed by a rate hike as soon as March, and that the federal funds rate would likely rise by as much as to triple this year.

The US dollar exchange rates have risen since the start of the new year and are still making significant gains from the previous six months when investors made big bets on the dollar in anticipation of the federal monetary policy normalization now underway.

Financial markets had already taken three rate hikes for the bank's 2022 interest rate before Chairman Powell confirmed they were likely on Tuesday while the dollar itself has been struggling so far in the new year to restore the momentum it had before its rally slowed in December. This may be the reason why many analysts attribute recent losses to profit taking among speculative traders.

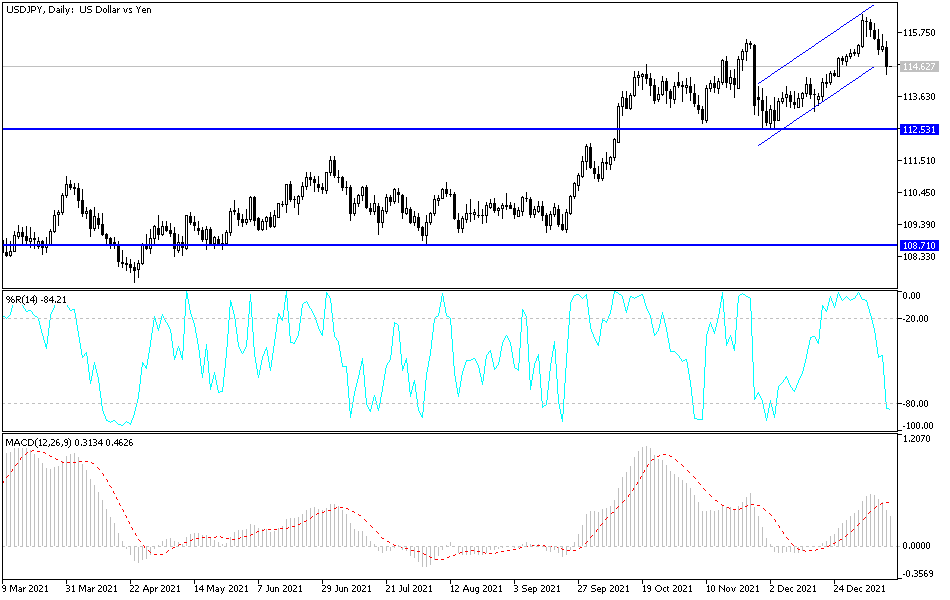

According to the technical analysis of the pair: On the daily chart, it is noticeable that the price of the USD/JPY currency pair started breaking its ascending channel. It started breaching the support level 113.75, which is important for the bears to control the trend to turn to the downside. On the other hand, in order for the currency pair to return to its stronger ascending path, it must move towards the resistance 115.45 again. I still prefer selling the currency pair from every bullish level. The currency pair will be affected today by the extent of risk appetite, as well as the reaction from the announcement of the PPI reading and the number of weekly jobless claims.