The British pound is recovering from its recent losses and may rise in the short term if the global stock market crash ends. Interacting with that, the price of the GBP/USD currency pair moved to the resistance level 1.3518 after strong selling that pushed it towards the support level 1.3440. Markets have stabilized after the extreme volatility seen at the start of the week and analysts see 2022 as a volatile year for investors, posing difficulties in predicting the way the British currency might behave.

Sterling has largely reversed some of its gains in 2022 against the euro and the dollar after investors sold stocks and associated “risk” assets in anticipation of higher US interest rates and an escalation of tensions on the Ukrainian border. "It was a rough start to the week for stocks," says Chris Beauchamp, chief market analyst at IG.

The near-term outlook remains volatile as sterling has a higher "beta" for stocks compared to the euro and the dollar, which means it tends to fall against these two currencies as investors dump the stocks.

The sell-off may now enter an extended territory, presenting the potential for a recovery in sentiment that could help the likes of the British pound and its associated currencies outperforming in "risk-on" conditions. The preferred proxy for investor sentiment is the US S&P 500, which is already down 7.75% in January. This drop takes the RSI into oversold territory as it fell below 30. The last time this happened was in 2020 when the markets slumped amid the spread of the coronavirus. For the RSI to stabilize, the downward pressure on stocks is likely to ease.

The global forex foreign exchange markets have returned to trading the binary risk/no-risk reaction to global risk sentiment, with predictable results. The safe-haven currencies of Japan, the US and Switzerland are benefiting while the biggest losers were the commodity dollars of New Zealand and Australia in addition to the Norwegian krone and emerging market names.

Between the two groups is the pound sterling and the euro, although the exchange rate from pound to euro tends to fall in and of itself in times of risk-free market conditions. Commenting on this, Renee Friedman, chief economist at EXANTE says, “The sell-off in risk has been relentless, but the bulls may come out of the ashes soon. A correction for the US tech and crypto sector has always been on the cards given the scale of the rally from the initial recession in early 2020 and the fact that returns have been on the rise for months.

There is light at the end of the tunnel as the Omicron variant is on the decline, and the UK announced this week that there will be no requirement for covid tests for fully vaccinated individuals arriving in England. Therefore, Friedman adds, "It is likely that other European countries will follow the UK's lead."

But financial analysts are warning of a volatile year ahead as traders readjust to a new regime of rising inflation and interest rates, and fluctuations likely to affect movement in the forex foreign exchange markets.

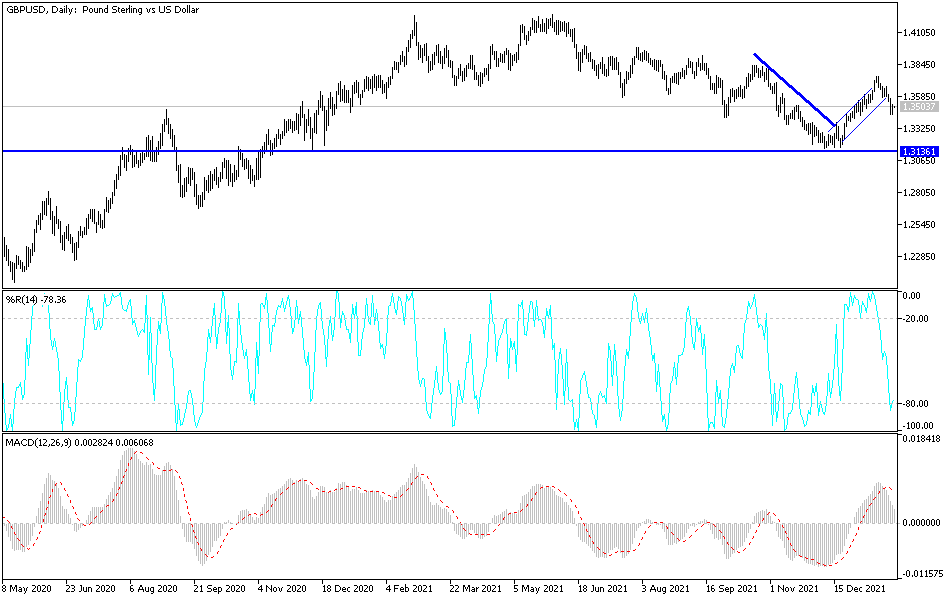

According to the technical analysis of the pair: There are new attempts for the GBP/USD currency pair to exploit the decline to form a buying base to return to the path of its last ascending channel. This requires more momentum factors, otherwise the pair will be exposed to more momentum to complete the recent selling operations. Bears eyes are currently on the 1.3330 support on the daily chart to confirm the strong and continuous control. On the other hand, the 1.3600 resistance will remain the most important for the currency pair's return to its last ascending channel.

All the focus of the sterling dollar pair today on the global stock markets and the reaction from the monetary policy decisions of the US Federal Reserve and the statements of Governor Jerome Powell.