The control of the bulls is getting stronger on the price performance of the GBP/USD currency pair. As a result, the currency pair is settling around the 1.3645 resistance level, the highest for the currency pair in more than two months. Nevertheless, speculative net long positions in the US dollar index rose again, returning to its highest levels since October. The US Federal Reserve has ramped up its hawkish tone in recent weeks and this last week was extended by the December FOMC meeting minutes. Very quickly, the debate shifted from the focus on the accelerated tapering of quantitative easing to the Fed's balance sheet reduction.

Researchers at Barclays describe the pound's recent performance as "resilient" as they expect the currency to continue to outperform its major peers over the coming weeks and months. The UK-based international lender and financial services provider says in a regular weekly forex market briefing that the British pound was the best performing G10 currency in the first week of 2022, buoyed by the positioning and expectations of a rate hike in February.

They found that further outperformance could be expected if these two issues continued to arise over the coming weeks.

The market is now anticipating a 75% chance of a second rate hike coming from the Bank of England at its February 3 policy meeting, and the odds of that, in turn, have been boosted by expectations that the Federal Reserve will be more “hawkish” in the US in 2022. Inflation in both from the United States and Britain to multi-year highs, policy makers have warned that the pandemic-driven price increase is not as temporary as many economists expected at the start of 2021. So it appears that the market thesis, for now at least, is that higher interest rates in the states the UK means higher rates in the UK, which in turn supports the British pound.

The Bank of England's February rate hike will be the second in just two months. The number of spikes to be delivered in 2022 overall could be a deciding factor in determining how high the pound can reach. Accordingly, Eric Martinez, forex analyst at Barclays, says: “The surprise rate hike from the Bank of England in December led to an immediate repricing of further rate hikes in the near term. However, the rates market has historically struggled to price in the Bank of England's final interest rate well above 1%.

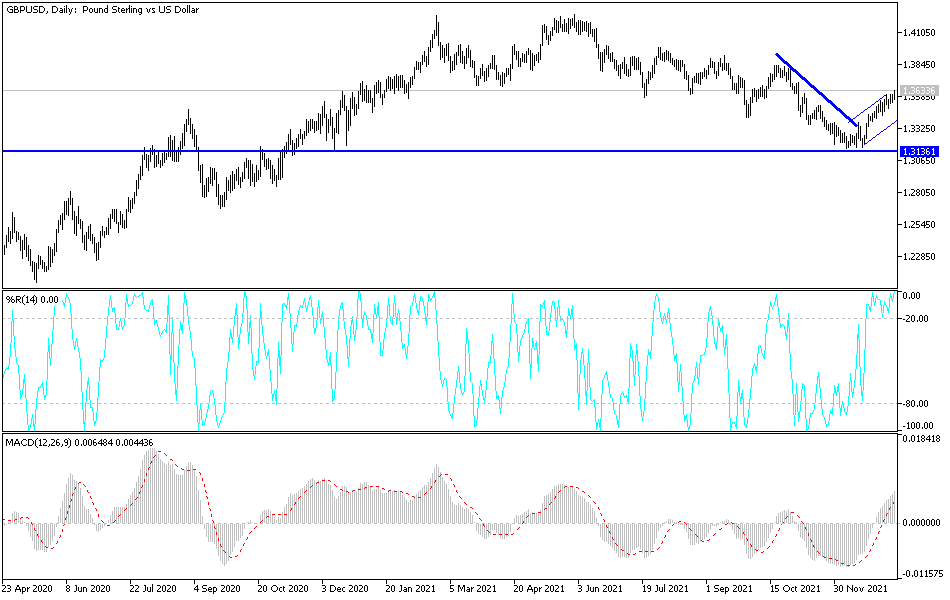

According to the technical analysis of the pair: The recent gains of the GBP/USD currency pair moved the price to the ceiling of the upper line of the ascending channel formed by the currency pair starting from the last third of December starting from the support 1.3197. The recent gains moved some technical indicators towards overbought levels according to the performance on the daily chart. Unless the sterling gains additional momentum, it may be considered activating profit-taking selling operations starting from the resistance levels of 1.3675 and 1.3745, respectively. On the other hand, according to the performance over the same time period, a trend reversal will not occur without the currency pair moving towards the 1.3385 support.

The currency pair will be affected today by the risk appetite of investors as well as the reaction from the release of US inflation figures.