GBP/USD made its fourth straight high last week, as the market ponders the dollar outlook. A rally above the recently recovered 1.36 high is likely to be boosted as the GBP navigates a minefield of economic data over the coming days. The recent strong bullish rebound gains for the GBP/USD currency pair pushed it towards the 1.3749 resistance level, its highest in two and a half months. It settles after the recent profit-taking sell-off around the 1.3630 level. All in all, sterling further continued the recent recovery when it rose about three quarters of a percentage against the dollar last week, making a fourth consecutive advance and a one-month recovery reversing half of the decline that pushed GBP/USD down from 1.4250 in June 2021.

Overall, the dollar's exchange rates have fallen broadly as of Tuesday as the selling accelerated following congressional testimony from Federal Reserve Chairman Jerome Powell and official figures confirming that US inflation reached a multi-decade high of 7% in December. Many analysts and other observers saw the dollar's declines most likely reflecting profit-taking by speculative traders who bid the currency higher over a six-month period approaching the new year only to see its momentum waning during the month from mid-December to mid-January. "The best explanation is that the Fed's hawkish bias, which began in earnest at the November FOMC meeting, was largely taken into account in the Market forecast and positioning. With market rates merging and the Fed's speech about four full interest rate increases for 2022.”

The surprise that the dollar's declines have caught many in the market will likely mean that analysts and investors will be keen to see the latest batch of Chicago Futures Trading Commission data covering traders' commitments during the week ending January 18. This could provide an indication of the extent to which any reduction in speculative “long positions” played a role in last week's price action.

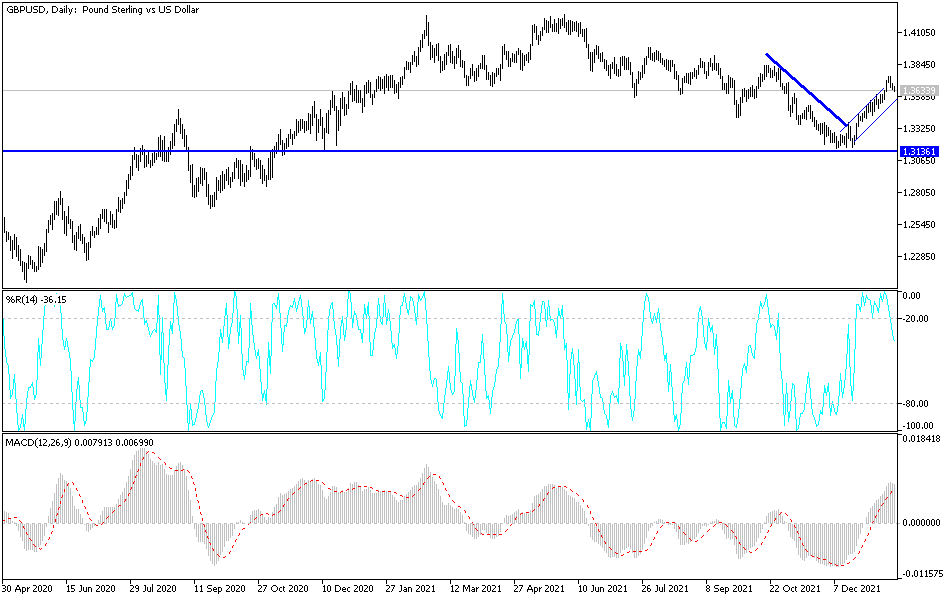

According to the technical analysis of the pair: Despite the recent sell-off, the GBP/USD pair is still moving stable within its ascending channel as shown on the daily chart below. There will be no breaking of that channel without moving towards the support levels 1.3550 and 1.3420, respectively. In general, stability above the 1.3600 resistance still motivates the bulls to advance further.

The currency pair will be affected today by the extent to which investors take risks or not, as well as the reaction from the announcement of the average wage reading, the change in employment and the unemployment rate in Britain.