For the fourth day in a row, the price of the EUR/USD currency pair is moving amid a bearish correction that was launched towards the support level 1.1315. The Euro gave up the gains of the beginning of 2022 trading when it moved towards the resistance level 1.1482. As I mentioned before, the Euro will continue to be a target to sell as it tries to make gains. Europe is still suffering from the effects of the pandemic and currently has strict containment restrictions. The European Central Bank is on hold despite inflation figures and the direction of other global central banks.

On the other hand, the Federal Reserve is the closest to raising US interest rates at a faster pace this year to stem US inflation, which reached its highest level in 40 years. This week, eurozone financial officials have ventured into a high-level political balancing act driven by conflicting economic forces: weaker growth expectations and stronger inflation. Finance ministers from the 19 countries that share the euro have pledged to continue budget stimulus for the European economy despite headwinds from the highly transmissible omicron variable. At the same time, they sought to reassure voters by pledging to be vigilant about sharp price increases.

Are we worried about inflation? It is evident that Dutch Finance Minister Sigrid Kaag told reporters in Brussels where she attended a meeting with her eurozone counterparts. "The purchasing power of individual citizens will be affected". The eurozone faces a slowdown in economic growth this year after a strong recovery in 2021 from a severe recession caused by the coronavirus two years ago. But rising inflation, which hit a record 5% in December and is linked to energy market pressures, has complicated the picture - for both policymakers and voters. The Frankfurt-based European Central Bank provided support in two main ways: keeping interest rates at zero or lower and helping to keep other borrowing costs in the market low by buying hundreds of billions of euros in assets in financial markets. Eurozone GDP is expected to grow by 4.3% in 2022 after an estimated 5% growth last year and a 6.4% contraction in 2020. However, the projected growth is above expectations of a maximum of 4% of GDP growth this year in the US, as the central bank warned of economic threats to inflation and indicated an imminent tightening of monetary policy. In contrast, European Central Bank officials, including President Christine Lagarde, have indicated they are in no hurry to raise interest rates, arguing that eurozone inflation will fall back to the bank's 2% target in time. The European Commission, the executive arm of the European Union, has forecast a further slowdown in economic growth in the eurozone in 2023 to 2.4%.

While growth prospects are weaker, national governments in Europe are pressing ahead with plans to spend hundreds of billions of euros in unprecedented EU funds raised to help weather the recession caused by the pandemic. In parallel, some countries, including France, are pushing for looser EU restrictions on national debt to allow more room for growth-enhancing public investment. This will require concessions from Germany, the traditional advocate of budget austerity. In this context, employment trends in Europe could play a key role for policy makers in the coming months because a tighter labor market could lead to wage increases, and thus stronger inflation. So far, the EU Commission has pointed to the continuing stagnation in European labor markets and has forecast that the unemployment rate in the eurozone will fall to 7.5% in 2022 from 7.9% in each of the previous two years.

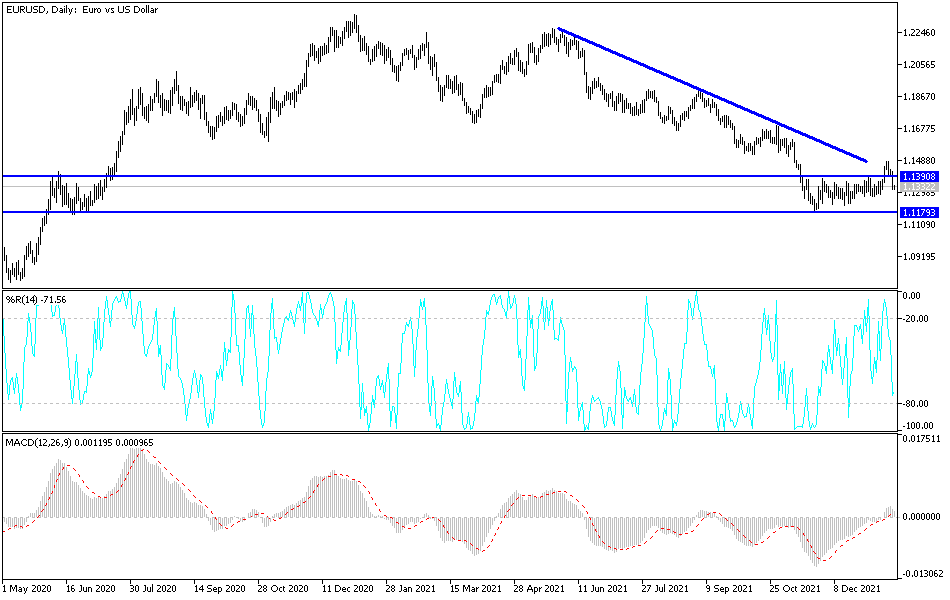

According to the technical analysis of the pair: The return of the price of the EUR/USD currency pair to the vicinity of the support 1.1330 returned the pair to the neutral zone with the most tendency to the downside, as shown on the daily chart below. Accordingly, the bears may have a stronger opportunity to launch further, and the closest to them is now the 1.1280 and 1.1190 levels, respectively, and the general trend of the pair remains bearish for a longer period. The euro-dollar is not awaiting important and influential data, whether from the euro zone or from the United States, and therefore investor sentiment towards risk appetite or not will have the strongest impact on the pair.