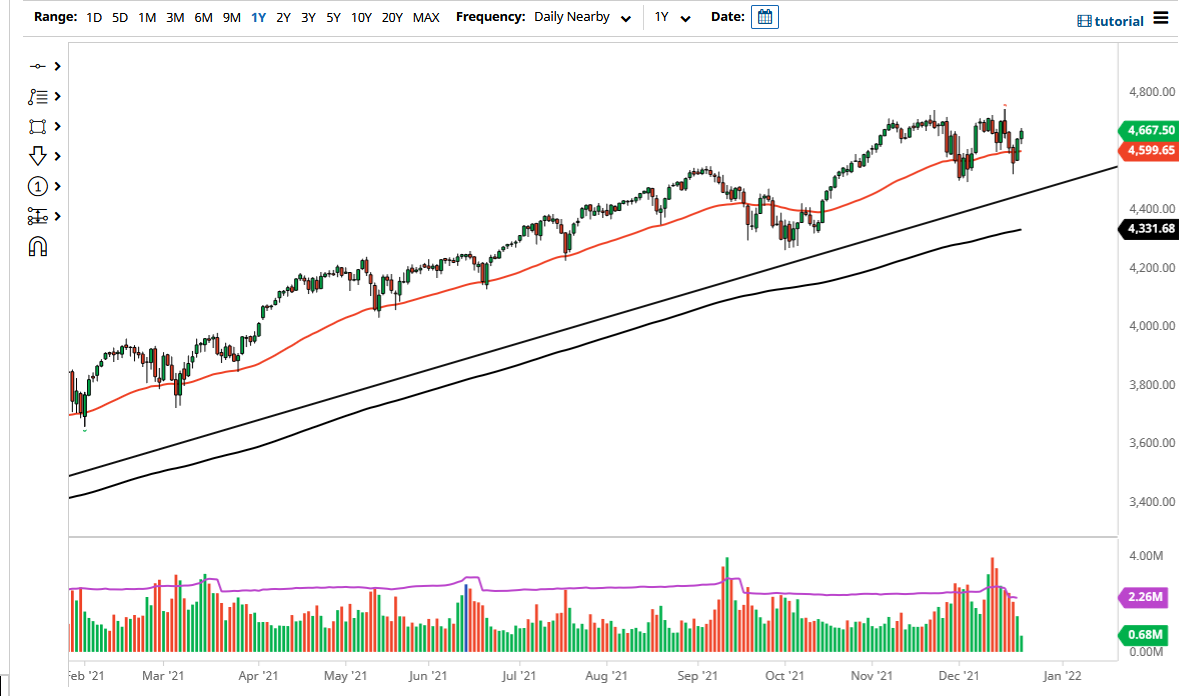

The S&P 500 rallied a bit on Wednesday to show signs of strength yet again. It looks as if people are trying to buy risk assets into the new year, but I would not get overly carried away with my position size as the lack of liquidity could work against you. Nonetheless, you clearly cannot be a seller of this market, as US indices are not designed to go lower for any significant amount of time. (This is why they are not equally weighted.)

The 50 day EMA sits just below the 4600 level, so I would assume that is going to be a certain amount of support, and then after that we got the crucial 4500 level. It is not until we break down below the 4500 level that I would be willing to buy puts, but even then I think I would probably be somewhat timid about doing so. I much more likely to buy some type of dip that shows signs of life. On the other hand, if we do take out the 4700 level, then it is likely that we simply go back to the recent all-time highs, and then on to the 4800 level. I do think it happens given enough time, but it may take a while to get there. After all, with the lack of trading volume between now and nonfarm payrolls in January, there is not a whole lot going on in the market to push things around.

Once we get a grasp on the job situation in January, then people will start to determine where they want to put risk on again, that will obviously have a major influence on this index. I do not see anything to suggest that they are going to be looking to short stocks, at least not anytime soon. With that, I like the idea of buying dips but I also recognize that you need to find a little bit of value so therefore you need to let the market come back towards you. The longer-term outlook for this pair is still a move to 5000 by my estimations, but that might be sometime in spring. One thing is for sure: we are still very much in an uptrend and that something that you cannot fight against, at least not if you want to keep your account full.