The GBP/USD gained a short-lived respite from prior selling pressure on Friday when the Bureau of Labor Statistics released what can only be described as the “downbeat” US non-farm payrolls report for November. The currency pair returned to the 1.3250 level, after it collapsed to the 1.3208 level, near its lowest of the year. It is settling around the 1.3230 level as of this writing, as the US dollar is still being abandoned as a safe haven in light of global concern over the restrictions of the Omicron variant.

According to official figures, the US labor market created or recovered from the virus about 210,000 jobs last month, well below the 553,000 that some measures of consensus among economists indicated as likely, although the data also came with a more pessimistic tinge. This was at a time when labor market participation was said to have risen last month while the unemployment rate has nonetheless continued to decline in what may eventually prove to be a dampening pressure on US wages.

The US unemployment rate fell by 40 basis points from 4.6% to 4.2%, a sharper decline than the drop of 0.0% to 4.5% that was unanimously envisaged, while the pace of wage growth fell on a monthly basis from 0.4% to 0.3% against expectations of a reading fixed at 0.4%. Commenting on the results, CIBC Capital Markets economist Catherine Judge says: “The household survey showed a huge gain of 1.14 million jobs, bringing the unemployment rate down more than expected, to 4.2% from 4.6%, even with a slight rise in the participation rate.” .

According to the results, the labor force participation rate increased from 61.4% to 61.8% in November - the highest level since before the pandemic - after months of flying largely unchanged from the previous level, and this indicates a possible improvement in the labor supply for the coming months. This may dampen various forms of inflationary pressures over the coming months and could better explain than anything else why the dollar exchange rates have regressed from previous broad post-issue gains because labor shortages and rising wages have been identified as important factors that have had an impact in pushing US inflation to its highest levels in several decades recently.

Markets are interested in US labor market data because the Federal Reserve had previously made restoring the economy to full employment a prerequisite - along with achieving the inflation target - for any final decision to begin reversing the interest rate cuts announced to support the economy at the start of the pandemic.

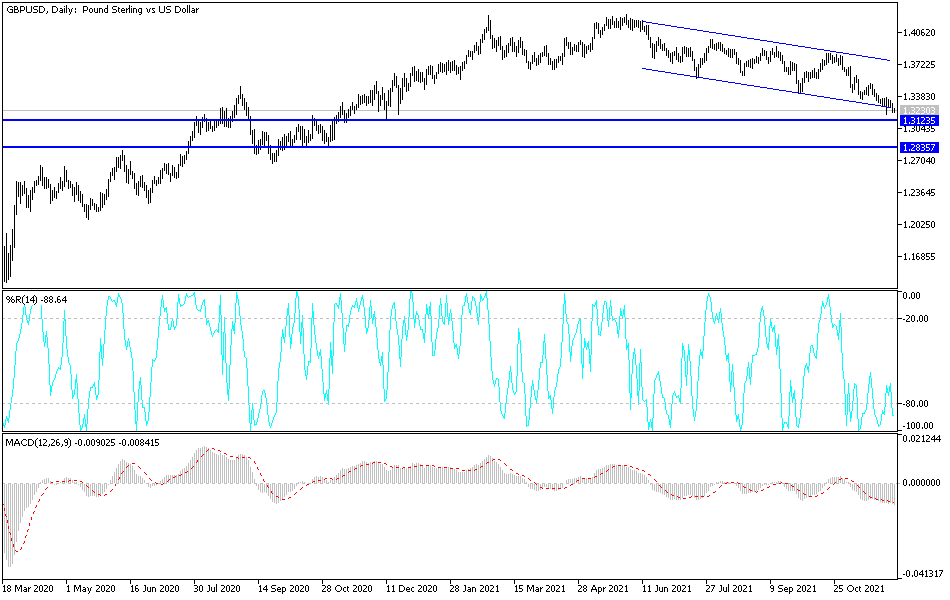

Technical Analysis

The downside pressure for the GBP/USD is still strong, and approaching the 1.3200 support as it is currently will open for a move towards lower support levels, as the technical indicators have some space before they reach oversold levels. If current market anxiety and risk-aversion continues, that may move the pair towards the support levels at 1.3190, 1.3100 and 1.3020. On the upside, and as I mentioned before, the 1.3660 resistance will have the strongest effect in changing the general trend to the upside.

Today's economic calendar is devoid of important US economic releases, and only the PMI reading for construction in Britain will be announced.