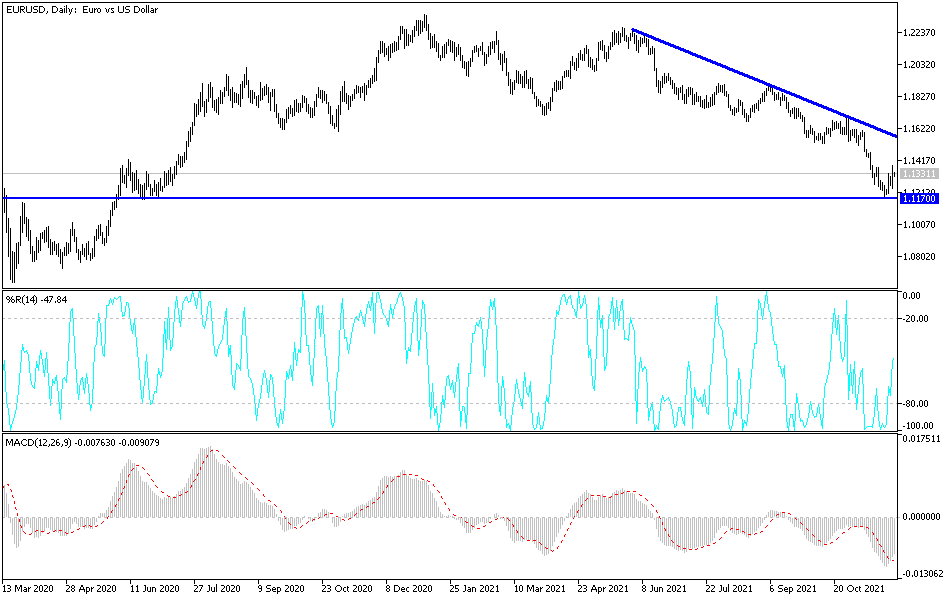

Fears of the new COVID variant continue to negatively affect investor sentiment, as countries, especially European, re-imposed lockdowns and hurt the euro against the other major currencies. The EUR/USD fell to the support level of 1.1186, the lowest in 16 months, and attempts to rebound did not pass the 1.1383 resistance level. It is settling around the 1.1330 level as of this writing.

EUR bears are sticking to bets that the longest monthly decline in more than two years is not over. Concern that the Omicron strain will avoid the current vaccines that have fueled bets on the Federal Reserve and other global central banks will keep interest rates low to support the economy. This reduces the attractiveness of the dollar and helps the euro recover from its lowest level in 16 months.

But what's next is not so simple. If tensions ease, markets will likely see a return to the latter status quo, with the euro continuing its long slide due to perceptions that the European Central Bank is tracking a global move toward tighter monetary policy. However, if fears intensify, the withdrawal of the US dollar as an investment haven may turn out to be very strong. This leaves a narrow path to a sustainable rally. And virus fears may need to keep spreads in check, without sliding into outright panic.

In this regard, strategic analysts at BMO Capital Markets led by Greg Anderson, who see the euro trading weaker in the next three months, wrote, “It is not clear why forex investors would seek 'safety' in anything but the US dollar. They point to March 2020, when Covid-19 was spreading in Western countries. The dollar fell and longs on the dollar were curbed as US yields fell and the euro rose.

Once this adjustment ended, the dollar rebounded, wrote BMO strategists.

On Tuesday, traders resumed their bets that global central banks would follow at a slower pace to raise interest rates after Moderna executives spooked markets by suggesting that an omicron alternative might require a new vaccine. These sentiments dealt an unexpected blow to the popular bet on a weaker euro, which assumes that other major central banks will raise interest rates much sooner than the European Central Bank. The single European currency is down about 9% from its peak in May and touched $1.1186 last week.

In addition to the euro's recent gains, carry trades involving risky emerging market currencies are being dumped. The euro was a popular funding currency due to the negative interest rates of the European Central Bank. Positioning plays a role as well as the sudden EUR rebound has investors betting that the currency will fall by surprise.

Asset managers' net positions turned positive on the euro since May 2020, according to data from the Commodity Futures Trading Commission for the week ending November 23. Hedge funds have also remained largely lower in recent weeks - hence the currency has been consistent about the risk of a stronger short squeeze, and Jordan Rochester, Nomura strategist, remains bearish on the euro and sees it weakening to $1.10. It is “disturbing” that the risk-isolated environment means the euro will get stronger against the dollar, but it won't last forever, he said.

Technical Analysis

For four trading sessions in a row, the EUR/USD is trying to recover from its lowest level in many months. Those attempts, as I mentioned before, will remain weak, and the rebound attempts will be a target for selling due to the above-mentioned factors. It is technically possible for the pair to move back below the 1.1300 support, which paves the way for stronger bearish breakdowns, the closest of which are currently 1.1245, 1.1180 and 1.1090. To break out of the current descending channel, the bulls will push towards the 1.1630 resistance as seen on the daily chart below.

Today, the euro will be affected by the announcement of the readings of the industrial purchasing managers index for the economies of the Eurozone and the dollar will be affected by the announcement of the ADP survey of the change in non-farm jobs and the ISM industrial survey reading in addition to new statements by the US Federal Reserve Chairman Jerome Powell.