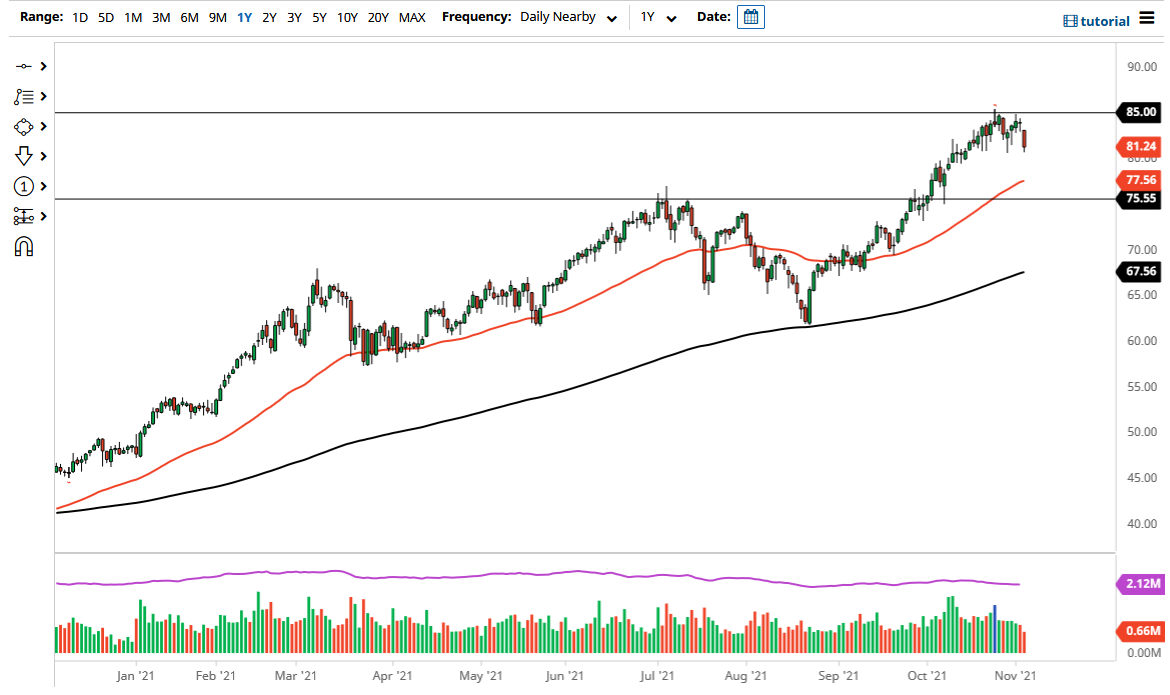

The crude oil inventory number showed a bigger-than-anticipated build, but at the end of the day, the crude oil market is still very much in an uptrend. The $81 level looks as if it is going to continue to offer a significant amount of support, so it is worth paying close attention to that overall region. The area of support probably extends down to the $80 level as well, so with that being the case I would be very cautious about shorting this market anytime soon. In fact, I believe that crude oil will continue to see plenty of buyers on dips, because the supply concerns out there still will extend into next year.

As the world reopens from the pandemic, it does make sense that crude oil would be in extreme demand, and the fact that we have not seen much in the way of capital expenditure over the last couple of years has only exacerbated the situation. With this being the case, I think that crude oil continues to be a “buy on the dips” type of situation.

I believe that not only is the $80 level important, but I believe that the $75 level is also important. This was the scene of a significant resistance barrier previously, and is a large, round, psychologically significant figure. Because of this, I do anticipate that a lot of traders will be paying close attention to it and the US dollar as well, as it does have a certain amount of a negative correlation to how this market behaves. The US dollar will be thrown around by the Federal Reserve's tapering behavior, but at the end of the day that will not change the supply/demand equation. Because of this, I think it is only a matter of time before we do rally and go looking towards the $90 level. Based upon most research that I have read, it would not be out of the realm of possibility to see oil hit $100 a barrel sometime in the next six months. I have no interest in shorting this market, unless something completely unseen ends up happening in the next couple of weeks.