Despite the announcement from the US Federal Reserve about its decision to reduce bond purchases, the USD/JPY remained stable around the 114.00 resistance. This confirms the continuation of the bullish trend, as its gains extended to the 114.22 resistance level, near its highest level in more than three years.

Federal Reserve Governor Jerome Powell sought to stress that tapering does not mean a rate hike is soon. He said officials can be patient about tightening, but they will not hesitate to take action if inflation calls for it. Therefore, the price of the dollar fell. Commenting on this, Sima Shah, chief strategist at Principal Global Investors, wrote, “Powell was very careful not to take any missteps today, and he cautiously stuck to his text that their focus is on lowering rates, not raising them. Everything the market wants to talk about!”

Nevertheless, investors largely maintained their bets on the timing of raising interest rates from the level they were in before the decision. Money market derivatives show about 55 basis points of price increases by the end of 2022. The first increase is expected around July, with a 70 percent chance the previous month, according to overnight index swaps.

Besides, the US Treasury announced the first reduction in its quarterly sale of long-term debt in more than five years, reflecting shrinking borrowing needs as the pandemic relief spending wave recedes.

US companies have added the most jobs in four months, indicating that employers are making progress filling a near-record number of job vacancies. The data precedes the Labor Department's monthly employment report on Friday, which is expected to show that private payrolls rose by 408,000 in October. On the other hand, service providers grew at a record pace in October, supported by resilient demand and stronger business activity.

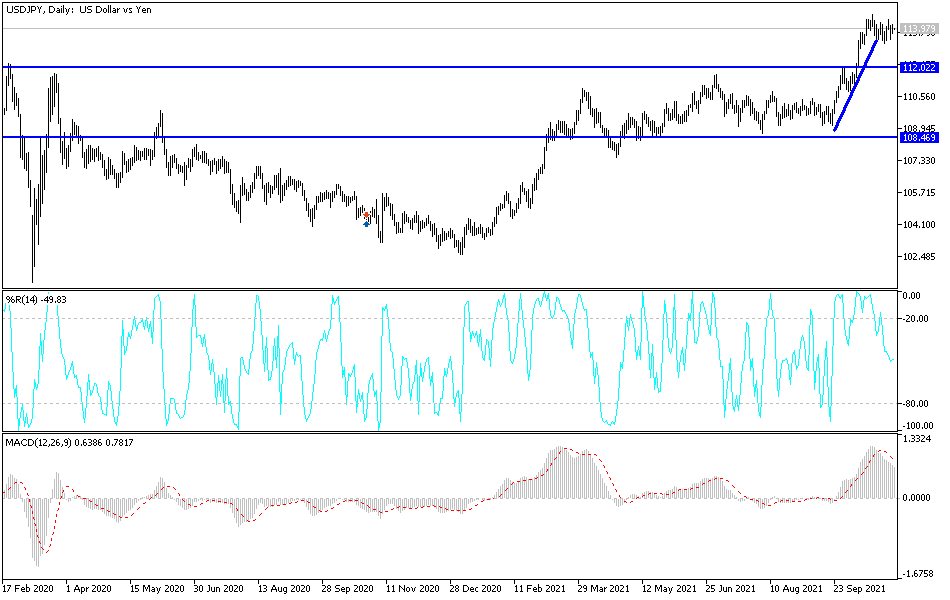

Technical Analysis

The USD/JPY stuck to the 114.00 resistance level , which will continue to support the bullish trend, but after the storm of Fed policy decisions has passed, I expect profit-taking until the US job numbers are announced tomorrow. Currently, the closest resistance levels for the pair are 114.35, 115.00 and 115.55. On the downside, and according to the performance on the daily chart, the bears broke through the 112.90 support to find an opportunity to turn the general trend around, which is still bullish.

The USD/JPY currency pair will be affected today by risk appetite, as well as the reaction to the announcement of weekly jobless claims, non-farm payrolls and US trade balance figures.