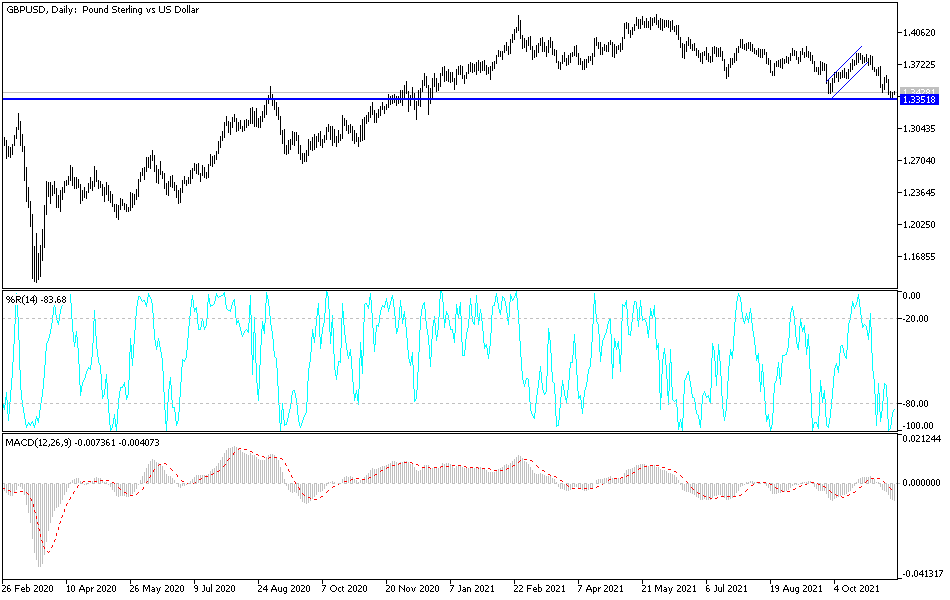

The British pound could not withstand pressure for long, so the GBP/USD was subjected to sell-offs that pushed it towards the 1.3352 support level, its lowest of 2021. It closed last week's trading stable around the 1.3413 level. The US dollar is still the strongest, supported by the good performance of the US economy, which puts pressure on the US Federal Reserve to accelerate the pace of tightening its policy, and thus raise interest rates. The pound was disappointed by the recent announcement of the Bank of England, which violated all expectations to maintain interest rates, in addition to new skirmishes between the two sides of Brexit and COVID waves that threaten the health system in Europe.

Currently, analysts believe that the British pound will come under pressure if Britain launches Article 16 of the Northern Ireland Protocol. Overall, growing concerns about Brexit tend to emerge faster and more clearly in the value of the British currency, and the launch of Article 16 raises new questions about the future of EU-UK relations. Such a move by Britain is in response to the deadlock in talks aimed at correcting problems with the protocol, but such a unilateral move could lead to the EU imposing trade tariffs, or even moving away from the FTA entirely.

Brexit is back, and for the Forex markets, the question is how much it will affect the British pound. Commenting on this, says Robert Howard, a market analyst at Reuters. Much of the negative impact of Brexit is already 'pricing' the pound, and so there is a risk of overstating the issue. James Smith and Chris Turner of ING Bank N.V in London say the FTA agreed last year was "only one degree of no-deal at all", so the economic impact of further escalation is very limited. The findings form part of a research note that comes as the Northern Ireland issue grows in importance with EU and UK negotiators holding talks again in London on Friday, and post-talk updates likely to provide some interest to markets.

No progress is expected and there are reports that the UK is preparing to implement Article 16 by the end of November.

It is likely that the European Union will impose countermeasures on such a move by Britain and some analysts are warning that this bullish collapse could send the pound lower. The news media reported that the prospect of a UK-EU trade war was an end result of the Article 16 launch while prominent Irish politicians were keen to telegraph the possibility of significant countermeasures.

Accordingly, analyst Smith from ING Bank says, “There is increasing talk of the European Union suspending its trade agreement with the United Kingdom, and in the event of the British government making sweeping unilateral changes to the Northern Ireland Protocol. This would revive the risk of a 'no deal' scenario, but the new uncertainty about Brexit may not actually be so. Significant impact on the market as it is supposed.” What ultimately matters, he adds, is to what extent the EU decides to retaliate against any British action. "And that depends initially on exactly how much of the Northern Ireland Protocol the UK government is seeking to suspend."

Technical Analysis

The continuation of the above-mentioned pressure factors means that the GBP/USD currency pair will continue its current downward path. The next support levels may be 1.3310, 1.3245 and 1.3180. A true reversal of the current bearish trend will not occur without breaking through the 1.3700 resistance again; otherwise the general trend of the GBP/USD will remain bearish. This week is important for the pound as the markets are awaiting the announcement of jobs, wages, inflation and retail figures from Britain.