With the gains in the US dollar stalled, the GBP/USD found the opportunity to capture some of the gains, which reached 1.3582 as of this writing. This comes at a time when the pound is clamoring to compensate for its sharp losses after the Bank of England abandoned the idea of tightening its monetary policy. This was the reason for the collapse of the currency pair towards the 1.3424 support level last Friday, its lowest in more than a month. The GBP/USD attempted to recover from its lows and left behind an indication on the charts that more rebound is likely this week, but much will depend on the market's appetite for the dollar and response to US inflation numbers.

Sterling was reeling after the Bank of England's monetary policy decision last Thursday forced investors to start dealing with false assumptions about the UK's interest rate outlook, but it rose sharply in the final hours of trading on Friday.

The possible decline of the dollar and the source of support for the pound against the dollar here is that financial markets were already pricing close to two Fed rate hikes by the end of 2022 and the Fed's "patience" or temporary tolerance. An excessive increase in inflation indicates that there is little, if any, room for an expected rise.

There is not much on the domestic side to guide the GBP/USD rate this week between the appearances of BoE Governor Andrew Bailey and other central bank heads and UK Q3 GDP data which is to be released on Thursday. We think GDP is unchanged on a monthly basis, below the expected level of 0.4%. And our expectations are for GDP growth to slow on a quarterly basis to 1.3% in the third quarter, from 5.5% in the second quarter, below the MPC’s latest forecast of 1.5%.

BoE Governor Andrew Bailey is scheduled to speak at an open forum event for the Bank of England's Virtual Citizens Task Force at approximately 17:00 on Monday before participating at 16:00 on Tuesday in a panel discussion titled "Central Banks and Inequality" at the conference Online is jointly hosted by the Federal Reserve, the Bank of Canada, the Bank of England and the European Central Bank, although it is unclear whether these events will host discussions about the bank rate.

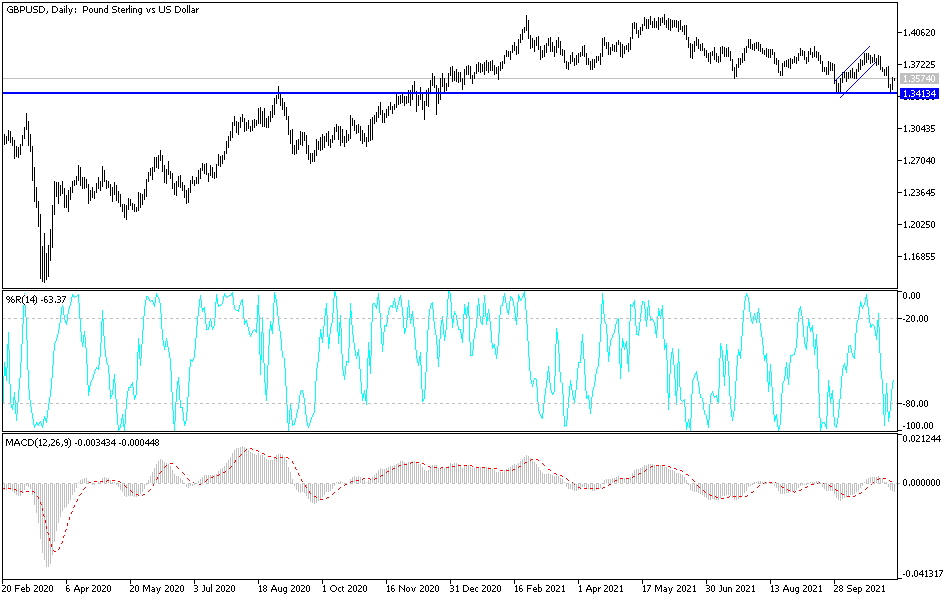

Technical Analysis

Despite the current rebound, the GBP/USD currency pair is still moving within its bearish channel that was formed recently. It will not return to the bullish outlook it had in October without breaking through the 1.3750 resistance again. On the downside, stability below the 1.3500 support will support the bears.

The currency pair will be impacted by the announcement of US inflation figures and the statements of monetary policy officials from both the Bank of England and the US Federal Reserve this week, in addition to the course of the recent Brexit and pandemic skirmishes.