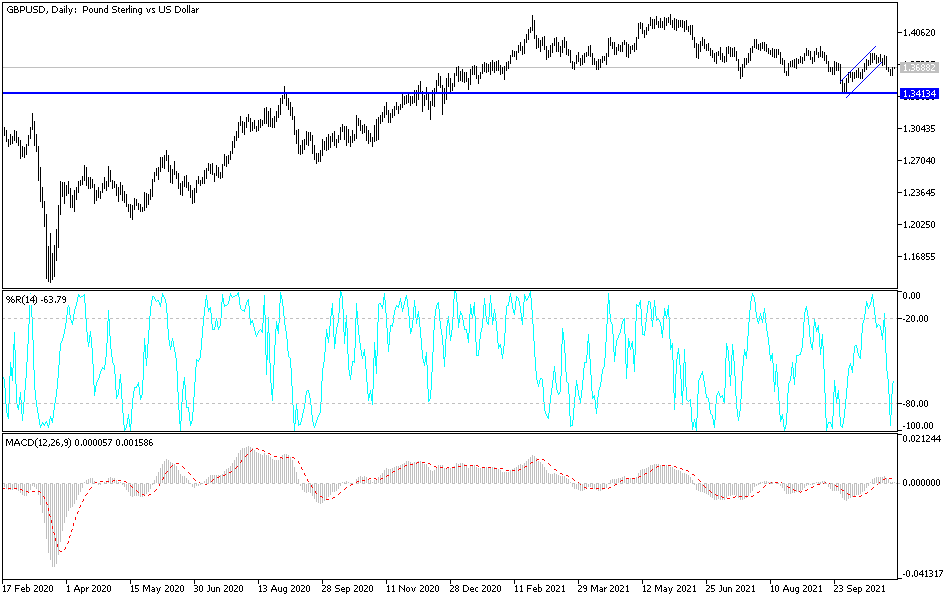

Today will see an important event for the GBP/USD, which is the Bank of England's announcement of its monetary policy decisions. The currency pair recovered to the 1.3690 resistance level as of this writing, after falling to the 1.3605 support level before the US Federal Reserve announced that it reduced its purchases.

While inflation is accelerating above the Bank of England's 2% target, crucial figures showing how the end of the furlough program has affected the job market won't be available until November 16, 12 days after the central bank's announcement Thursday noon in London. BoE officials will not see the Office for National Statistics survey, due out early Thursday, which will show what happened to an estimated one million workers on furlough when the program closed. The government figures for the last month of the program, which were also published on Thursday, come in very late as well.

However, the MPC said in September that a key question for its decision was "how the economy will adjust to the furlough shutdown; the effect of any change in unemployment; Continuing any difficulties in reconciling jobs and workers.” The lack of clarity in the labor market is one reason why economists are divided over whether the British central bank will raise interest rates this week. An ongoing labor supply shortage will further put pressure on wages, which the Bank of England will struggle to dismiss as "temporary".

Markets are betting 15 basis points higher to counter inflation that could hit 5%, guided by the absence of any real rollback from Governor Andrew Bailey. The Bank of England's latest forecast was that unemployment peaked in the winter at 4.75%, below the balance sheet office's forecast of 5.25%. This suggests that unless the BoE turns pessimistic about employment in the near term, the case for an impending interest rate hike remains.

On another sentimental note for the pound, tensions between the EU and UK continue to provide some background noise, but the main risk to the pound is a complete fall between the two sides. Such an outcome may be motivated by the failure to reach a new agreement on the Northern Ireland Protocol - the element of the Brexit deal that covers Northern Ireland's unique location that includes both the EU and the UK.

Reports released in the middle of the week show that the UK is seeking new legal advice to support a potential change to the protocol. According to the Financial Times, the UK government is seeking to appoint new external legal advisors in preparation for a possible reform of the protocol. The move to find new legal advice will fuel the expectations that ministers are prepared to use.

The Article 16 Protection Mechanism for trying to fundamentally rework the deal, which has soured relations between the EU and the UK since it came into force last January. This would be a negative result for sterling if the EU retaliates by increasing trade frictions between the two sides. The Financial Times reported that the government was looking for new legal advisors to enable Suila Braverman, Britain's attorney general, to provide legal opinions in support of the government's plans.

The report adds that the move was instigated by concerns that current outside advisers would not be willing to support the government's plans to use Article 16 as a backdoor to rewriting the deal. And there is little evidence that political risks are weighing on the pound, as was the case before the UK's exit from the European Union. In fact, much of the 2021 introductions can be attributed to the completion of some exits removing the buildup of uncertainty.

The risk, of course, is that this risk grows to such an extent that it affects the behavior of investors and asks for a new discount from sterling.

Technical Analysis

Despite the halt in losses, the GBP/USD currency pair is still under bearish pressure and broke the 1.3560 support. The Bank of England may disappoint the bulls today. On the other hand, if there are strong signs of tightening the policy as soon as possible, I do not rule out a move towards the 1.4000 psychological resistance this week, if this is similar with what the Fed announced yesterday.