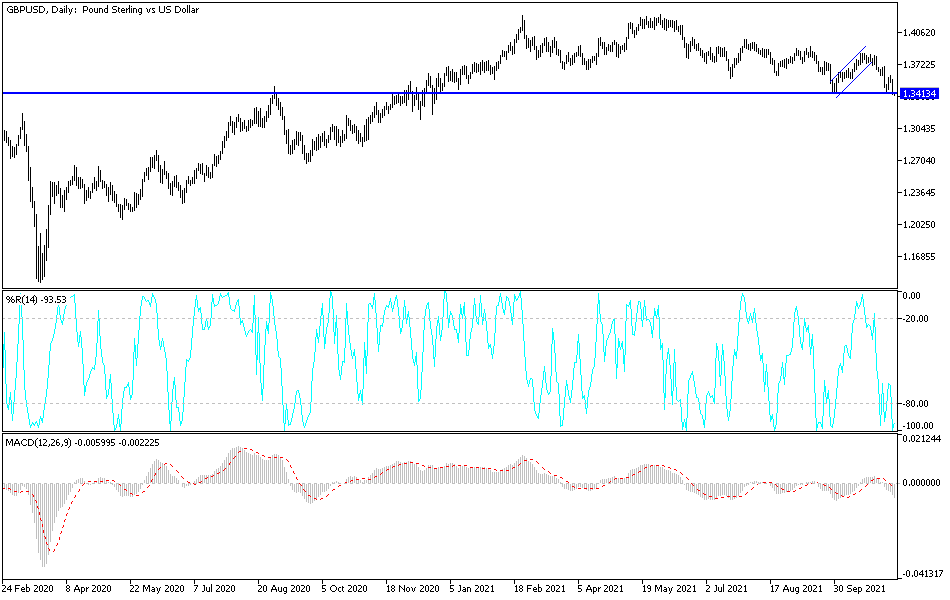

Yesterday’s trading session was one of several catastrophic sessions for the GBP/USD since the Bank of England's announcement last week. The currency pair collapsed yesterday from the 1.3565 resistance level down to the 1.3400 support level and today tested the 1.3392 support level before settling around the 1.3430 level as of this writing. The currency pair was exposed to new pressure factors, including record US inflation, which makes the US Federal Reserve race the Bank of England to raise interest rates.

In addition, skirmishes increased between the two sides of Brexit, which weakened the sterling further. The European Union has issued new warnings against a possible move by the United Kingdom to launch Article 16 of the Irish Protocol, developments that are potentially headwinds for the British pound. Fears of a trade war between the UK and the EU continue to mount after Irish Deputy Prime Minister Leo Varadkar said his government is now preparing for such a possibility.

Varadkar's comments come ahead of an expected launch of Article 16 by the UK, which has been frustrated by the EU's lack of action in easing the burdens on trade between the rest of the UK and Northern Ireland.

The activation of Article 16 would allow the UK to suspend all or part of the treaty. But Varadkar said such a move would in fact lead to the cancellation of the entire BREXIT deal and precipitate the breakdown of relations with the EU. "I don't think anyone wants to see the European Union suspend the trade and cooperation agreement with Britain," he told state broadcaster RTÉ.

"If Britain behaves in a way that it resigns from protocol, and resigns from the Withdrawal Agreement, I think the EU will have no choice but to introduce what we call rebalancing measures in response," he added. For his part, Britain's chief negotiator David Frost said in Parliament, "I gently suggest to our European friends to remain calm and keep things in order."

The Forex markets could move with pressure on sterling exchange rates as uncertainty grows over the future trading relationship between the UK and the EU, creating headwinds for any gains. Strategists at BMO Capital Markets are cautious about the outlook for the pound given the rising tensions over EU-UK relations and the possibility of a trade war over Northern Ireland. “For now, we also expect sterling to trade on a more defensive tone on the expectation that the UK government will release Article 16 of the Northern Ireland Protocol sometime during the second half of November,” says Stephen, FX analyst at BMO Capital Markets. .

The next major moment in the ongoing talks between the European Union and the United Kingdom comes on Friday when a scheduled meeting will be held between lead negotiators David Frost and Maros Sevchovic. Prior to the meeting, the Vice-President of the European Commission, Sijović, will meet informally with the EU ambassadors and brief them on the recent meeting with British negotiators, as well as the ongoing talks.

In this regard, Jessica Parker, the BBC News correspondent in Brussels, says that an EU diplomat told her the talks were going "very badly".

Technical Analysis

The GBP/USD pair collapsed to its lowest level of this year. The MACD indicator is to the downside, which means that the currency pair is ready for more setbacks, and the support levels 1.3355 and 1.3280 will be the next targets for a more bearish performance. On the upside, the pair will need to break through the 1.3730 resistance again, otherwise the general trend for the GBP/USD pair will remain bearish.

The British pound will be affected today by the announcement of the growth rate of the British economy and the rate of industrial and manufacturing production amid the energy crisis and supply chains. There is an American holiday today.