For the second day in a row, the bulls are trying to bring the EUR/USD out of its bearish channel as the pair settled around 1.1606 and the bears moved the price to the 1.1513 support area, the lowest in more than 15 months. The EUR/USD reversed Friday's losses with potential room for more stability over the coming days if the dollar continues to show signs of fatigue for a four-month rally against the major currencies.

The European single currency, the euro, hit new 2021 lows against the dollar on Friday before the dollar slipped against several currencies in the wake of the November non-farm payroll report, which threw the US labor market in a stronger light than previously seen. On the heels of the Fed's decision to end its quantitative easing program over the eight months to the middle of next year, Friday's data initially favored the dollar, although the US currency was seen in a broad decline ahead of the weekend.

While many analysts and investors are still bearish regarding the EUR/USD outlook, says Lee Hardman, Currency Analyst at MUFG, who was a seller of the EUR/USD rate from 1.1650, “We are keeping the idea of trading the EUR/USD pair short. The trade idea is off to a good start as the EUR/USD pair fell to its lowest level for the year 2021 at 1.1514. We continue to expect the EUR/USD to trade heavily towards the end of the year on the back of diverging monetary policy between the European Central Bank and the Federal Reserve. The main risk will be a policy surprise from the European Central Bank on December 16 when they are set to unveil their quantitative easing plans for next year."

The US dollar's gains were halted after US Federal Reserve Chairman Jerome Powell suggested last week that the US central bank is unlikely to be afraid of its stance on interest rates due to the recent increase in inflation, after he said at the press conference in November that the bank could wait patiently until the third quarter of 2022 for inflation to fall.

We have argued that the timing and pace of easing QE depends on progress in the labor market, but that the timing and pace of rate hikes will depend on whether and how quickly inflation declines as the underlying effects wear off next year. "We reiterate that a correction in US inflation is the most important call for next year,” said Athanasios Vamvakidis, FX analyst at Pova Global Research, in a note last week.

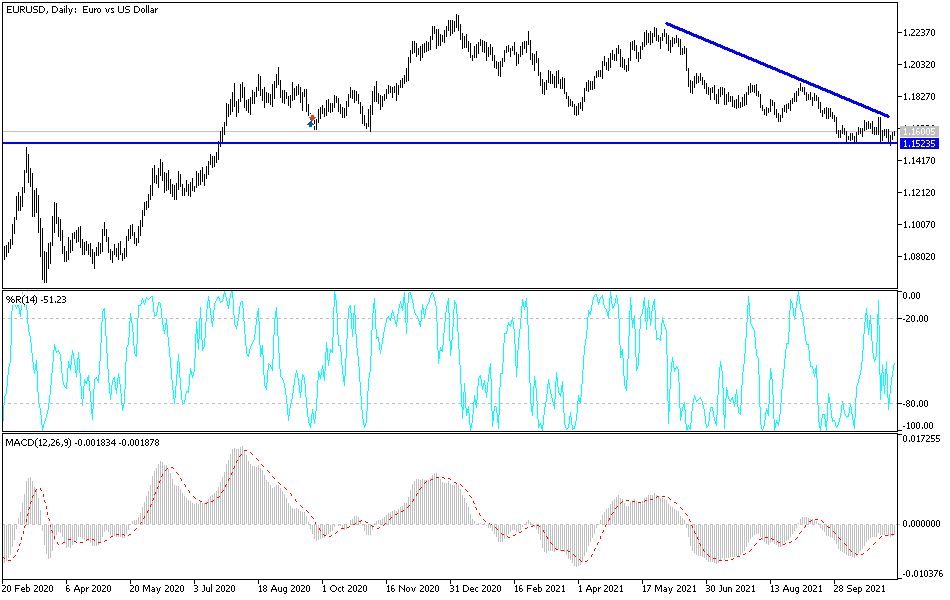

Technical Analysis

Despite the recent performance, the general trend of the EUR/USD is still bearish. There may be an opportunity to change the trend if the bulls move towards the 1.1750 resistance level and the psychological peak of 1.2000. That is according to the performance on the daily chart. Otherwise, the movement will remain around the 1.1600 support, preparing for the bears to complete the path again.

The German ZEW index will be announced, along with new statements from ECB Governor Lagarde. Then, US inflation figures, the Producer Price Index, and the statements of US Federal Reserve Chairman Jerome Powell will be announced