The EUR/USD will remain in narrow ranges until the market's reaction to the important events this week passes. These events include the US Federal Reserve’s announcement of its monetary policy update and then the US job numbers by the end of the week. Since the beginning of this week's trading, the EUR/USD has settled in a range between the support level 1.1546 and the level of 1.1613, amid bearish momentum. Overall, the dollar's rally may not be over yet, especially if the Fed is more "hawkish" than markets expected.

This is the most likely outcome of the US monetary policy update today, November 3, as the monthly tapering of $15 billion is a foregone conclusion. However, the statement is likely to say that inflation risks are now on the upside. Many analysts argue that Federal Reserve Chairman Jerome Powell would be comfortable with the current market pricing in the 2022 policy rally, but refrains from saying so explicitly to preserve policy selectivity and avoid preempting the December point chart.

Pricing suggests that the market will see about 2.5 increases by the end of 2022.

The Fed has become more hawkish. This persistent surplus of real unemployment appears over estimates of natural unemployment and under-inflation relative to the target. Of course, Powell will be shy about the number of appropriate rate hikes in 2022, leaving investors to read between the lines. He should therefore be wary of his views of his tone and the answers to questions at the press conference - in particular, his views on the trade-off between inflation and unemployment, a gradual rise in interest rates and politics, universal employment and inflation expectations.

The US dollar has remained strong in recent weeks amid expectations to end quantitative easing and start raising interest rates in 2022. Another hawkish policy outcome on Wednesday is likely to only exacerbate this trend and may put the EUR/USD exchange rate on its way to a test support 1.15 over the coming days or less.

US monetary policy makers are expected to decide today to scale back their massive bond-buying program as the economy continues to recover from the pandemic. Powell recently acknowledged that inflation risks are "clearly to the upside," but stuck to his core case that price pressures will eventually subside as supply chain issues are resolved. The personal consumption expenditures price index - a measure of inflation targeted by the Fed - rose 4.4 percent in September from a year earlier. For his part, Powell said in a virtual panel discussion on October 22: “We can be patient” in raising interest rates and “letting the labor market heal.” The Fed chair, who will hold a press conference after the meeting today, faces a dilemma when it comes to the labor market. He realizes that it is "too narrow by many measures". Job opportunities are high and workers are leaving their employers in search of new opportunities at record levels.

Technical Analysis

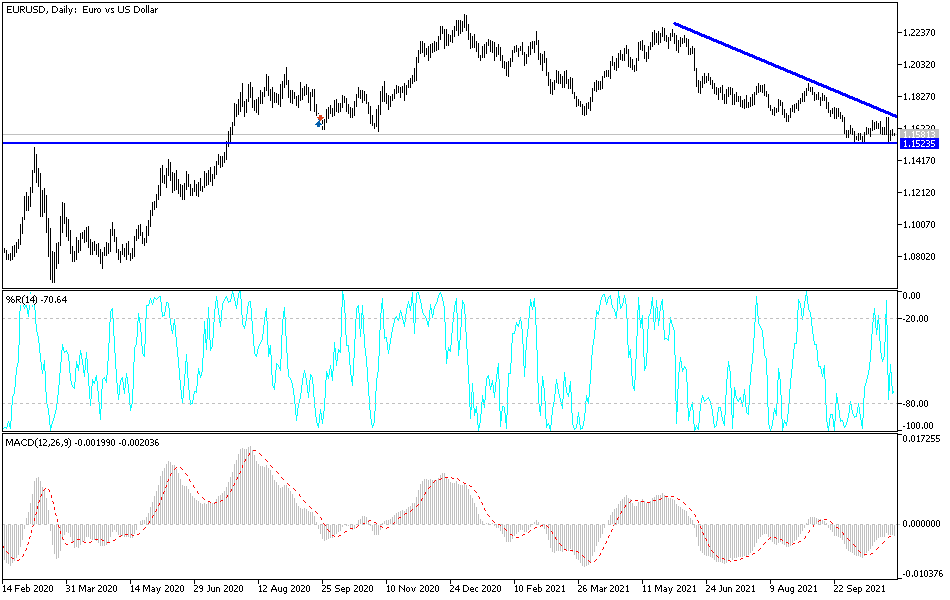

The general trend is still bearish, and a breach of the 1.1500 support will strengthen the bears’ control over the trend. At the same time, technical indicators may reach strong oversold levels if the currency pair moves towards support levels at 1.1450 and 1.1360. On the upside, according to the performance on the same time frame, the first reversal will be achieved by penetrating the 1.1775 resistance and a complete change of direction by testing the 1.2000 psychological resistance. Otherwise, the general trend of the EUR/USD will remain bearish.

From the Eurozone, the change in Spanish unemployment, the Italian unemployment rate, the unemployment rate in the Eurozone, and new statements by ECB Governor Lagarde will be announced. From the United States, the ADP reading will be announced to measure the change in US non-agricultural employment, then the ISM purchasing managers' index for services, ending with the most important monetary policy decisions of the US Federal Reserve and the statements of Chairman Jerome Powell.