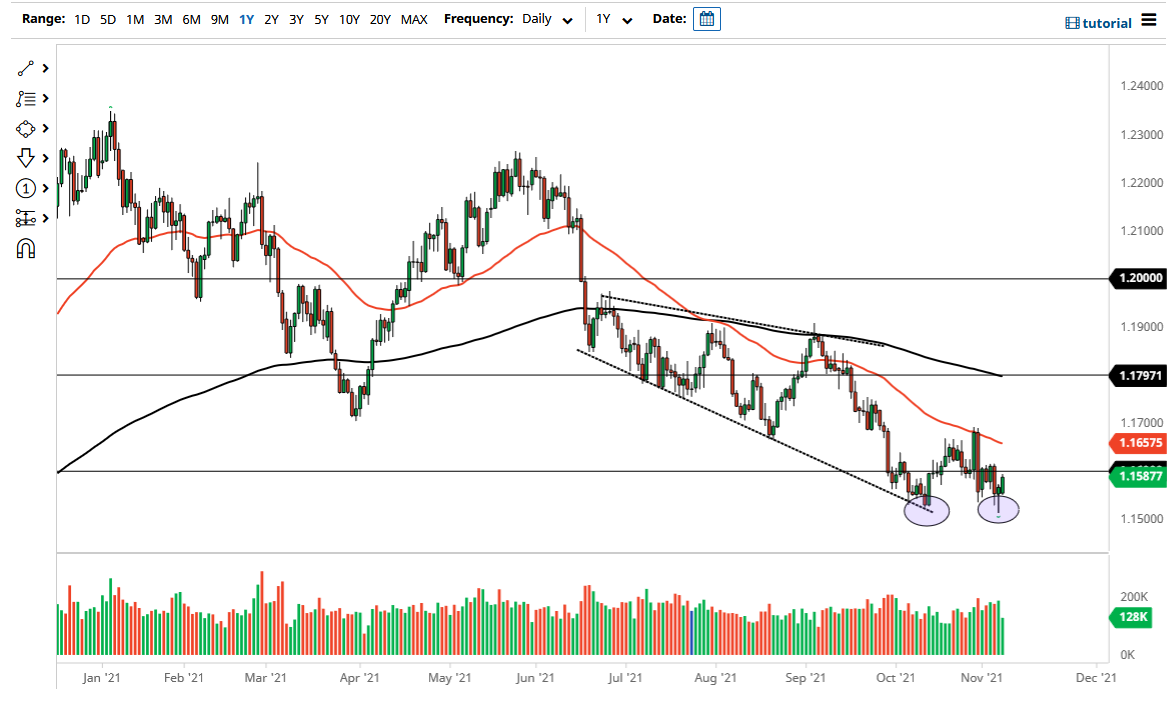

The euro had a very interesting day on Friday, turning around to form a hammer. Monday had more of the same type of action, as we have broken above the hammer, which is a very bullish sign. Furthermore, as you can see on the chart, I have marked the possibility of a double bottom. The question now is whether or not we can break out above the most recent spike high. That would be the 1.17 handle, and if we do break above that level, then it is very likely that we could go much higher.

If we do break above that, then it is very likely that the market goes looking towards 1.18 handle, which is an area that has been important more than once, and currently features the 200-day EMA sloping along it. Because of this, I think the market is likely to see a bit of a pushback in that area, but if we do reach all the way to that area, I would anticipate it would be a bigger move against the US dollar than anything else. In the short term, it certainly looks as if the greenback is going to struggle, but whether or not we have a serious move to the upside might be a totally different question.

I believe that the euro will probably underperform quite a few other currencies, but it does give you a bit of a clear picture as to what is going on with the US dollar in general. If this pair rises, it is very likely that the dollar will fall against most currencies. On the other hand, if we were to turn around and break down below the 1.15 level, that would be very negative for the euro, and suggests that perhaps the US dollar was going to strengthen yet again against other currencies around the world. As interest rates in the United States have been falling recently, and it seems more likely than not that this pair will probably continue to try to recover, although it may very well be a laggard in comparison to the British pound, Australian dollar, and the New Zealand dollar as a few examples. From a longer-term standpoint, it certainly makes sense that we would see an attempt to defend this area as well.