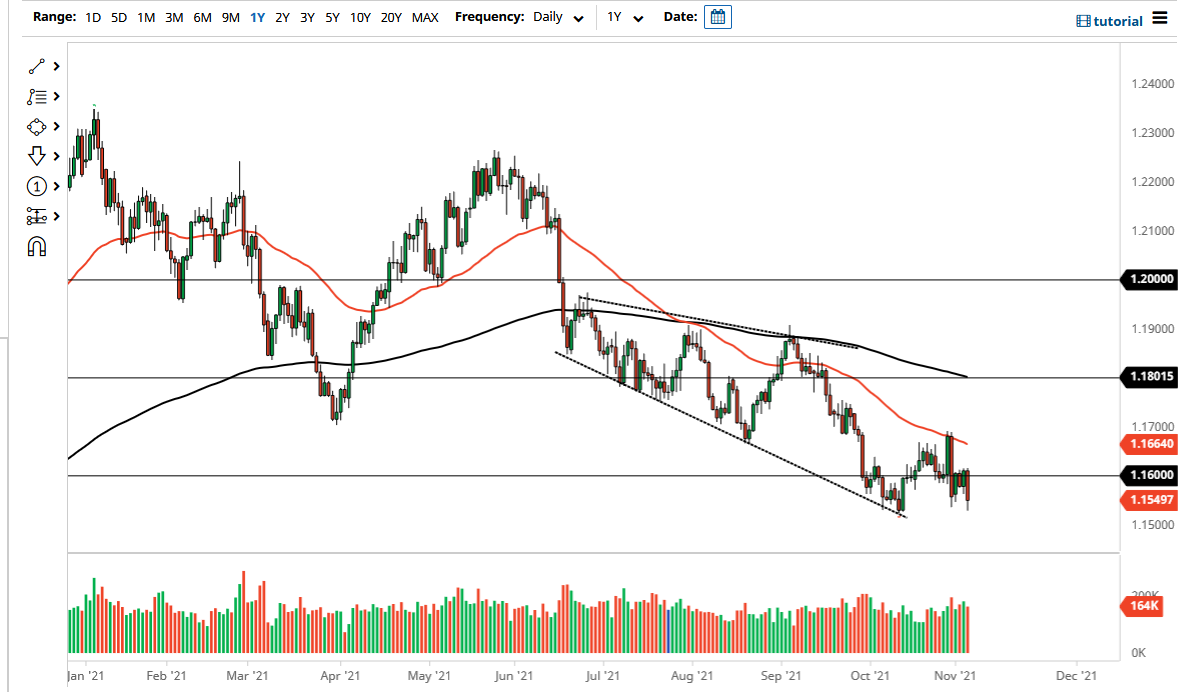

The Euro has fallen a bit during the course of the trading session on Thursday, reaching towards the 1.1525 level. This is an area that has been relatively important more than once, so I think it is interesting that we have bounced from there. At this point, I think if we can stay above the 1.15 handle, we have a very real possibility of breaking to the upside. At this point, the market is likely to see a lot of noise in this general vicinity, and if we end up closing on Friday above the last couple of days candlesticks, that could be the beginning of something rather important.

On the other hand, by the end of the day on Friday, if we find ourselves below the 1.15 level, it is very likely that the Euro would fall rather significantly. At that point, it is likely that we could go looking towards the 1.1250 level underneath. All things been equal, this is more or less going to be an indictment on the US dollar, which of course is the main driver of the Forex market in general. With that being the case, Friday is crucial due to the fact that the jobs number will throw the greenback all over the place. There are a lot of questions as to whether or not the Federal Reserve is going to continue tapering, but right now I think it is obvious. I frankly, the Federal Reserve is tightening while so many other central banks are not, but European economic numbers have gotten better, suggesting that perhaps we are going to start to see inflation pick up in Europe, thereby forcing the ECB to do something.

At this point, I think I am going to wait until the end of the day on Friday in order to get into this market. I typically do not trade this pair very often, but it is likely that we could see a bigger move starting to form here. That could be more of an investment and less of a short-term trade, and I will let you know on Daily Forex this coming Monday as to which direction I am getting involved. I have a couple of levels that I have mentioned previously that I will be paying close attention to, but it is not until we get the daily close on Friday that I will be putting any money to work.